- The U.S. government has charged market makers with crypto fraud and manipulation.

- FBI created a token, NextFundAI, to bait the perpetrators and aid the investigation.

The U.S. government has charged three market makers and 18 others with crypto fraud and manipulation. The FBI led the investigation by setting a trap and creating a digital token, NextFundAI, to document the alleged perpetrators’ actions.

Following the investigation, four firms were indicted for widespread crypto fraud and manipulation. This included Gotbit, ZM Quant, CLS Global, and MyTrade.

Reacting to the charges, U.S. attorney Joshua Levy hailed the investigation as ‘one of a kind’ and a stark reminder to crypto investors.

“This investigation, the first of its kind…Wash trading has long been outlawed in the financial markets, and cryptocurrency is no exception. The message today is, if you make false statements to trick investors, that’s fraud. Period.”

Others charged in crypto fraud

The investigation established that the market makers offered ‘market manipulation-as-a-service.’ This involved inflating token trading volumes and dumping tokens after more users jumped on the artificial pump.

The prosecutors mentioned the Saitama token, which hit a multi-billion dollar market cap, as an example of the pump-and-dump scheme.

As a result, the investigation implicated 18 people, including leaders of the market makers, their employees, and promoters of the fraudulent tokens.

Interestingly, Gotbit is one of the most well-known and active market makers, heavily leaning on memecoins.

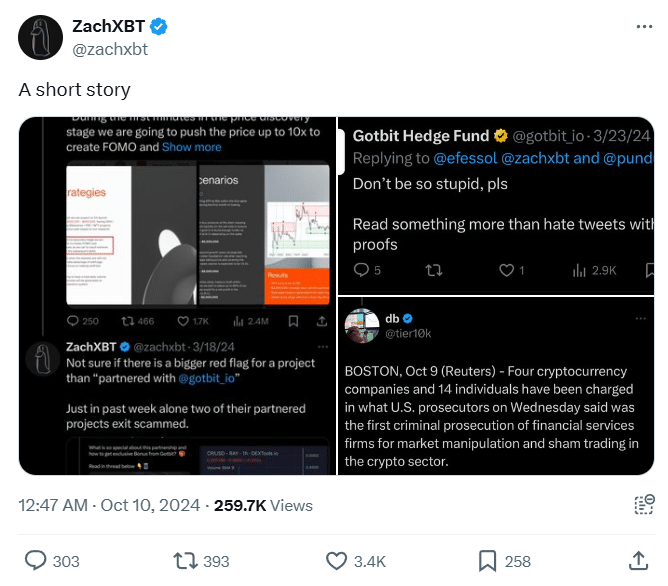

Gotbit’s CEO, Aleksei Andriunin, has been an active X (former Twitter) user and was flagged last year by ZachXBT, a renowned blockchain investigator.

Source: X

Other leaders, including ZM Quant’s Riqui Liu and Baijun Ou, CLS Global’s Andrey Zhorzhes, and Liu Zhou of MyTrade, were indicted, too.

The U.S. government reportedly seized $25 million and deactivated several bots used in wash trading.

That said, retailers harmed by NextFundAI or the tokens mentioned in the investigation, like Robo Inu, would be refunded.

However, the charges appeared to have ‘unsettled’ some social media influencers and crypto promoters. Ansem, one of X’s crypto influencers and promoters, posted that he might ‘retire’ his account.

Source: https://ambcrypto.com/crypto-fraud-us-charges-3-market-makers-18-others-in-sting-operation/