- ChainCatcher event examines U.S. IPO trends for crypto firms.

- Panel includes leaders from digital asset platforms.

- U.S. listings bring credibility but also regulatory challenges.

ChainCatcher is holding a Twitter Space event titled “Going Public in the U.S., the Last Stop for Crypto Companies?” featuring prominent figures from Web3 and investment sectors on June 28, 2025.

The event delves into the appeal of U.S. public listings for crypto firms, examining opportunities and regulatory challenges in a global market.

U.S. IPOs Draw Crypto Firm Interest and Scrutiny

ChainCatcher’s Twitter Space event, “Going Public in the U.S.”, features leaders from Web3 companies such as OSL, Futu Canada, and HashKey Group. The panel discusses motivations and risks in pursuing U.S. public listings.

Crypto companies aim to access large institutional capital and liquidity in the U.S., while enhancing regulatory legitimacy. Recent IPO plans by firms like Circle signify potential transformations in market dynamics.

Community discussions on platforms like GitHub and Discord show cautious optimism toward U.S. IPOs but acknowledge regulatory challenges. The focus remains on transparency and compliance demands for crypto firms. Midori Ge, BDM, Futu Canada, stated, “U.S. IPOs provide a crucial platform for crypto firms aiming for deeper institutional engagement and enhanced liquidity.“

Previous IPO Efforts Highlight Regulatory Challenges

Did you know? Previous IPO attempts by major crypto companies often increased visibility and market interest, yet faced regulatory hurdles, demonstrating the complex interplay between public markets and crypto industry growth.

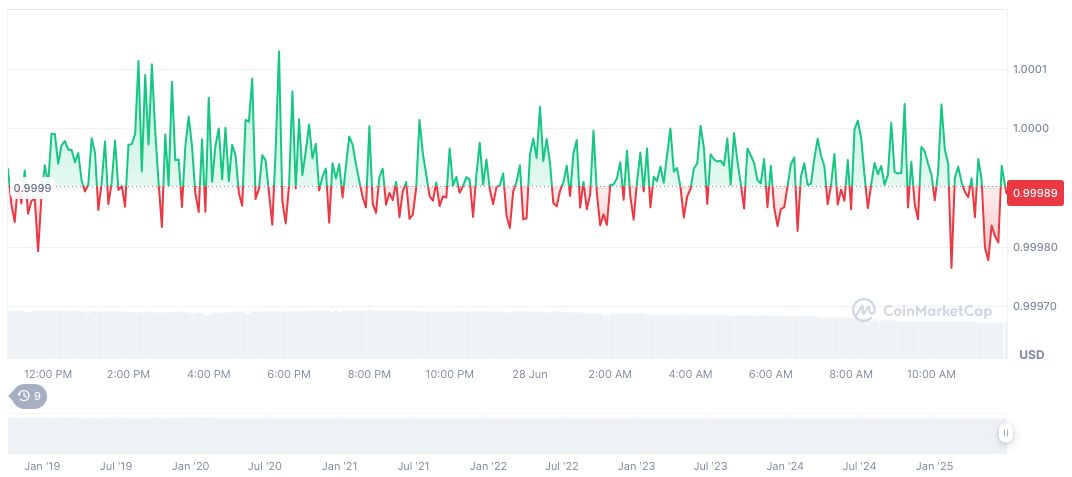

USDC maintains a stable price of $1.00 with a market cap of $61.71 billion, accounting for 1.87% of the market. Its 24-hour trading volume decreased by 45.61%. Recent price trends show a minor 0.01% rise in the past seven days, according to CoinMarketCap.

Coincu analysts indicate that while U.S. IPOs offer credibility, they may introduce heightened compliance costs. The trend may influence DeFi protocols by increasing liquidity, but firms must navigate regulatory landscapes diligently.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345743-chaincatcher-us-ipo-crypto-event/