- Ziglu enters special management due to insolvency amid financial losses.

- FCA halts operations and freezes customer funds following directives.

- Special administrators appointed to manage asset distributions.

Mark Hipperson’s British crypto platform, Ziglu, has declared bankruptcy and entered special management. On July 7, RSM Restructuring Advisory was appointed by the court in charge as administrators. Recent losses and the FCA’s intervention catalyzed these measures.

Special management was necessary following substantial financial losses at Ziglu. The FCA ordered the cessation of operations, impacting client withdrawals and access to funds without protection from deposit insurance schemes.

Financial Collapse: Ziglu’s £24 Million Losses and FCA Actions

Ziglu’s entry into special management marks a significant turn for the company amid ongoing financial difficulties. The request for court intervention and subsequent appointment of special administrators occurred following over £24 million in losses, inclusive of £4 million lost to Celsius Network’s collapse. The firm’s distress led to freezing user funds as of June 13th.

Actions taken by the Financial Conduct Authority were instrumental in halting Ziglu’s operations. In response, the market is exhibiting concerns over exposed funds, given the absence of Financial Services Compensation Scheme coverage. Notably, user withdrawals have remained suspended, increasing uncertainty among affected clients.

Community reactions have been notably adverse, with customers expressing frustration over asset access restrictions. Public forums reflect a sentiment of distrust, as Ziglu’s leadership remains largely silent. Industry observers highlight the importance of regulatory interventions in crypto firms under financial strain.

Clients’ ability to access or withdraw funds was suspended following the FCA’s directive. — Damian Webb, Special Administrator, RSM Restructuring Advisory LLP

Community Backlash and Market Implications for Crypto Firms

Did you know? The structure for Ziglu’s administration under UK law parallels past fintech wind-downs but contrasts with U.S. Chapter 11 processes, which often offer more customer protections.

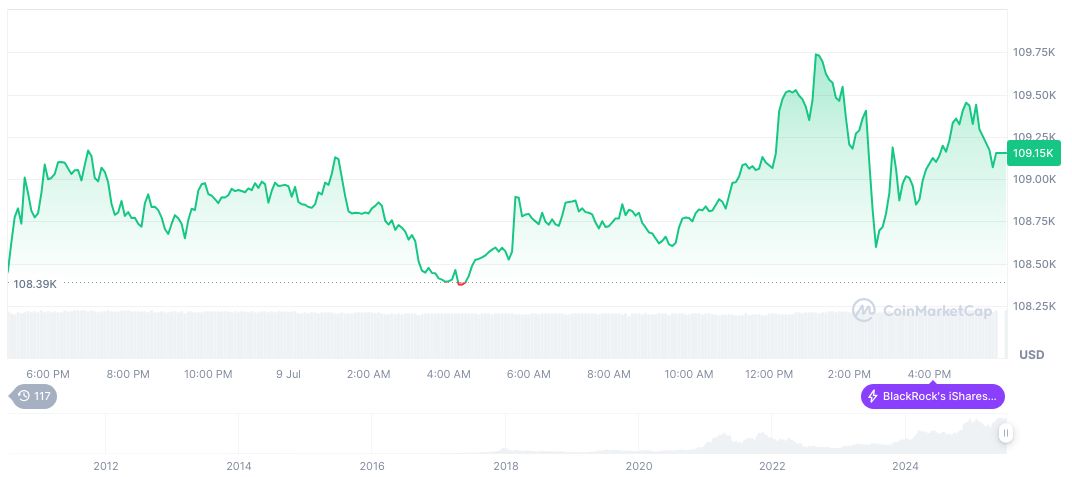

Bitcoin (BTC) holds a current price of $111,554.03, with a market cap of $2.22 trillion according to CoinMarketCap. The 24-hour trading volume is $59.45 billion, up by 42.57%. Over the past 90 days, BTC’s price rose by 38.27%, showcasing notable resilience amid market fluctuations.

The Coincu research team points out that Ziglu’s situation highlights the vulnerability of crypto platforms during market downturns. The lack of regulatory safeguards for digital assets underscores potential challenges. Future outcomes may necessitate stronger regulatory frameworks, to stabilize cryptocurrency markets during economic instabilities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347795-ziglu-special-management-fca-intervention/