- Crypto markets faced record $19 billion liquidations after Trump’s 100% China tariff threat.

- CoinGlass called it the largest liquidation in crypto history; 1.6 million traders wiped out.

- Analysts Zeberg and van de Poppe see a final rally before a macro cool-off.

The crypto market saw its steepest one-day drop in months, falling 9.93 % to $3.73 trillion in market cap as Trump’s 100 % tariff threat on Chinese imports sent shockwaves through risk assets.

Investors rushed to cut exposure as liquidation cascades erased billions within hours and sparked flashbacks to March 2020’s Covid-era panic.

According to CoinGlass, 1,618,240 traders were liquidated in 24 hours, totaling $19.13 billion, that’s the largest wipeout in crypto history. Crypto analyst, Analyst Ash Crypto noted the event was 20 times bigger than the Covid crash and more than ten times the FTX collapse.

Bitcoin Breaks Below $112K Support

Bitcoin is now trading at $111,802, down nearly 8% in the past 24 hours. Ethereum has fallen over 12%, sliding to $3,778. Both assets broke through critical support zones that had previously held steady for weeks.

Altcoins have been hit even harder. Binance Coin (BNB) has tumbled 13%, while Solana and Cardano have crashed over 16% and 20%, respectively. XRP dropped by nearly 14%, now trading around $2.42. Dogecoin, TRON, and other mid-cap tokens also suffered steep declines, confirming a broad-based correction that has spared almost no asset.

Related: U.S. Shutdown Stalls 90 Crypto ETF Approvals in October, Freezes $10 Billion in Inflows

Economist Henrik Zeberg Sees a “Final Rally Before the Fall”

Economist Henrik Zeberg believes this crash could be setting up the next big move for Bitcoin. In his view, the crypto market is entering a key stage before a potential breakout. While many expect the U.S. dollar to weaken, Zeberg thinks it is actually nearing a short-term bottom, which could give risk assets like Bitcoin — a temporary boost.

According to Zeberg, weak non-farm payroll data in the U.S. shows that the economy is losing momentum. That, he says, often creates the right conditions for a final “blow-off” rally, the last strong surge before a major market cooldown.

“Final Rally Before the Fall”

Zeberg explained that most of the biggest crypto gains come during this final vertical phase, when prices rise sharply and fear of missing out (FOMO) takes over

However, he also warned that this period doesn’t last long. Once the dollar starts to strengthen again, it could trigger another correction across equities and crypto.

Bitcoin Eyes Its Cycle Defining Level

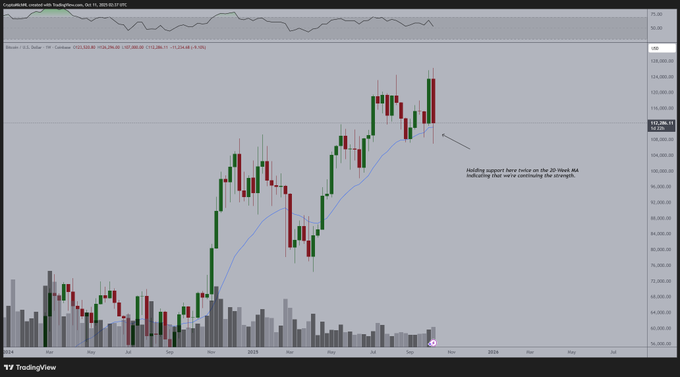

Market analyst Michael van de Poppe says Bitcoin’s next move depends on whether it can hold above its 20-week moving average, currently near $112,000. If it stays above this level and begins to rebound, he says this drop could mark the final capitulation phase, similar to what happened during the COVID-19 crash and the FTX collapse.

A strong recovery from this zone could confirm Zeberg’s view that the market still has one last major rally left before the cycle peaks.

Related: Bitcoin’s Price Now Tracks Global Liquidity Curves, Not Block Rewards

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/crypto-crash-2025-19-billion-liquidations-march-2020/