- CFTC launches Crypto Sprint to enhance U.S. digital asset regulations.

- Targets innovation boost and regulatory clarity.

- Bitcoin, Ethereum markets anticipated to be impacted.

The U.S. Commodity Futures Trading Commission (CFTC) announced a new Crypto Sprint Initiative in collaboration with the SEC to advance digital asset regulation, aiming for global market leadership.

The initiative seeks to enhance regulatory clarity and foster blockchain innovation, potentially reshaping the U.S. crypto market landscape and affecting major assets like Bitcoin and Ethereum.

CFTC’s Crypto Sprint Set to Transform Digital Asset Rules

The CFTC introduced the Crypto Sprint Initiative, aimed at implementing the President’s Working Group on Financial Markets’ recommendations. Acting Chair Caroline D. Pham confirmed the launch on August 1, highlighting collaboration with SEC officials. Project Crypto hopes to achieve clear regulatory guidelines.

The new initiative focuses on providing clear regulations for the digital asset industry and fostering innovation in the crypto market. This move is expected to enhance transparency for U.S. and global entrepreneurs venturing into digital assets under CFTC oversight.

“The CFTC is working diligently to realize President Trump’s vision of making the United States the world’s crypto capital. We will collaborate closely with SEC Chair Paul Atkins and Commissioner Hester Peirce to advance ‘Project Crypto.’ Providing clear regulation for the digital asset market now and fostering innovation will deliver on the government’s commitment to usher in the crypto golden age” — Caroline D. Pham

Bitcoin Prices and Market Forecast Amid CFTC Actions

Did you know? The CFTC’s previous digital asset guidance helped stabilize Bitcoin futures, paving the way for increased institutional involvement in the cryptocurrency space.

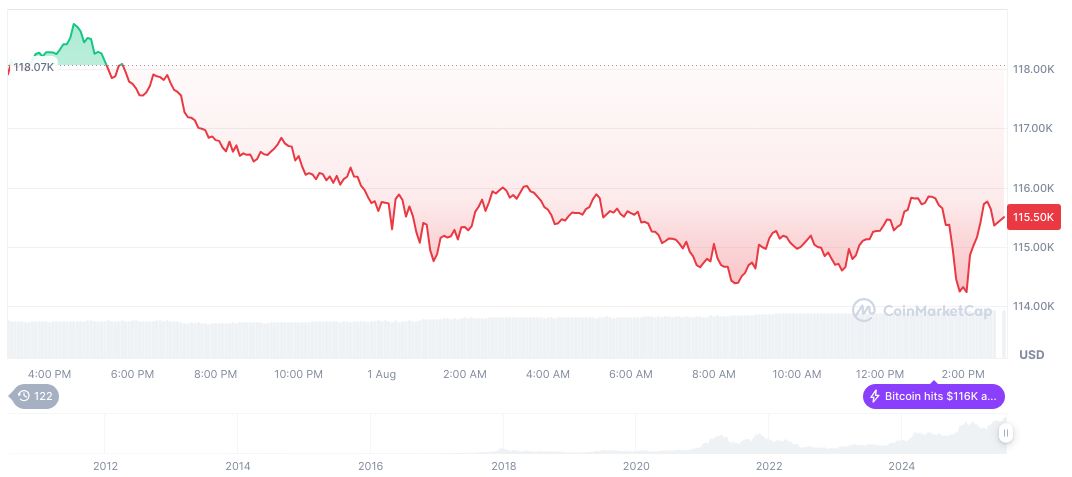

Bitcoin’s current price stands at $113,678.21, with a market cap of $2.26 trillion and dominance of 61.41%, according to CoinMarketCap. Its 24-hour trading volume reached $79.50 billion despite a 1.27% dip, reflecting persistent volatility yet exhibiting a notable 18.50% rise over 90 days.

Experts from the Coincu research team predict the Crypto Sprint Initiative could drive increased stability and growth in crypto markets. Historically, such regulatory efforts attract more institutional entities, suggesting potentially favorable technological and financial outcomes for industry participants.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/cftc-launches-crypto-sprint-initiative/