- Bitcoin’s slide from $126 K to $121 K pulled the Crypto Fear and Greed Index down to 55 (Neutral).

- $650 million in liquidations and high Open Interest suggest short-term caution.

- Analysts see a “healthy reset” before a potential ETF-driven rebound.

The crypto market cooled sharply as traders booked profits from Bitcoin’s recent all-time-high run. Total crypto market cap fell about 2.5 % in 24 hours to $4.15 trillion, according to CoinMarketCap.

As such, the crypto Fear and Greed Index, provided by Binance-backed CoinMarketCap, dropped from 62%, which represents greed, to 55%, which represents neutral sentiment from traders.

Related: Wall Street Veteran Paul Tudor Jones Renews Bitcoin Call as Institutional Profits Climb

What’s Next for Crypto Market Sentiment?

Is Elevated Open Interest a Bad Omen?

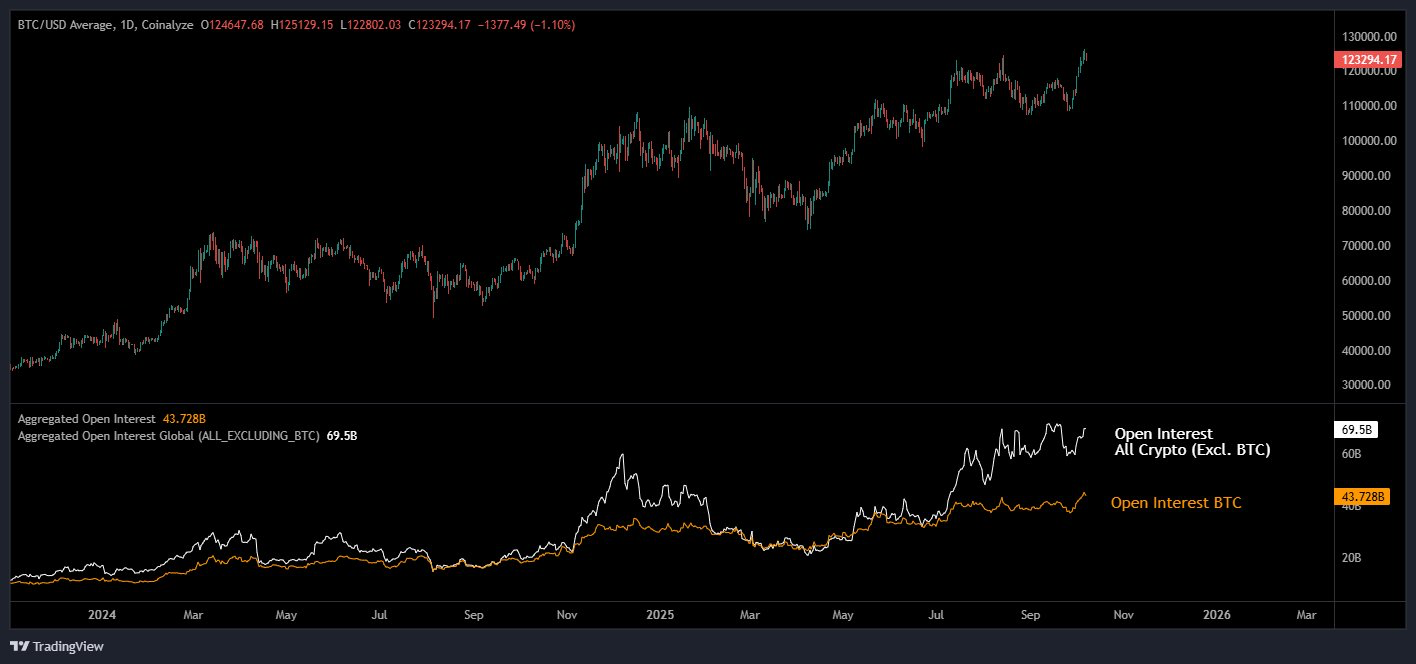

The crypto markets’ Open Interest has scaled to the same levels recorded during the fourth quarter of 2024, which resulted in 30% drawbacks.

