- The Crypto Fear and Greed Index rose to 79 on July 12, 2025.

- Extreme greed mood signals potential volatility in crypto markets.

- Institutional ETH accumulation seen as BTC faces profit-taking.

The Crypto Fear and Greed Index surged to 79 on July 12, placing it in the “extreme greed” category that raises market alertness. This leap reflects burgeoning investor optimism, spurred by institutional actions in the crypto sphere.

On July 12, 2025, the Crypto Fear and Greed Index jumped to 79 from 71 the previous day. This ascension places market sentiment firmly within the “extreme greed” territory, suggesting a notable shift in investor behavior toward speculation. The index gauges sentiment through multiple inputs, including volatility and market volume, indicating a broad spectrum of factors influencing this surge.

“Extreme Greed” Surge and its Market Implications

The shift in the index reflects heightened bullish anticipation, drawing investor attention to potential volatile conditions. Increased trading volumes and visibility in social media metrics are contributing factors, affecting decision-making processes within the crypto community. Institutional actors have notably turned their focus toward Ethereum, with major players like Bit Digital and BTCS increasing their ETH holdings.

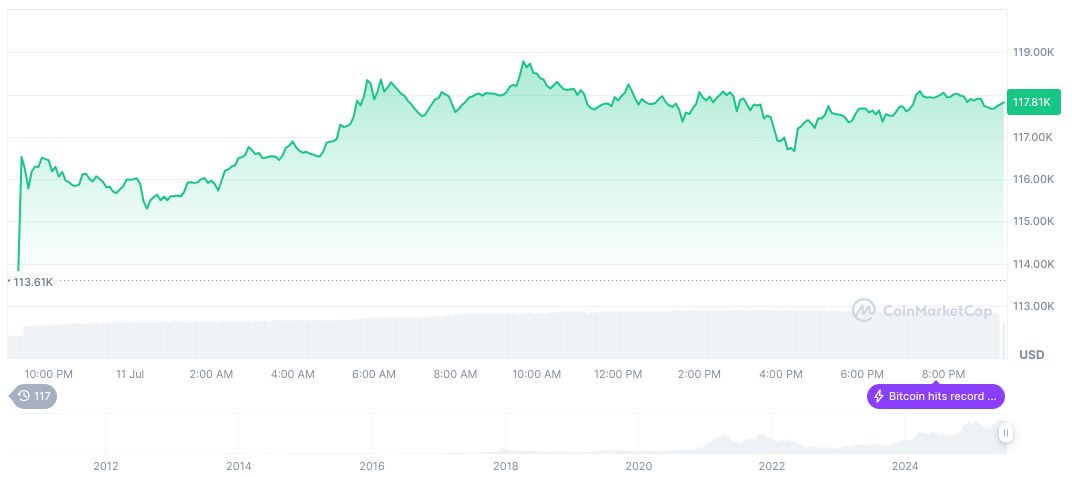

Market reactions have been mixed. Bitcoin’s price dipped to below $117,000, potentially indicating profit-taking actions by some investors in response to the “extreme greed” environment. Notably, leading crypto figures and heads of major online platforms have yet to publicly address this sentiment index shift. This silence could imply that market participants are relying on other communication channels or strategies to guide their actions. “No direct statements have recently appeared on his official channels regarding this event as of July 12, 2025.” – Sam Tabar, CEO, Bit Digital.

Bitcoin’s Volatility Amid Historical Sentiment Patterns

Did you know? Historical trends reinforce the necessity of preparing for both market corrections and upward rallies amidst extreme sentiment changes.

Bitcoin’s recent price at $117,548.98 stems from an intricate interplay of investor actions and market influences. Based on data from CoinMarketCap, the cryptocurrency exhibits a market cap of 2.34 trillion and dominance of 63.83%. Its 24-hour trading volume faced an 11.11% decline, though its overall value rose by 1.77%. Performance over the last 90 days reflects a notable gain of 38.11%, showcasing the crypto’s robust standing amid systemic fluctuations.

Insights from analysts highlight potential correlations between market sentiment indicators and asset volatility patterns. Recent institutional acquisitions signal a favorable outlook on crypto’s long-term trajectory. To manage current market risks, core strategies might include diversifying holdings and exploring opportunities in various decentralization-focused assets such as DeFi protocols.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348168-crypto-fear-greed-index-extreme-greed/