- Funding rates for crypto derivatives plummet, marking lowest since 2022 crash.

- Massive deleveraging observed in BTC and ETH markets.

- Binance sees a significant drop in funding rates, suggesting market bottoming.

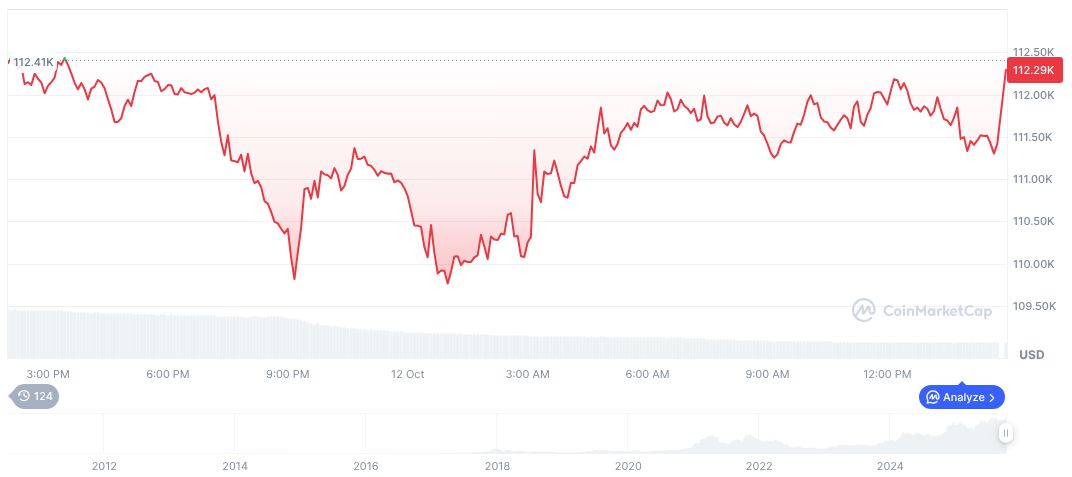

Cryptocurrency funding rates have plunged to their lowest since the 2022 crash, driven by a significant leverage reset across major assets like BTC and ETH, according to Glassnode data.

This reset indicates potential market bottoms and massive deleveraging, with $1.74 billion in positions liquidated across exchanges, highlighting systemic shifts in crypto market dynamics.

Crypto Betting on Potential Market Bottoms as Rates Fall

Funding rates for cryptocurrency derivatives have reached their lowest levels since the 2022 bear market, driven by a pronounced deleveraging across assets like BTC and ETH, according to Glassnode. Amr Taha, On-chain Analyst, Independent, commented, “Such deeply negative rates historically correlate with local market bottoms, pointing to potential capitulation among bearish traders.”

With funding rates plummeting, trading platforms like Binance have recorded negative numbers pointing to potential local bottoms and a possible trader capitulation. This adds to market volatility with significant economic impact due to unexpected liquidations.

Market participants and analysts are reacting to the changes with caution. On-chain analysts, like Amr Taha, suggest these negative rates historically correlate with market bottoms, emphasizing the potential end of current bearish trends. The crypto community closely watches these developments on social platforms without immediate public statements from major leaders.

Community Watches Closely Amidst Historic Negative Rates

Did you know? The current funding rate levels mirror those seen during the 2022 bear market, when Bitcoin prices sank over 75%, reinforcing the systemic risk of leveraged trading.

As reported by CoinMarketCap, Bitcoin (BTC) is priced at $114,698.35, with a market capitalization of approximately $2.29 trillion. The asset holds a market dominance of 58.80%, with a 24-hour trading volume of $92.44 billion, showing a 1.60% increase. Price has changed by 2.79% over the past 24 hours, but has seen declines over 7, 30, 60, and 90 days.

Expert insights from Coincu suggest further attention on regulatory intervention due to funding rate shifts impacting market stability. The research emphasizes historical volatility patterns, cautioning on potential long-term effects on crypto trading norms. Additionally, enhanced regulatory scrutiny may evolve with ongoing market adjustments, potentially altering the landscape for digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-funding-rates-low-2022/