Already, the high leveraged crypto market has resulted in notable liquidation of long traders, thus fueling the odds of a long squeeze. During the past 24 hours, more than $650 million was liquidated from the crypto market, with over $497 million involving long traders.

However, Bitcoin’s funding rate has shifted from negative to positive, signaling a possible rebound in the coming days. Notably, positive funding rates are associated with a bullish outlook and vice versa.

Analyst Insights and Expectations

According to crypto analyst Benjamin Cowen, Bitcoin dominance is about to rebound in the coming weeks as liquidity shifts from altcoins. The crypto analyst previously noted that the parabolic altseason will only begin after the Ethereum price sets several new all-time highs, possibly in November onwards,

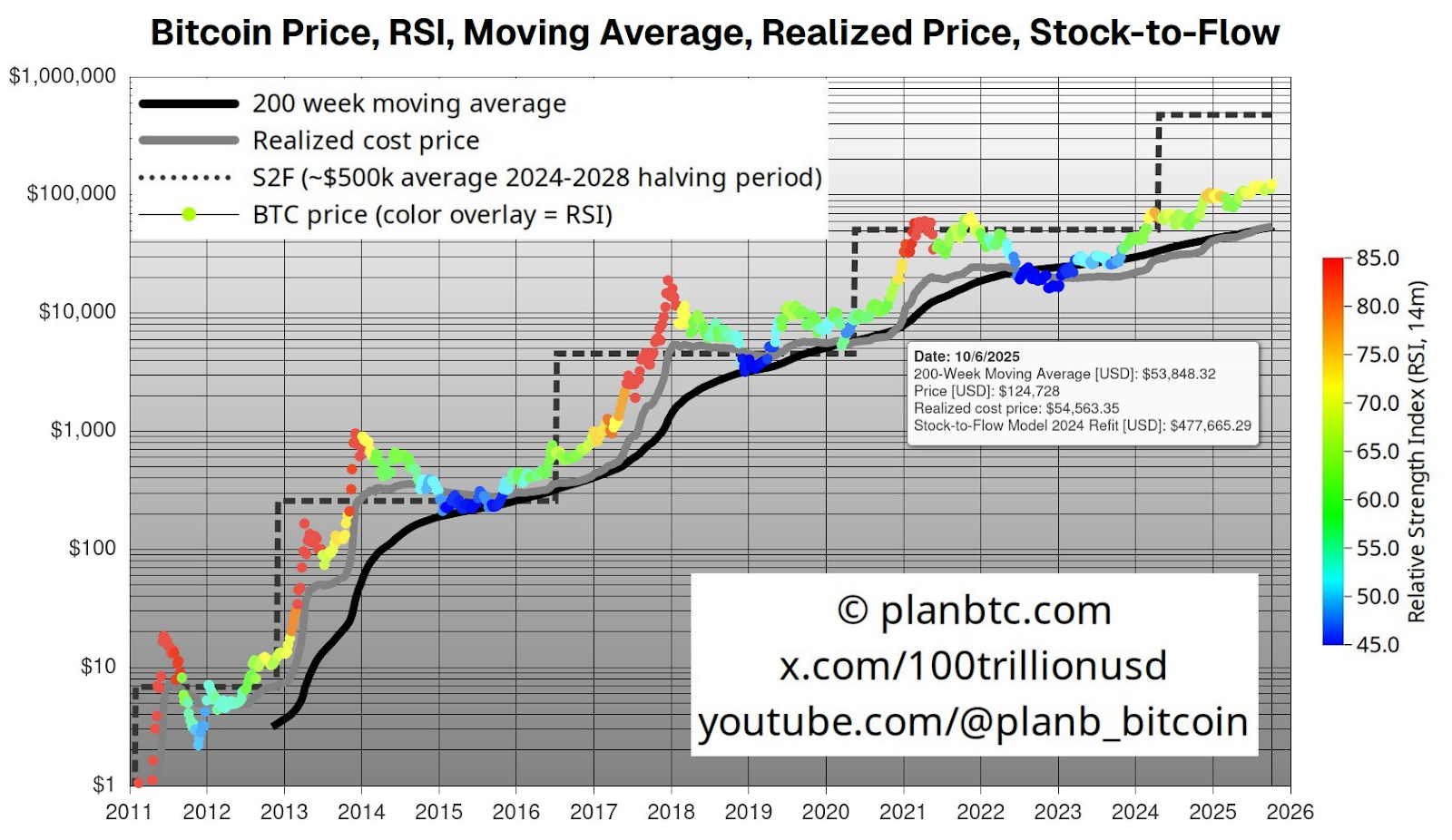

Meanwhile, crypto analyst PlanB has reiterated that more upside momentum will happen in the near future. Furthermore, PlanB noted that Bitcoin’s monthly Relative Strength Index (RSI) has been hovering around 72, which is not close to overbought levels experienced during the past bull markets.

