- Binance aids global crypto regulation amid U.S. strategy shift.

- Binance employs 1,400 for compliance roles.

- U.S. establishes Bitcoin as a strategic national asset.

Binance aids global crypto regulation amid U.S. strategy shift. Binance employs 1,400 for compliance roles. U.S. establishes Bitcoin as a strategic national asset.

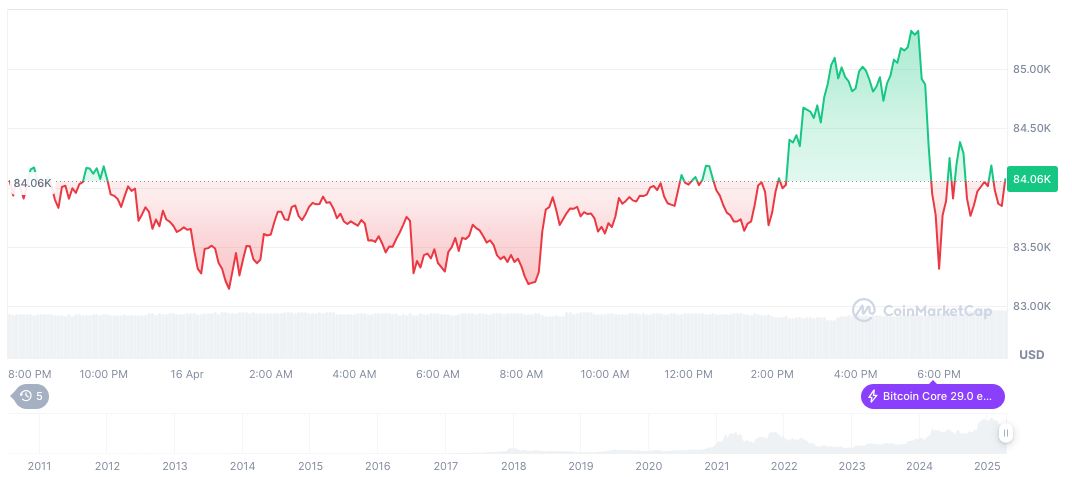

The U.S. commitment to a digital asset framework has significant implications for global crypto regulation, as other nations may be influenced. This shift is generating market uncertainty, particularly seen in Bitcoin’s recent price decline.

Binance’s Strategic Role in U.S. Bitcoin Policy Shift

Binance’s CEO Richard Teng revealed that under President Trump’s administration, the U.S. is adopting a friendlier crypto stance by developing a digital asset framework and national reserves. Binance is assisting multiple countries in establishing regulatory structures for digital assets but did not specify which ones.

Binance’s efforts to assist countries in developing a cryptocurrency regulatory framework come as the U.S., under President Trump, opts for a friendlier stance towards digital assets. This includes a new strategic national reserve and an emphasis on regulatory clarity. Richard Teng mentioned that nearly 25% of Binance’s workforce is focused on compliance-related activities. This investment is seen as critical amidst evolving global regulations.

“It’s close to 25% of our global staff [about 1,400 employees] working in compliance. It’s a very key commitment and investment.” – Richard Teng

Bitcoin’s Price Impact and Historical Context of U.S. Move

Did you know? The U.S. administration’s move to establish a strategic national Bitcoin reserve marks the first-ever such initiative by a major global economy, showcasing a notable shift from previous restrictive policies.

CoinMarketCap reports Bitcoin’s price at $84,128.67, with a market cap of approximately $1.67 trillion and a dominance of 62.98%. Over the past 90 days, Bitcoin has experienced a drop of 17.14%. With a circulating supply of 19,852,434 BTC, market activities continue to drive price changes. These details reflect Bitcoin’s evolving status in the context of strategic national initiatives.

Insights from the Coincu research team suggest that these regulatory changes under Trump’s administration could accelerate widespread adoption. Historical data, coupled with the current market dynamics, aligns with expectations of increased institutional engagement.

Source: https://coincu.com/332649-binance-supports-global-regulation/