In a pivotal development for the crypto industry, BlackRock met with the SEC’s Crypto Task Force on May 9, discussing critical regulatory issues that could shape the next wave of institutional adoption in digital assets.

The meeting comes amid a bullish wave in the crypto market, fueled by a new U.S.-U.K. trade deal and Bitcoin’s return to $100,000 for the first time since February.

Key Topics: Staking, Tokenization, ETF Rules

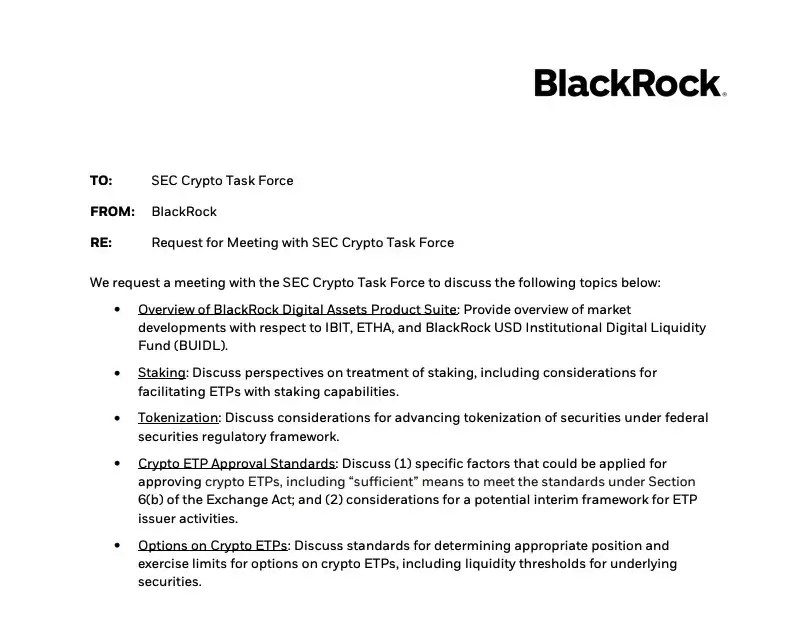

According to notes from the meeting request, BlackRock and SEC officials examined:

- Staking regulations and how staking products might be treated under U.S. securities law

- Tokenization frameworks, including regulatory pathways to support asset-backed tokens

- Exchange-traded product (ETP) approval standards, likely in reference to BlackRock’s existing and planned crypto ETFs

- The future of options trading on exchange-traded crypto products

BlackRock was represented by Benjamin Tecmire, Head of Regulatory Affairs, and Robert Mitchnick, Head of Digital Assets. The meeting reflects the asset manager’s continued push to deepen its role in the digital asset space—and signals the SEC’s evolving approach to engaging with major institutions pursuing crypto innovation.

Regulatory Momentum Builds

The discussion highlights the SEC Crypto Task Force’s increasing willingness to interact with industry leaders, even as regulatory clarity on staking, tokenization, and ETF pathways remains under development. For BlackRock, the talks further cement its position at the forefront of institutional crypto adoption.

Source: https://coindoo.com/blackrock-and-sec-discuss-crypto-etfs-staking-tokenization/