Este artículo también está disponible en español.

By Matthew Hayward, Senior Market Analyst at PrimeXBT

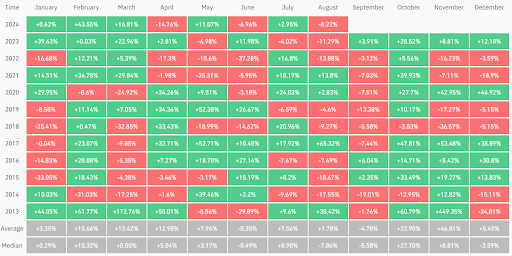

Historically, Bitcoin and the broader cryptocurrency market tend to experience a downturn in the month of September. This month has typically led to bearish price action movements, with both Bitcoin and other cryptocurrencies seeing consistent negative returns. However, this September has been unusually eventful, with heightened price activity driven by shifts in the macroeconomic landscape and signals from central banks regarding potential policy adjustments. These factors have created a “perfect storm” of volatility within risk assets, particularly in cryptocurrencies. As seen from the past decade of data, September consistently ranks as the worst month for trading Bitcoin.

Source: Crypto.ro

Bitcoins Seasonality and the Crypto Cycle Theory

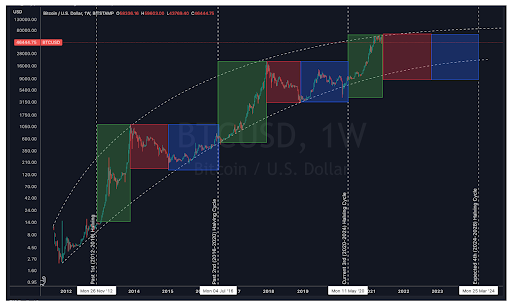

Traditionally Bitcoin and the broader cryptocurrency market have closely followed the “cycle theory,” particularly aligning with Bitcoin’s four-year halving cycle. So, how does this cycle relate to the current market performance? Following the most recent halving event, we have seen months of consolidation, with prices fluctuating within a range and market sentiment remaining predominantly bearish. This sentiment has directly influenced current market behaviour, keeping prices stable and reflecting the cautious outlook of traders and investors during this phase of the cycle.

Source: Tradingview, Bitcoin Mathematics

Uncertainty in the Macro-Landscape

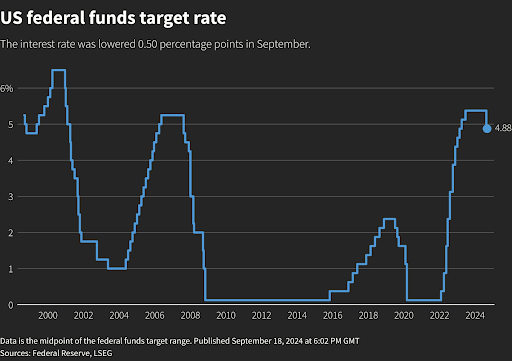

The macroeconomic landscape is becoming increasingly dynamic, marked by heightened uncertainty around central bank policies, something we haven’t seen in years. This uncertainty raises critical questions: will we face a recession, or will the economy continue to grow? With central banks navigating challenging economic conditions, the market is anticipating potential shifts in policy. This environment, combined with September’s historical tendency for consolidation and lower price movements, sets the stage for increased trading volume and volatility. As we approach key monetary policy decisions, especially with the U.S. elections on the horizon, we can expect an extended period of heightened volatility in the cryptocurrency market.

Source: Reuters

Big move from the FED and their Interest Rate decision

This month we have already seen the Federal Reserve surprise markets by implementing a 50 basis point rate cut, lowering the interest rate from 5.5% to 5%. This unexpected move has caught the attention of market participants, signalling a shift in monetary policy that could have effects on the broader economy and financial markets. You can observe below how after this rate cut decision, we have already started to see the total crypto market as a whole shift to the upside. Almost a 10% increase since the announcement.

