- China sentences individuals for laundering through virtual currency.

- Signals tightened regulations on digital assets.

- Stringent measures on crypto misuse in financial crimes.

China’s top legal authorities sentenced individuals in Beijing for laundering telecom fraud proceeds via cryptocurrency, illustrating heightened legal measures against virtual currency misuse.

This case signifies amplified regulatory action targeting crypto-related crimes, impacting market perceptions and compliance strategies within Chinese cryptocurrency activities.

Individuals Sentenced for 500,000 RMB Crypto Laundering

The events involved An, Chen, and Guo using an online platform to launder funds obtained through telecom fraud by purchasing virtual currencies. This was facilitated by logging into cryptocurrency exchanges and transferring funds to criminally designated accounts.

This case drew attention as part of China’s efforts to tighten regulations against digital assets. According to a Supreme People’s Court Official, “Cryptocurrency transactions explicitly used for laundering or concealing criminal funds constitute a punishable offense. The ‘should have known’ standard applies even if the defendant denies explicit knowledge of the crime.” However, major figures in China’s crypto industry have largely remained silent, likely due to legal sensitivities.

Analysis by Coincu reveals increasing Chinese regulatory oversight could potentially deter the misuse of cryptocurrency. This reflects a historical trend where non-compliance has resulted in severe legal consequences, highlighting a significant shift in enforcement strategies.

China’s “Should Have Known” Standard in Crypto Crime

Did you know? China has implemented a “should have known” standard, holding individuals accountable for using crypto in crimes, even if they claim ignorance. This represents an extension of compliance expectations beyond mere acknowledgment of digital asset use.

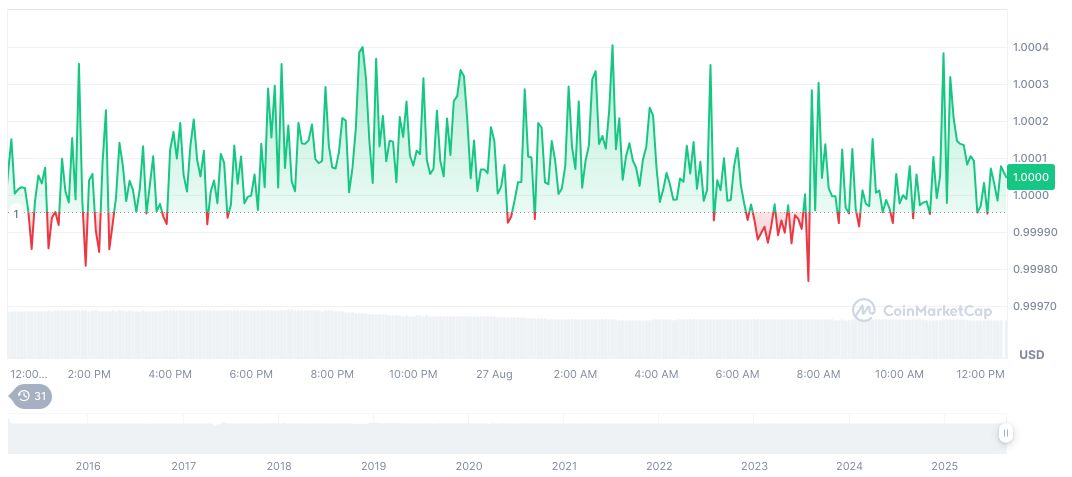

Data from CoinMarketCap on Tether (USDT) shows it maintains a steady value around $1.00, with a market cap of $167.22 billion. Notably, its 24-hour trading volume reached $127.68 billion, highlighting major activity amidst legal actions in China.

Analysis by Coincu reveals increasing Chinese regulatory oversight could potentially deter the misuse of cryptocurrency. This reflects a historical trend where non-compliance has resulted in severe legal consequences, highlighting a significant shift in enforcement strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/china-crackdown-crypto-laundering-sentences/