- Coincheck acquires Aplo for European expansion with MiCA compliance.

- Transaction to conclude by October 2025.

- Focus on serving institutional clients in Europe.

Coincheck, a Japanese crypto exchange, announced its acquisition of Aplo, a French digital asset brokerage, aiming to expand its reach in the European market by October 2025.

This move aligns with Coincheck’s global expansion strategy, leveraging Aplo’s regulatory position to bolster European institutional crypto services amid increasing demand and evolving MiCA compliance standards.

Coincheck’s Strategic Move for European Market Dominance

Coincheck’s acquisition of Aplo is part of its expansion strategy into the European market. The transaction will see all outstanding shares of Aplo converted into newly issued Coincheck Group stock. The acquisition is expected to close by October 2025.

The acquisition aims to enable Coincheck to leverage Aplo’s regulated infrastructure for serving institutional clients within the European Union. Coincheck’s focus on expanding institutional service offerings aligns with Aplo’s ongoing MiCA registration efforts.

Reactions to the acquisition lack specific statements from key crypto figures or regulatory authorities. Market experts speculate on potential enhanced institutional access across Europe, aligning with broader industry trends towards regulatory compliance for facilitating market entries.

Market Insights and Implications Post-Acquisition

Did you know? The acquisition of Aplo by Coincheck draws parallels with other crypto exchanges that have partnered with regulated entities in Europe post-MiCA to accelerate their regional expansion.

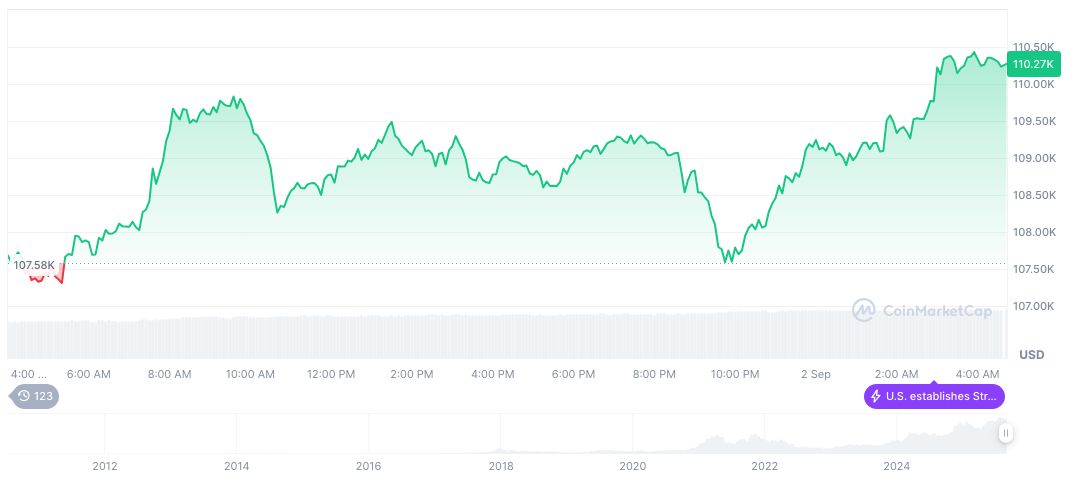

According to CoinMarketCap, Bitcoin (BTC) is priced at $110,243.70, with a market cap of nearly $2.20 trillion. BTC holds a market dominance of 57.64%, witnessing a 1.42% rise over the past 24 hours as of September 2, 2025. The 24-hour trading volume was reported at approximately $67.01 billion, undergoing a 26.35% increase.

Insights from the Coincu research team suggest this acquisition could enhance Coincheck’s market share in Europe, aligning with MiCA’s regulatory framework. Aplo’s status with the AMF and its ongoing MiCA application present a strong foundation for facilitating institutional transactions in the region.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/coincheck-european-expansion-aplo-acquisition/