Crypto newsletter founder Lark Davis has argued that the next decade could decisively favor LINK over XRP. This comes amid new developments from Chainlink and Ripple in boosting its ecosystem.

Lark Davis Supports Chainlink on a Long-Term Basis

Lark Davis gave his take on a discussion about these two ecosystems on a Rollup TV interview, during which he was asked to compare both tokens. Davis thinks LINK will outperform XRP over a period of 10 years.

What does @LarkDavis think about the $XRP vs $LINK rivalry?

He gives his blunt take… pic.twitter.com/YCnaNoOZBS

— Andy (@andyyy) December 16, 2025

“I think Chainlink is an infinitely better asset than XRP…I don’t own any LINK at the moment, but I think it’s an infinitely better asset. Their CCIP technology is persuasive,” he said.

Davis says that both systems are different. Davis thinks that Ripple mainly operates within its own ecosystem and tries to attract the support of large banks and payment systems.

Although it has been around for over ten years and has many loyal users, Davis noted that XRP is not used very often daily, which he sees as a downside. He also pointed out how Chainlink connects various networks.

“And it has the infrastructure to make all the silos talk to each other and bring assets, you know, move corn from silo to silo. It’s a pretty amazing piece of technology. And now they finally started doing buybacks and stuff like that,” Darvis added.

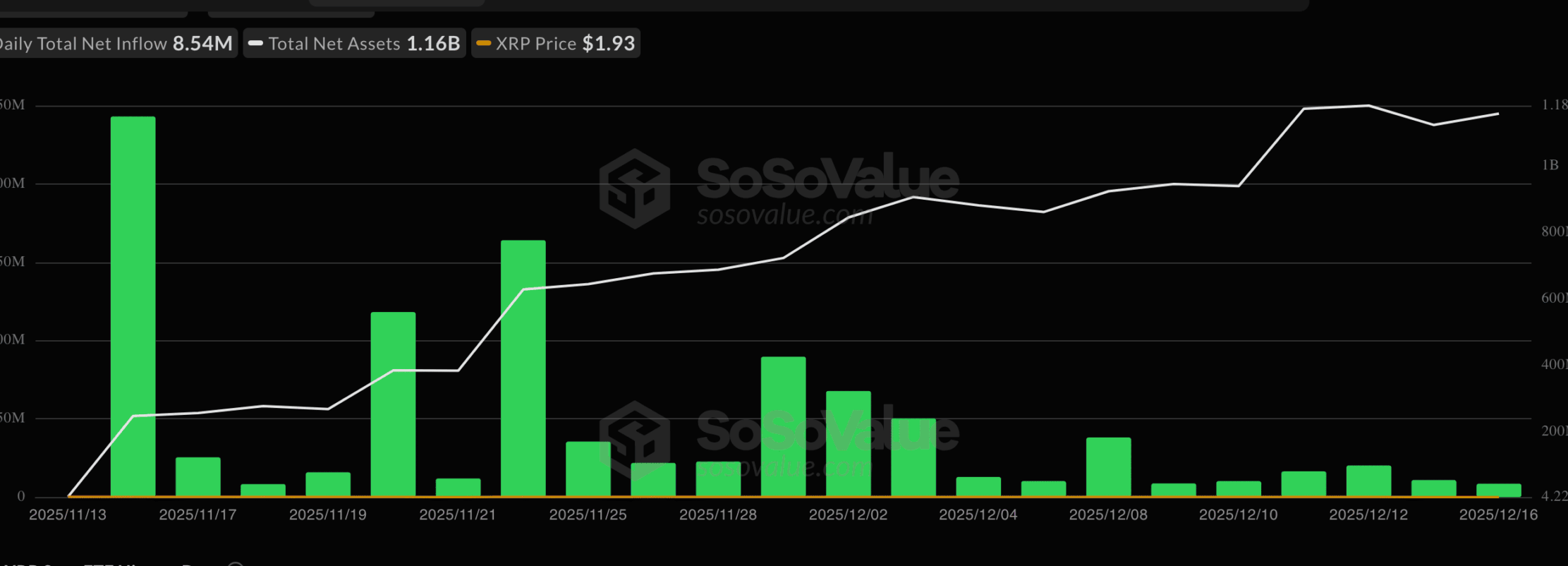

Despite his doubts, the Ripple coin still draws institutional investment. Spot XRP ETFs have broken the $1 billion barrier for accumulated inflows.

The crypto founder explained that he understands the reason behind people getting interested in the Ripple coin. He further explained that the coin, when fully realized, will yet show upside potential.

“I understand why people are investing in XRP…if Chris and Brad do it right and everything happens, it could go up to $10.”

What Utility Boosts the LINK Case?

Just earlier this month, Coinbase’s Layer-2 network Base launched its first official Solana bridge. That means assets are able to move across chains without having to rely on complex third-party tools.

Outside of bridges, the platform is playing a bigger role in turning real-world assets into digital ones. The DTCC has received approval from regulators to start a pilot program for this new digital asset system. They will use the platform, and the launch is expected in the second half of 2026.

Also, Grayscale launched the first Chainlink ETF in the U.S., with the ticker symbol GLNK. This product allows people to invest in LINK in a regulated way.