- Bitrace’s report unveils $52.5 billion crypto fraud.

- Surge centered on stablecoin embezzlement activity in 2024.

- Regulatory action doubled stablecoin freezing over three years.

Bitrace’s recent report revealed a substantial surge in crypto-related fraud, totaling $52.5 billion in 2024. This alarming rise, notably tied to stablecoin embezzlement, surpassed losses from 2021 to 2023 combined.

Such significant fraudulent activity reflects the vulnerabilities within the crypto industry. Regulatory responses intensified, particularly through heightened cooperation with law enforcement, marking a notable pivot towards enhanced system integrity.

$52.5 Billion Fraud Linked to Stablecoin Scams

Bitrace’s detailed findings underscore a troubling increase in blockchain addresses linked to illicit activities, culminating in $52.5 billion in 2024. The report highlights the proliferation of advanced scams, notably in stablecoin embezzlement. Key actions included Tether and Circle freezing over $1.3 billion in suspicious funds, doubling previous years’ totals.

Rising scrutiny and law enforcement cooperation have led to substantial impacts on Ethereum and Tron networks, manifesting in enhanced regulatory focus and proactive steps towards reducing fraud activities. These developments signal a decisive shift towards ensuring greater market reliability.

Significant voices, including Isabel, CEO of Bitrace, noted, “Criminals use advanced technology to execute targeted attacks… understanding the full scope of these threats is key to developing effective prevention and recovery strategies.” The ongoing collaboration between regulators, stablecoin issuers, and law enforcement signifies collective efforts in safeguarding the crypto landscape.

Accelerated Regulatory Actions and Market Reactions

Did you know? History shows that 2024’s $1.3 billion in stablecoin freezes doubled the actions from the previous three years, highlighting escalating regulatory engagement and its pivotal role in curbing crypto crime.

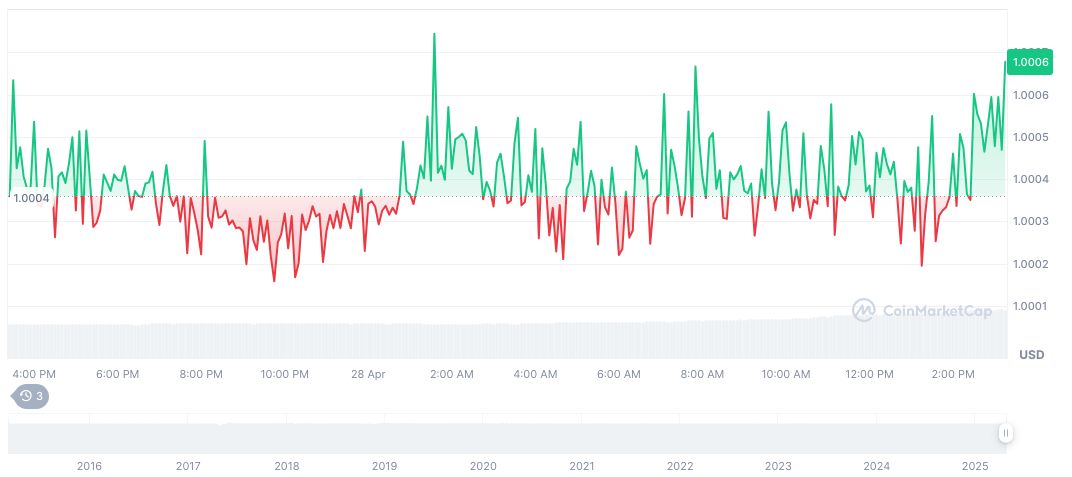

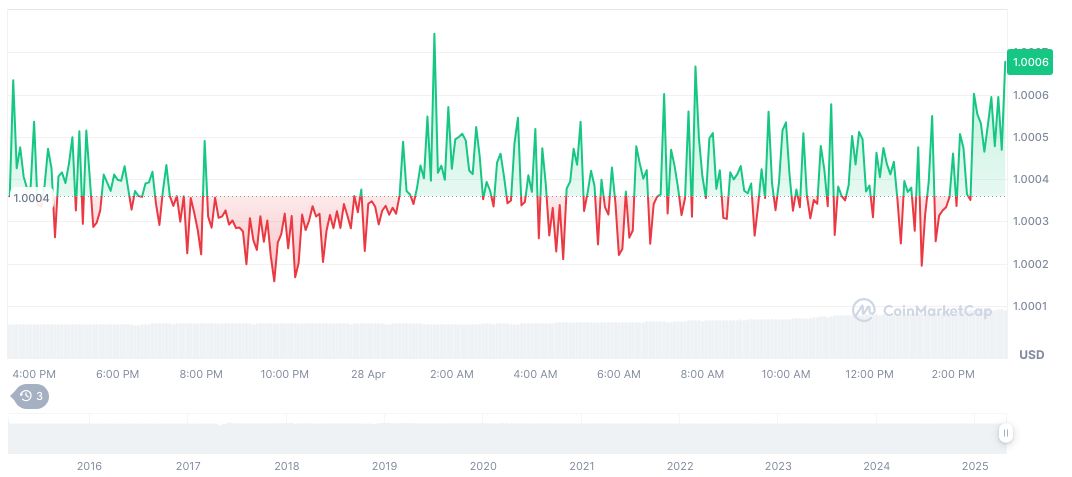

Tether’s USDT remains highly stable, trading at $1.00, with a market cap exceeding $148 billion. Data from CoinMarketCap reports the coin’s near-zero volatility over 90 days, underscoring its critical role in crypto markets despite ongoing regulatory scrutiny.

Insights from Coincu’s research team predict that enhanced compliance will foster regulatory changes, paving the way for more secure digital transactions. Increased transparency and cooperation may reduce illicit activity, supporting a more resilient cryptocurrency market foundation globally.

Source: https://coincu.com/334850-bitrace-crypto-fraud-report-2024/