- Circle shares quadruple post-IPO, inspiring crypto firms toward public listings.

- Surge in Circle shares could drive more IPOs.

- Major players like FalconX and Gemini prepare listings.

Jeremy Allaire’s Circle Inc. (NYSE: CRCL) has seen its share price quadruple since its debut on the New York Stock Exchange. Analysts suggest this success will encourage other cryptocurrency firms to pursue similar strategies.

Circle’s shares demonstrated impressive growth, reaching four times their initial public offering price of $31 per share within days on the NYSE. The lack of official statements from FalconX, Gemini, and others highlights cautious optimism as these firms ponder future IPOs influenced by Circle’s landmark results.

Circle Shares Skyrocket, Prompting Industry Interest

This surge in Circle’s market value signals heightened interest from institutional investors in cryptocurrency companies. Analysts anticipate a wave of public listings from crypto firms. The U.S. Securities and Exchange Commission is now processing multiple confidential submissions, suggesting robust behind-the-scenes activity among crypto ventures.

Market reactions have been broadly positive, especially in the equity sector, where anticipation builds for upcoming listings from significant players like Kraken and Bithumb. With an eye on the future, market watchers expect upcoming IPOs to align with Circle’s successful formula.

“The scale of Circle’s debut marks it as the most successful US IPO in years for companies raising over $100m, signaling a major shift from the market caution that followed previous crypto winter periods,” according to a Financial Analyst.

Historical Gains Highlight Investor Appetite

Did you know? Circle’s successful IPO marks the most substantial first-day gain for a U.S. IPO surpassing $100 million since 2021, indicating a fresh investor appetite for crypto-based equities.

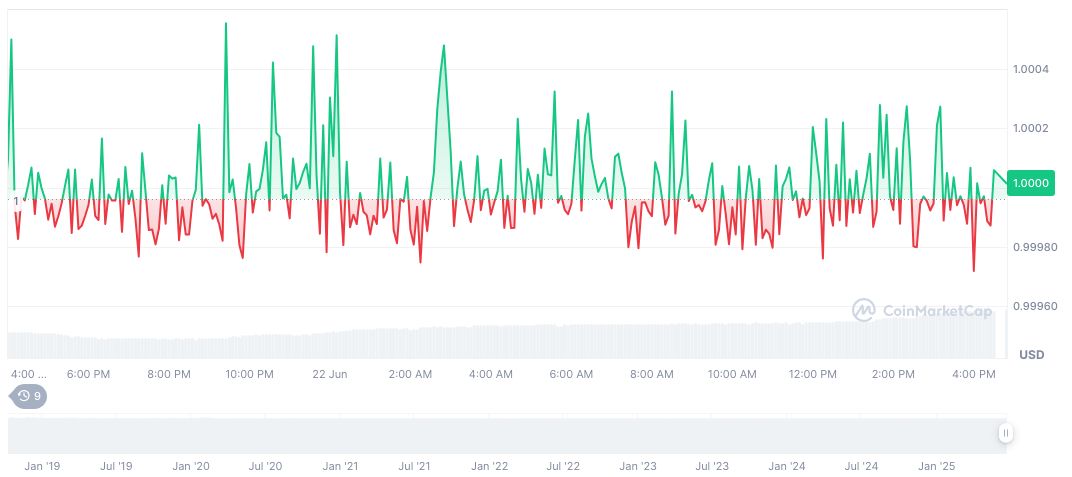

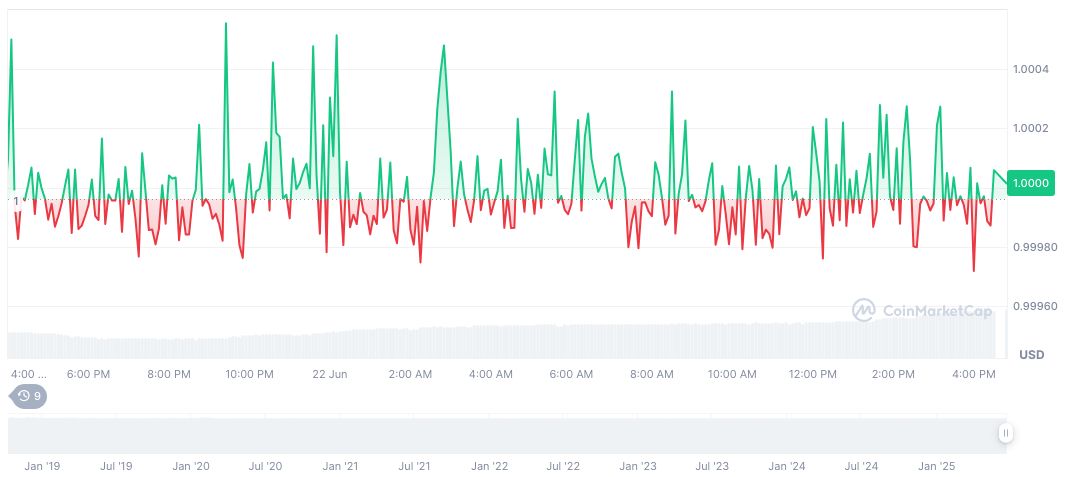

According to CoinMarketCap, USDC (USDC) currently holds a $61.26 billion market cap, reflecting a slight 0.01% increase over the past 30 days. Trading volume surged by 88.62% over 24 hours. The stablecoin’s steady price at $1.00 reinforces its stable position in the crypto market as of the latest data on June 22, 2025.

Expert analysis suggests that these IPOs may face regulatory scrutiny, especially in regions contemplating stablecoin regulations. The Coincu research team emphasizes that market trends supporting these high-profile listings are contingent on legislative clarity and technological adoption globally.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344633-circle-stock-surge-crypto-ipos/