- Circle’s IPO raises $1.1 billion, impacting stablecoin ecosystem.

- Increased institutional interest in stablecoins.

- USDC and DeFi protocols face market shifts.

Circle’s IPO, priced at $31 per share, raised $1.1 billion, valuing the company at $6.2 billion.

The IPO marks the first public offering by a stablecoin issuer, potentially increasing institutional engagement in the crypto ecosystem as USDC’s influence grows.

Circle’s $1.1 Billion IPO: A New Era for Stablecoins

Circle’s IPO demonstrates a pivotal moment in the crypto market. The company raised a significant $1.1 billion, valuing it at $6.2 billion. It marks the first time a stablecoin entity has achieved public listing at this scale. Circle’s public offering attracted vast attention, highlighting its potential to enhance institutional investment in stablecoins.

The IPO’s valuation emphasizes USDC’s expanding role, drawing interest from major financial sectors and investors. Stablecoins and DeFi protocols, especially those utilizing USDC, are expected to experience greater market participation. Circle’s success could accelerate institutional capital inflows into stablecoins, prompting shifts across related assets, including ETH and BTC.

Kiwi, Head of Research at OKX Ventures, said, “The Circle IPO marks a pivotal moment in our industry, offering insights into institutional engagement and the stablecoin landscape.” — ChainCatcher Official Event Announcement

Market Dynamics Post-Circle IPO: Regulatory and Growth Insights

Did you know? Leading up to Circle’s IPO, stablecoins saw unparalleled growth. History shows events like this boost market confidence and drive institutional adoption, similar to Coinbase’s IPO.

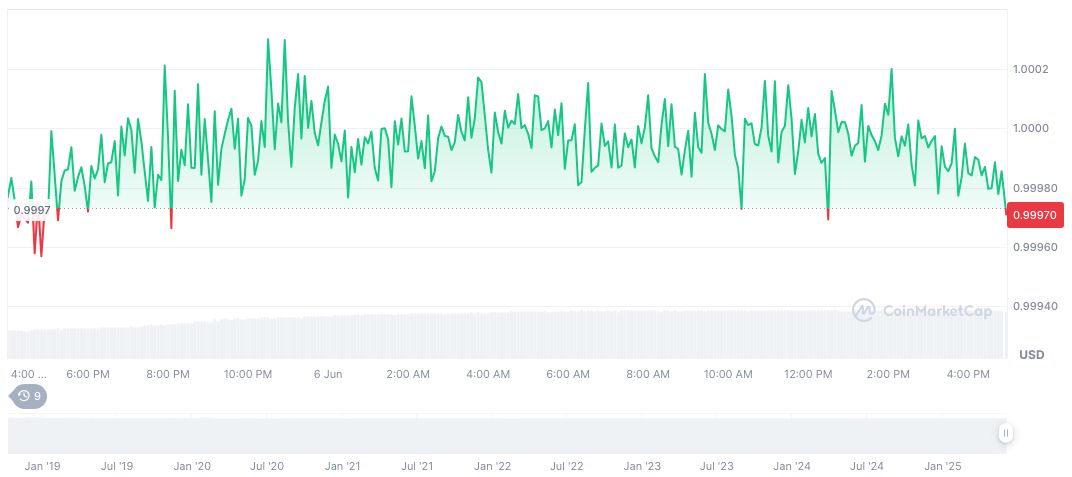

As of June 6, 2025, USDC holds a market cap of 61,029,483,865 with a stable price of $1.00. Over the past 90 days, the price showed minimal fluctuation at -0.01%. CoinMarketCap reports a 60.03% increase in 24-hour trading volume, indicating robust market activity.

Insights from Coincu’s research suggest regulatory and market adaptations. With Circle paving the way, future technological and financial frameworks for stablecoins could evolve rapidly. Enhanced market transparency and institutional integration are likely, diversifying crypto’s appeal.

Source: https://coincu.com/341927-circle-ipo-crypto-shift/