- Binance founder Changpeng Zhao is optimistic about the crypto industry.

- US policy changes and ETF growth enhance market outlook.

- Blockchain applications anticipated beyond financial transactions.

Binance founder Changpeng Zhao expressed optimism about the crypto industry in a recent interview, citing improved US policies and institutional interest.

Zhao’s comments highlight the potential for further advancements in blockchain applications beyond financial transactions, as well as positive regulatory signals from the US market.

Zhao Highlights ETF Growth and US Policy Impact

Changpeng Zhao, former CEO of Binance, addressed the evolving crypto landscape, emphasizing increased institutional investments via ETFs. Zhao noted the positive development of US regulatory policies exceeding his expectations, suggesting global influence from these changes. He expressed willingness to support the US as a crypto hub, despite current limitations in certain areas.

Zhao’s insights indicate a surge in institutional capital into crypto assets, primarily through ETFs, enhancing market liquidity and potentially benefiting Bitcoin and Ethereum. This shift is coupled with the expanding application of blockchain technology in taxation and healthcare, demonstrating its broader socioeconomic impact.

“I am very optimistic about the current development of the industry. Institutional and corporate funds are flowing into crypto through avenues such as ETFs. Moreover, blockchain technology will break through transaction and financial attributes, contributing to various aspects of government and people’s livelihoods (such as taxation, healthcare, etc.)” – Changpeng Zhao, Former CEO and Founder, Binance.

The crypto community has responded positively to Zhao’s outlook, with many industry figures endorsing his perspectives. The ongoing adaptation of US policies is seen as a catalyst for wider acceptance and possibly setting a precedent for other countries to follow. However, some stakeholders remain cautiously optimistic about the full realization of these regulatory advancements.

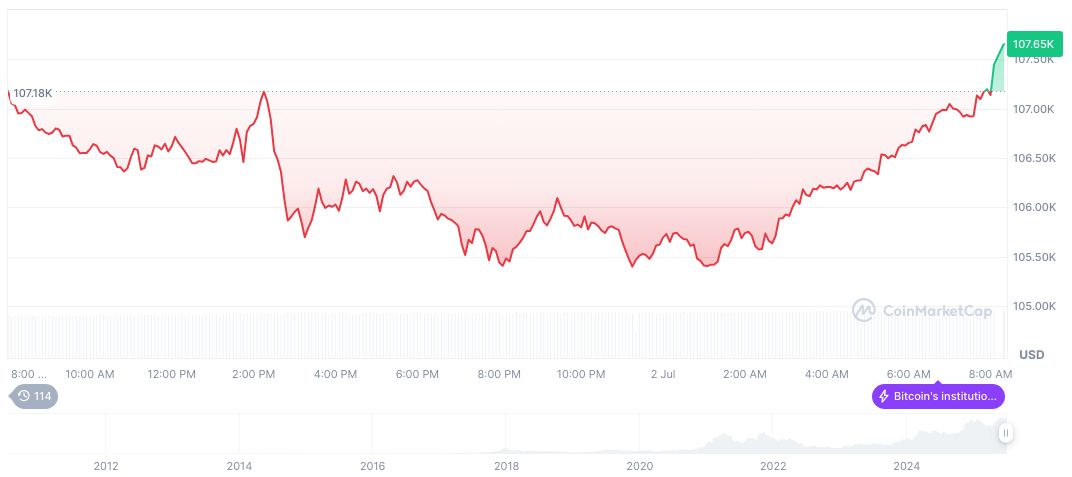

Bitcoin Surge: Market Data and Historical Insights

Did you know? Improved US regulatory stances, like earlier Bitcoin ETF approvals, have historically increased investor confidence, leading to greater capital inflows into major cryptocurrencies.

Bitcoin (BTC) stands at $109,249.92, with a market cap of $2.17 trillion, according to CoinMarketCap. The dominant cryptocurrency, showing a 3% 24-hour price jump, has sustained growth over 30, 60, and 90-day periods, reflecting heightened market interest.

Coincu research identifies an ongoing commitment toward integrating crypto into mainstream financial systems. This focus aligns with recent policy advancements and the expanded roles of digital assets in institutional portfolios, potentially escalating the industry’s global influence and adoption rates in traditional sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346489-zhao-supports-us-crypto-policy/