Bigger Market Picture

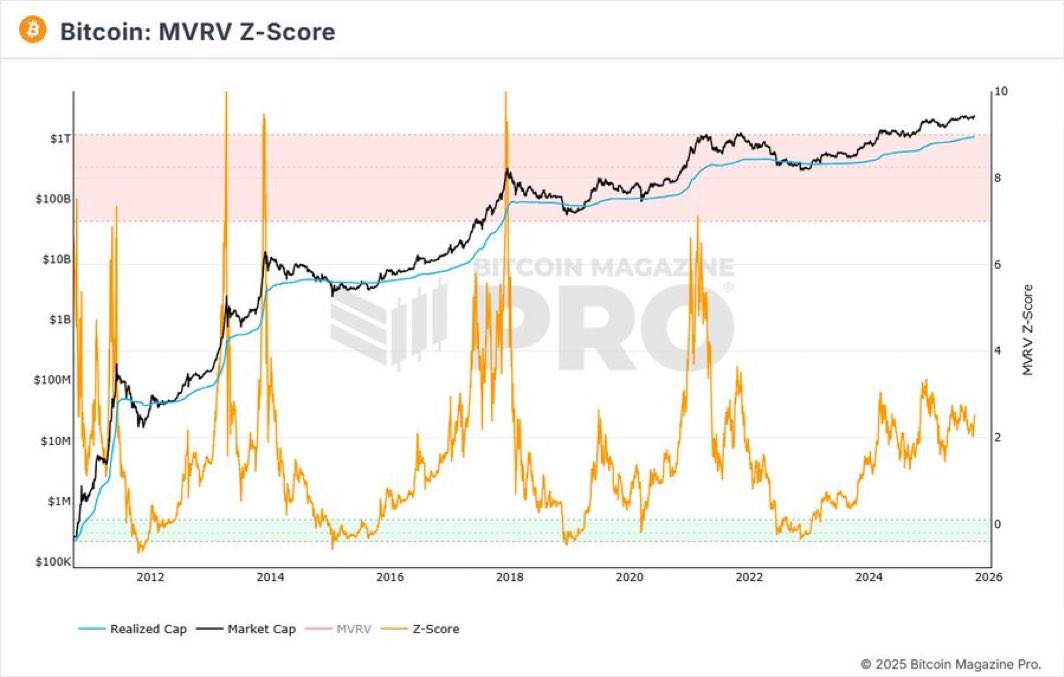

The crypto market has not yet experienced parabolic growth akin to the 2017 and 2021 bull rally summers. Furthermore, the MVRV Z-Score shows that Bitcoin price has not yet recorded its peak similar to its prior bull market cycles.

The macro bullish outlook is bolstered by the renewed demand for the U.S. spot BTC ETFs. In the past two weeks, the U.S. spot BTC ETFs have recorded a net cash inflow of over $4.4 billion led by BlackRock’s IBIT.

Ultimately, Bitcoin will lead the wider crypto market in a similar parabolic rally akin to Gold once capital rotation escalates. For the first time in human history, the Gold price surged above $4k per ounce to trade at about $4,038 at press time.

Related: Bitcoin Eyes $250K as Arthur Hayes Links Rally to Trump Fed Takeover

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/crypto-fear-and-greed-index-drops-to-55-as-traders-eye-reset/