- Chinese government bans ICOs, mandates closure of crypto exchanges.

- Bitcoin dropped to $2,817 by September 15.

- Global market shifts as investors react to China’s actions.

On September 4, 2017, seven Chinese government agencies, including the People’s Bank of China, banned initial coin offerings (ICOs) nationwide, requiring cessation of domestic cryptocurrency exchanges.

This crackdown significantly impacted Bitcoin and Ethereum prices, leading to a notable market decline and shifting of operations offshore.

China’s Government Enforces Full ICO Ban on September 4, 2017

On September 4, 2017, the Chinese government, including the PBOC and six other top ministries, issued a joint notice to combat unauthorized fundraising activities. The government mandated the cessation of all ICOs and instructed domestic cryptocurrency exchanges to shut operations.

The mandated shutdown led to a sharp withdrawal of funds and a drop in Bitcoin and Ethereum prices. Investors were instructed to receive refunds, causing instant market instability and institutional hesitations. The People’s Bank of China, Central Bank of China stated, “By nature, [ICOs are] unauthorized and illegal public financing activity, which involves financial crimes such as illegal distribution of financial tokens, illegal issuance of securities, illegal fundraising, financial fraud and pyramid scheme.”

Coincu Research indicates that China’s initial stringent regulations prompted fluctuations in global markets as they signaled the scope of regulatory powers and potential international emulation. Historical patterns suggest ongoing regulatory scrutiny may either hinder or adapt to technological advancements in cryptocurrency ecosystems. For instance, while China bans fundraising via virtual currencies for companies, other regions like Singapore have outlined their own digital token regulatory position.

Price Drop and Market Repercussions Follow China’s Actions

Did you know? The 2017 ICO ban in China marked one of the first major state-level crackdowns on cryptocurrency activities, setting a precedent for global regulatory actions.

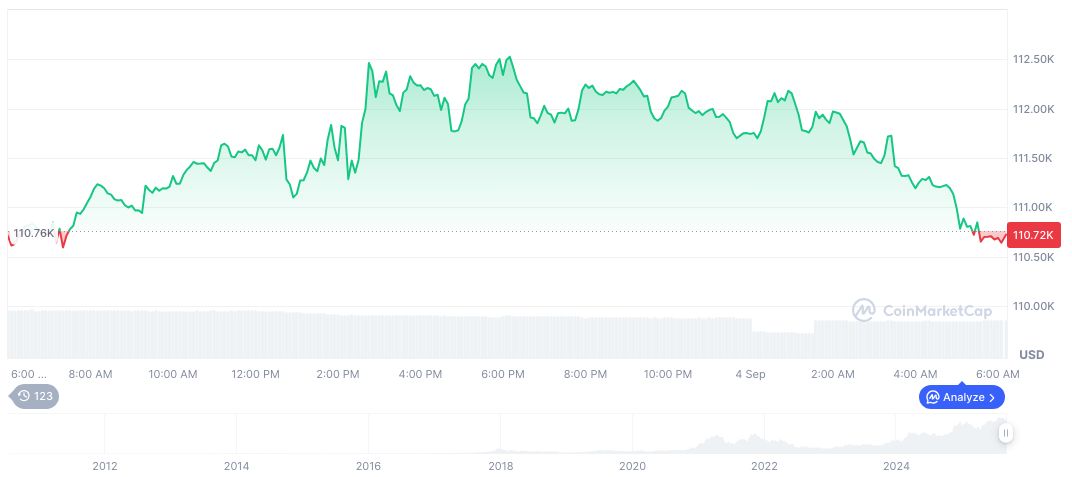

As of September 4, 2025, Bitcoin (BTC) held a market cap of $2.21 trillion, with a circulating supply of 19,915,362, as reported by CoinMarketCap. The asset saw a 0.09% rise in 24 hours but exhibited a 1.82% decline over a week. Renewed price movement trends depict a 7.47% increase over 90 days, suggesting a recovery from prior volatility.

As of September 4, 2025, Bitcoin (BTC) held a market cap of $2.21 trillion, with a circulating supply of 19,915,362, as reported by CoinMarketCap. The asset saw a 0.09% rise in 24 hours but exhibited a 1.82% decline over a week. Renewed price movement trends depict a 7.47% increase over 90 days, suggesting a recovery from prior volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/china-bans-ico-crypto-exchanges/