- U.S. cryptocurrency policy report’s release postponed, affecting market sentiment.

- Matrixport highlights risk in leveraged positions amid predicted market cooling.

- Expectations of consolidation for Bitcoin and Ethereum as summer lull approaches.

Matrixport’s recent report indicates the cryptocurrency market is entering a cooling phase, affecting Bitcoin and Ethereum, with consolidation trends likely until August, amid U.S. policy delays.

This slowdown poses risks for leveraged positions and market confidence, with stalled policy updates further impacting market dynamics amid stalled momentum.

Bitcoin, riding high on inflows from major funds like BlackRock

Bitcoin, riding high on inflows from major funds like BlackRock, mirrors Ethereum’s overbought status. This leaves both vulnerable to short-term pullbacks. Matrixport emphasizes heightened liquidation risks for Ethereum, where open contracts surged from $14 billion to $25 billion, while the White House movement reflects strategic focus on stablecoins tethered to U.S. Treasury bonds due to their increasing macro-financial relevance.

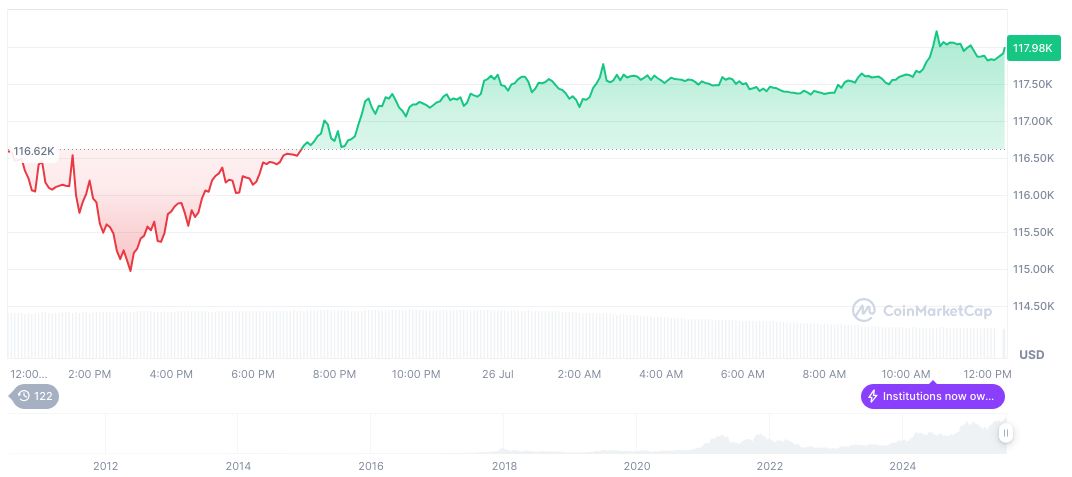

On July 27, 2025, Bitcoin’s latest data from CoinMarketCap reveals its price at $118,294.10, with a dominance of 60.34% and a market cap of $2.35 trillion. It shows significant growth over three months, with a 25.21% increase. Trading volume saw a drop of 39.83% in the past 24 hours.

Cas Abbé, Trader/Analyst, Twitter – “Ethereum (ETH) is currently at its most oversold level since Q3 2024… traders should closely monitor ETH for a potential bullish reversal,” referencing the Stoch RSI oversold signal from early July.

Summer Outlook: Bitcoin Hits $118K Amid Market Lull

Did you know? Past summers often see the crypto market enter a lull, with range trading and decreased volumes. This seasonal pattern usually sets the stage for renewed activity in Q3.

Coincu analysts highlight a consolidation environment remains probable as institutional flows steady market support amidst regulator ambivalences. Market participants are advised to buy Ethereum (ETH) with USD while monitoring policy updates and the GENIUS Act, which may drive future trends and technological advancements, maintaining a vigilant eye on pursuing safer investment strategies during this period.

Coincu analysts highlight a consolidation environment remains probable as institutional flows steady market support amidst regulator ambivalences. Market participants are advised to buy Ethereum (ETH) with USD while monitoring policy updates and the GENIUS Act, which may drive future trends and technological advancements, maintaining a vigilant eye on pursuing safer investment strategies during this period.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-cooling-regulatory-delays/