- Major corporate players hold over $100 billion in digital assets.

- MicroStrategy and others lead in Bitcoin holdings.

- Ethereum sees a surge in institutional interest.

Corporate cryptocurrency finance firms, including MicroStrategy, now hold over $100 billion in digital assets, primarily Bitcoin and Ethereum, according to a July 31 Galaxy Research report.

This significant holding underscores growing institutional interest in cryptocurrencies, potentially influencing market dynamics and driving further corporate treasury investments.

$100 Billion in Corporate Crypto Holdings Signals Shift

MicroStrategy, Metaplanet, and SharpLink are prominently involved in this extensive digital asset accumulation, collectively holding over $100 billion in assets. MicroStrategy has gained attention for securing over 791,662 bitcoins, valued at approximately $93 billion. The firm maintains a significant presence in the crypto sphere, powering its corporate treasury strategy with Bitcoin. As Ethereum also draws institutional interest, over 1.3 million ether is reportedly held by these firms, valued around $4 billion.

The growth in corporate cryptocurrency holdings highlights a pivotal shift, underscoring increased trust in digital assets as credible treasury components. Ethereum indicates a notable uptick in institutional flows into corporate reserves, with trends showing further acceleration in 2025, particularly for Ethereum.

The community and industry have responded with cautious optimism. Michael Saylor, Executive Chairman of MicroStrategy, is vocal in advocating for Bitcoin as a principal treasury asset, reinforcing this strategy openly on social platforms.

MicroStrategy remains committed to our Bitcoin strategy and continues to accumulate #BTC as our primary corporate treasury asset. — Michael Saylor, Executive Chairman, MicroStrategy

Bitcoin and Ethereum Lead in Institutional Interest

Did you know? Historically, large-scale corporate acquisitions of Bitcoin, such as those by Tesla and Square in 2021, have sparked significant market rallies, showcasing the influential power of institutional purchases.

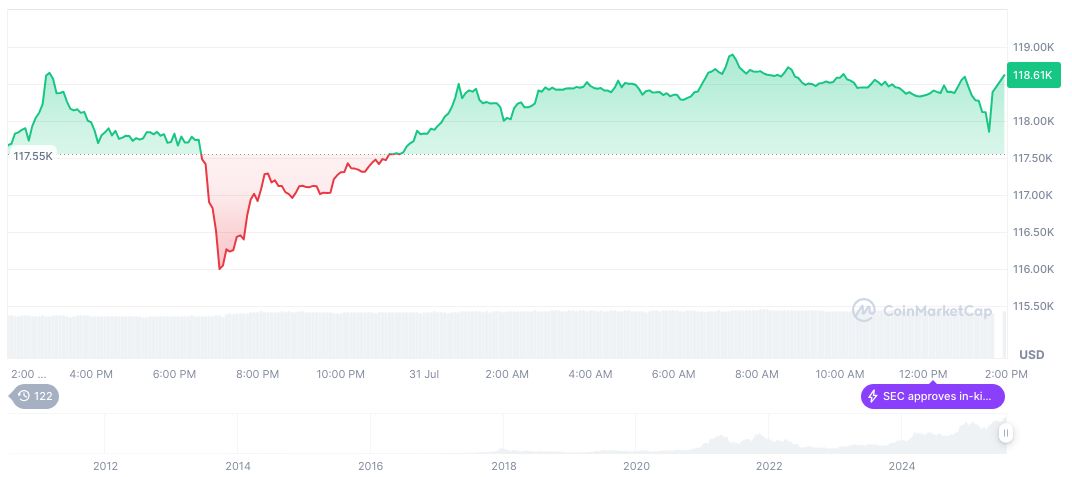

Bitcoin’s current market position remains robust, with a price of $117,934.76 and a market cap nearing $2.35 trillion. Dominating 60.76% of the market, Bitcoin’s volume reached $68.61 billion, influenced by varied trading trends over recent months. Its steady price increase reflects investor confidence amidst fluctuations, CoinMarketCap reports.

Experts from Coincu state that the growing institutional embrace of cryptocurrencies signals transformative changes within financial infrastructures. Enhanced regulatory clarity and technological advancements, especially in blockchain applications, are anticipated. Data and historical trends support projections of sustained growth in digital asset adoption by traditional financial entities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/corporate-crypto-holdings-100-billion/