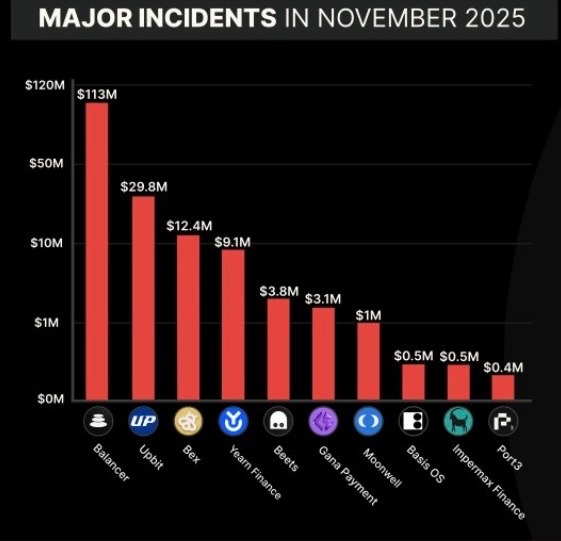

- The Surge: Crypto hacks jumped 10x in Nov, totaling $172M in gross losses.

- The Victims: Balancer ($113M) and Upbit ($30M) led the list of exploited entities.

- The Cause: Smart contract code flaws replaced phishing as the #1 attack vector.

The cryptocurrency sector suffered a catastrophic security regression in November, with total losses from exploits and hacks surging nearly 1,000% month-over-month.

According to a forensic report by blockchain security firm CertiK, the industry lost a total of $127 million, with smart contract vulnerabilities, rather than phishing, reclaiming the title of the primary attack vector.

Closer Look at Major Crypto Exploits in November 2025

During the four weeks of November 2025, CertiK Alert recorded more than 10 major attacks. The largest crypto attack in November involved Balancer and Upbit, which lost $113 million and $29 million respectively.

Bex and Yearn Finance registered a net loss due to system exploits of about $12.4 million and $9.1 million. PeckShieldAlert reported earlier on Monday that Yearn Finance had been siphoned of more than $9 million, whereby the attacker exploited its smart contract function to mint near infinite amounts of yETH tokens.

Delated: Hackers Exploit GANA Payment for $3.1 Million on BSC Chain

The DeFi attackers exploiting code vulnerabilities were a major contributor to the list of funds in November. Poor design in bridges and other security features proved to be expensive for the DeFi space. Moreover, crypto wallet compromises recorded a loss of over $33 million in November.

The North Korean hackers, who are sponsored by the government, were accused of stealing a significant amount of the stolen funds in November. The sophisticated attack methods and the use of crypto mixers, such as Tornado Cash, remained a major flow of stolen funds last month.

Market Impact and Possible Solution on the Crypto Exploit Menace

The 10x month-over-month increase in November’s crypto exploit has contributed to the recent bloodbaths. Moreover, funds lost have lowered institutional and investors’ confidence in DeFi protocols’ ability to secure trillions of dollars.

At press time, the DeFi ecosystem had a total value locked (TVL) of about $114 billion and a stablecoins market cap of around $306 billion. The Ethereum (ETH) core developers, led by Vitalik Buterin, have been advocating for enhanced privacy, decentralization, and security within the crypto and blockchain space to enhance mainstream adoption of digital assets.

According to Buterin, crypto users must not trust web3 developers seeking to centralize their systems in the name of enhanced services. Essentially, Buterin believes that developers must reduce centralization in a bid to eliminate risk points.

Related: StakeWise Recovers $20.7 Million From Balancer Exploit, To Reimburse Users Pro Rata

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/crypto-hacks-november-2025-certik-report-balancer-upbit-exploit/