- The SEC has extended its review for Bitwise 10 Crypto Index Fund’s ETF conversion.

- Final decision expected by July 31, 2025.

- Community and market await SEC’s decision eagerly.

The decision by the U.S. Securities and Exchange Commission (SEC) regarding the Bitwise 10 Crypto Index Fund’s ETF conversion remains pending, with a final ruling expected on July 31, 2025.

This extension has led to heightened industry anticipation, affecting market projections and investor sentiment.

SEC’s Review Extension Stirs Market Excitement and Anxiety

The news that the SEC has yet to approve the conversion of the Bitwise 10 Crypto Index Fund to an ETF has drawn significant attention. The SEC extended the review period (SEC Extends Decision Deadline), citing the need for further considerations before granting approval. This new deadline has investors closely watching market moves, particularly how different assets included in the fund might react.

Bitwise Investment Advisers, the fund sponsor, has not issued any official statements regarding the current status of the approval. The fund continues to trade as BITW on the OTCQX market, with Coinbase acting as the custodian. The delay is seen as part of a broader trend, as the SEC takes its time approving multi-asset crypto index ETFs due to concerns about market manipulation and investor protection.

Market reactions have been cautious, with no significant movements in affected assets like BTC, ETH, XRP, SOL, ADA, among others. The community remains optimistic, awaiting the SEC’s decision on July 31. A representative from the U.S. Securities and Exchange Commission, titled as SEC Spokesperson, remarked, “The United States Securities and Exchange Commission published a Notice of Designation of Longer Period for further action on proceedings to determine whether to approve or disapprove…”

Bitcoin Prices Soar 27% Despite Pending ETF Decision

Did you know? Despite delays in ETF approval, the Bitwise 10 Crypto Index Fund reported an AUM of $1.68 billion as of July 2025, illustrating strong investor interest in diversified crypto assets.

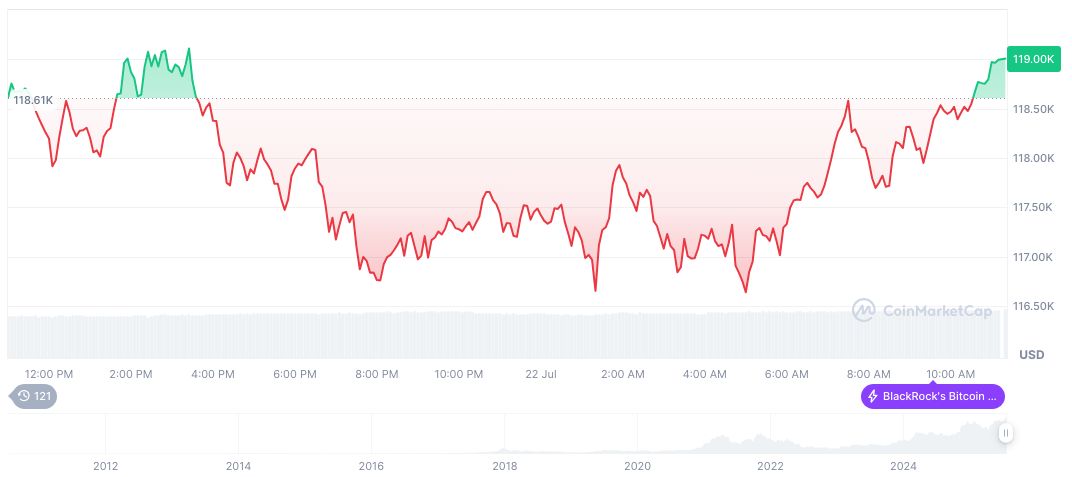

Bitcoin (BTC) prices have been notably volatile, currently priced at $119,637.47 with a market cap of 2,380,310,806,169.42 USD. Its market dominance is at 60.26%, with 19,896,031 in circulating supply. The price has increased by 27.42% over 90 days. These figures, sourced from CoinMarketCap, underscore the asset’s ongoing market relevance.

The Coincu research team highlights potential outcomes if ETF approval is granted. Approval could lead to heightened institutional interest and investor inflows into crypto markets, similar to past SEC decisions on Bitcoin and Ethereum ETFs. This development could mark a notable milestone in crypto market regulatory advancement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/350207-bitwise-10-crypto-etf-pending/