- BlackRock and SEC discuss crypto ETF regulations, focusing on collateralization and liquidity.

- Momentum for investor protection and innovation in crypto markets.

- Potential changes in crypto ETF approval could affect market structure.

BlackRock, the world’s largest asset manager, met with U.S. SEC officials on May 9, 2025, to discuss regulatory standards for crypto financial products. The meeting aims to enhance investor protection and product innovation in the crypto market while exploring new ETF approval standards.

BlackRock, a major player in asset management, discussed regulatory standards for crypto assets with SEC representatives, highlighting topics like collateralization and ETF options. Robert Mitchnick, Head of Digital Assets at BlackRock, led these discussions focused on enhancing the structure and approval process of crypto ETFs. As Robert Mitchnick said, “BlackRock is positioning to clarify criteria for authorized participants in crypto ETPs and is advocating for the integration of staking into regulated features.”

BlackRock’s Role in Shaping Future Crypto Regulations

The deliberations included critical aspects of crypto ETFs such as liquidity thresholds and position calculation. BlackRock seeks to refine the role of authorized participants in handling crypto exchange-traded products, potentially paving the way for new financial products bridging traditional finance and blockchain technology.

Market observers are keenly watching for SEC’s guidance following these discussions. No statements have been released by BlackRock since the meeting. The broader crypto community anticipates further regulatory clarity, which could impact asset valuations and institutional strategies.

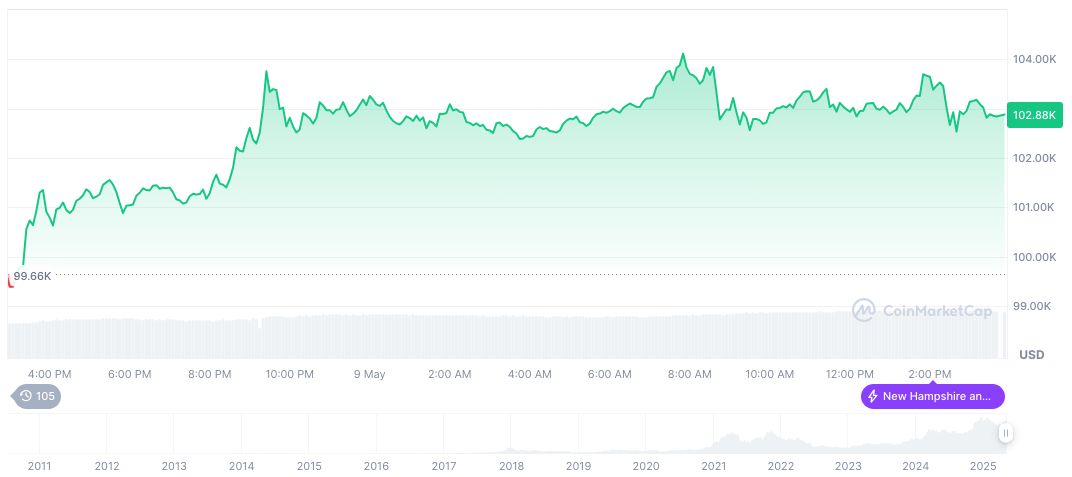

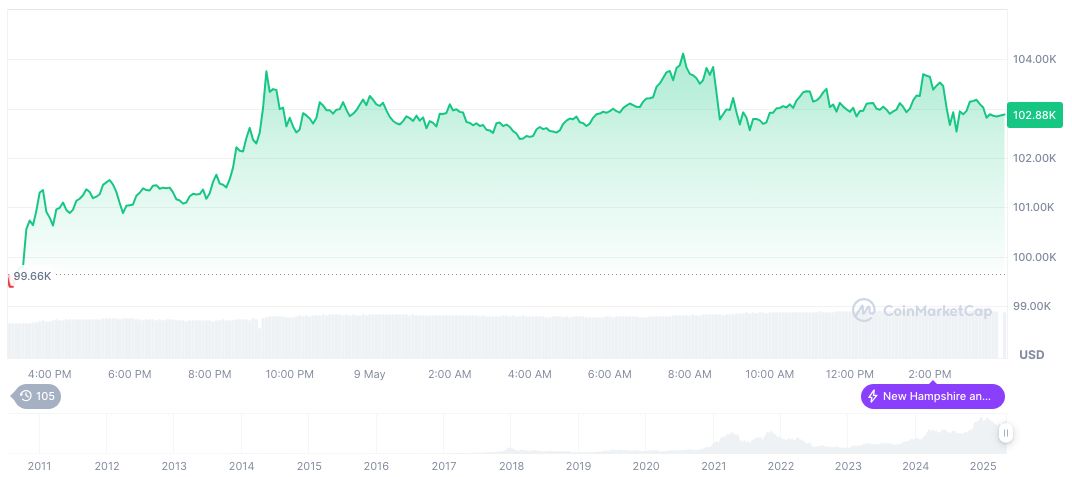

Market Data and Insights

Did you know? In 2023, BlackRock was pivotal in the SEC’s approval of spot Bitcoin ETFs, marking a significant regulatory milestone that positively influenced broader institutional investment in crypto assets.

Bitcoin, currently priced at $103,002.91, marks a significant presence in the crypto market with a market cap of $2.05 trillion and a dominance of 62.66%, according to CoinMarketCap. BTC trading volume dropped by 15.23% over the last 24 hours, though its month-over-month value continues to surge, rising 24.81%.

The Coincu research team suggests that BlackRock’s ongoing regulatory dialogues with the SEC could lead to innovative staking in their Ethereum ETFs. This integration may attract higher yields, sparking increased institutional interest and potentially influencing crypto market dynamics and asset pricing.

Source: https://coincu.com/336731-blackrock-sec-crypto-regulation-meeting/