TOTAL CRYPTOCURRENCY MARKET CAP:

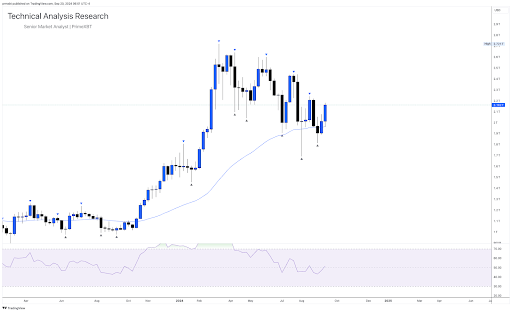

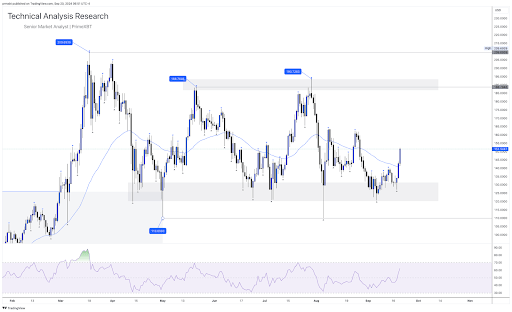

Bitcoins price action during this period of uncertainty

Despite September’s reputation as a historically weak month for Bitcoin, there are already signs of a potential breakout by the end of the month. Current price movements suggest a shift in market sentiment, hinting at the possibility of continued upward momentum. This outlook aligns with Bitcoin’s halving cycle, which tends to precede bullish phases. Many experts believe we are approaching this critical phase, with favourable market conditions and long-term cyclical trends likely to drive a surge in Bitcoin’s price in the near future.

BITCOIN (BTC/USD):

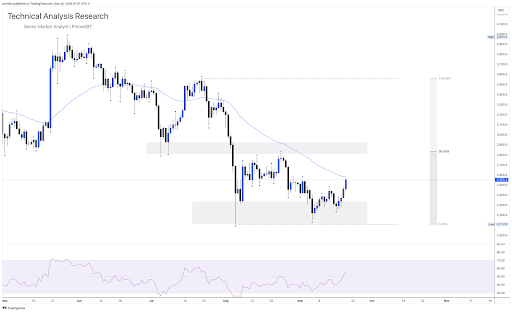

Other notable moves in the Cryptocurrency space

Following the release of favourable monetary policy data for risk assets, some interesting trends have emerged in the altcoin market. Solana, in particular, appears to be leading the way, showing the most volume and momentum. Its price is up nearly 25% for the month, challenging the belief that September is typically a poor-performing month for cryptocurrencies. This surge suggests that market dynamics may be shifting, with certain altcoins going against traditional patterns and benefiting from improved economic conditions.

There have been other notable movements, particularly from Ethereum (ETH). Despite the recent launch of the ETH ETF, there has been a somewhat delayed response in terms of increased volume and volatility in the pair, unlike the immediate surge seen after the Bitcoin ETF launch. However, Ethereum seems to be staging a comeback, with its price now trading above the $2,500 mark and showing signs of further short-term gains. It will be interesting to see if the ETH ETF ultimately has a positive impact on price action as market conditions evolve.

How to capitalise on the upcoming economic events

As the macro landscape evolves and uncertainty surrounding policy adjustments and macroeconomic conditions grows, new opportunities emerge. PrimeXBT, a leading online Crypto and CFD broker, provides an exclusive all-in-one trading platform designed to meet the diverse needs of traders.

At PrimeXBT, you can trade various price movements across multiple markets, including Crypto Futures and CFDs on cryptocurrencies, foreign exchange, indices, and commodities. It also offers the possibility to buy and trade with Crypto as well as fiat. With industry-lowest fees, powerful trading tools, and a broad selection of asset classes, PrimeXBT delivers the features you need to make the most of these economic opportunities.

Trade economic events with PrimeXBT

Disclaimer: The content provided here is for informational purposes only and is not intended as personal investment advice. Past performance is not a reliable indicator of future results. The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. Virtual assets are inherently volatile and subject to significant value fluctuations, which could result in substantial gains or losses. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money. PrimeXBT does not accept clients from Restricted Jurisdictions as indicated in its website.

Source: https://www.newsbtc.com/news/primexbt-can-septembers-historical-trends-shape-the-current-crypto-market-performance/