- CFTC launches Crypto Sprint to enhance U.S. leadership in crypto markets.

- Boosts spot trading and leverages strategies, aligning with SEC.

- Public feedback solicited for policy development in digital assets.

The U.S. Commodity Futures Trading Commission (CFTC), under Acting Chairman Caroline D. Pham, announced a new Crypto Sprint to advance spot cryptocurrency trading as part of federal priorities.

This initiative aligns with SEC’s Project Crypto, aiming to enhance U.S. leadership in digital finance, affecting market dynamics and regulatory clarity for digital assets nationwide.

CFTC’s Strategic Move to Boost U.S. Crypto Trading

The primary change involves the expansion of spot trading frameworks, including leveraged and margined trading for retail and institutional participants. The initiative also seeks to incorporate extensive public consultation to refine approaches to leverage, margin, and retail trading policies.

Industry responses have been forthcoming. Caroline D. Pham stressed the urgency of regulatory clarity, asserting that it will deliver on the Administration’s promise. Feedback from exchanges and protocol contributors is already shaping policy evolution, as indicated by active discussions through various forums.

“The CFTC is wasting no time in fulfilling President Trump’s vision to make America the crypto capital of the world. We will work closely with SEC Chairman Paul Atkins and Commissioner Hester Peirce to achieve Project Crypto. Providing regulatory clarity now and fostering innovation in digital asset markets will deliver on the Administration’s promise to usher in a Golden Age of Crypto.” — Caroline D. Pham, Acting Chairman, CFTC CFTC Press Release

Regulatory Clarity and Market Impact on Bitcoin

Did you know? The CFTC’s approach to perpetual derivatives and 24/7 trading has already set precedents, driving regulatory clarity and significantly boosting institutional readiness.

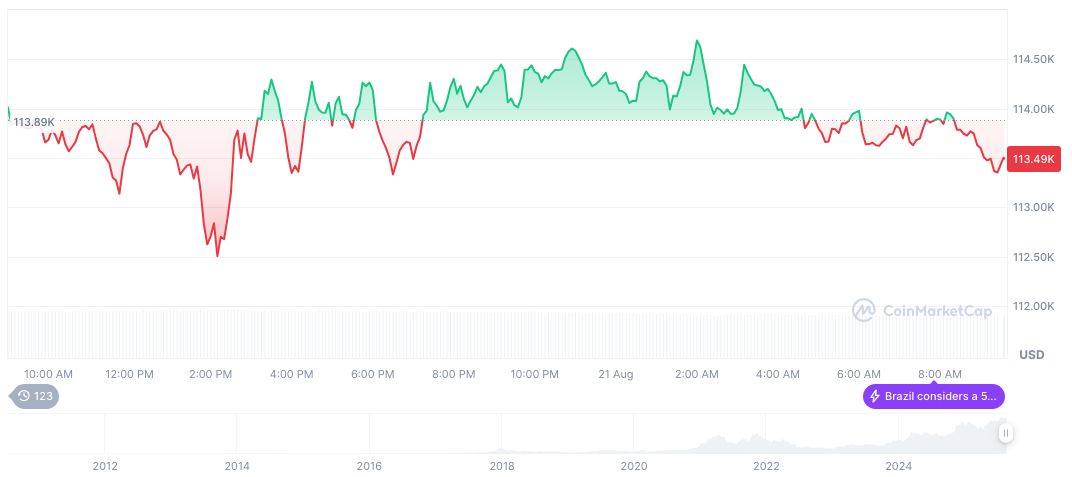

As of August 21, 2025, Bitcoin (BTC) reports a market cap of $2.24 trillion and market dominance of 58.70%. The current price of BTC is $112,390.73, showing a 1.66% decrease over 24 hours, and a 5.23% decline over the last 7 days. Trading volume saw a significant reduction, reported at $58.73 billion, according to CoinMarketCap.

According to Coincu’s research team, historical trends in regulatory clarity have typically sparked an increase in market engagement and expansion of trading activities. Such regulatory benchmarks are expected to stimulate investment strategies and introduce novel financial instruments in digital asset markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/cftc-announces-crypto-sprint-initiative/