Crypto markets today have been relatively positive, with Bitcoin (BTC) prices up close to 1%. In the short term, investors can expect the bullish outlook from yesterday to continue, catalyzing another crypto market rally. If BTC price fails to hold above a key support level, it could, however, prompt a step crypto market crash.

3 Reasons for Crypto Market Caution:

- Historical data shows Bitcoin’s seasonality will add a headwind, preventing crypto markets from rallying massively this month and next.

- From a mid-to-short-term perspective, Bitcoin price needs to hold the four-hour support level of $54,676 to sustain the ongoing recovery rally.

- From a lower time frame, BTC could trigger a minor rally to $62,200.

Crypto Markets Crash or Rally: What’s Next?

Crypto markets have not crashed or rallied but have noted a sideways movement for over five months. This development can be attributed to uncertain macroeconomic conditions, recession fears, and geopolitical tensions, to name a few.

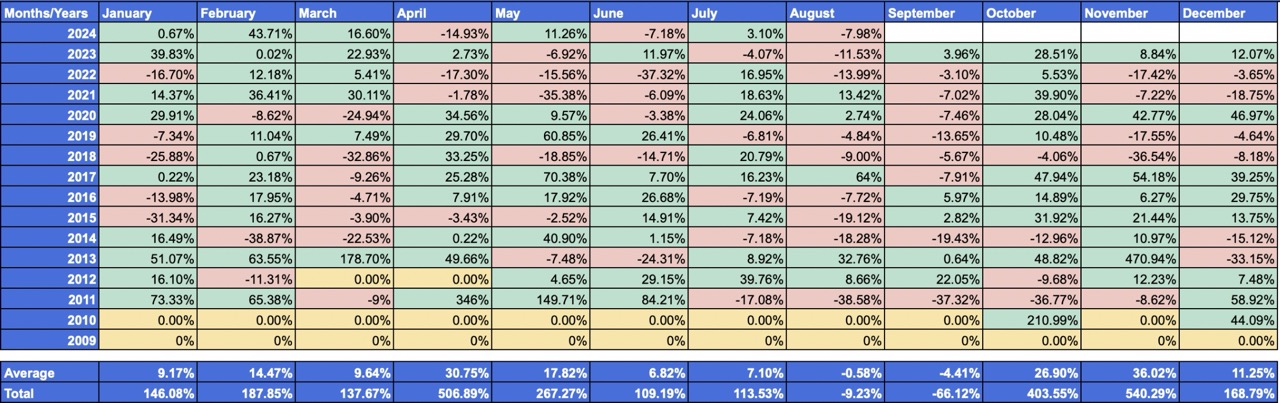

While all of the above factors are true and have affected Bitcoin and the broader crypto markets, one thing that goes unnoticed is the seasonality and its effect on the markets. Historical data for the past 13 years shows that the third quarter has the worst performance, with an average return of 2.78%.

So far, the monthly returns table shows Bitcoin price had a total return of 3.10% in July, and -7.98% in August so far. If the current outlook continues and history repeats itself, investors should not expect a massive run-up for BTC price. But this quarter is a blessing in disguise for long-term buyers and institutions, as it allows them to accumulate BTC at a discount. Wherever BTC goes, the crypto markets will follow suit. Hence, investors need to understand the seasonility of Bitcoin price.

Sorting the months based on their return shows that September is the worst-performing month, with an average return of -5% in the past 13 years. So, investors could expect crypto markets to slide lower in September, especially if history repeats.

According to the monthly and quarterly returns, Bitcoin price prediction indicates no signs of triggering an uptrend.

Bitcoin Price Mid-to-short-term Outlook Forecasts Bullishness

The four-hour Bitcoin price chart shows that the five-month consolidation has created a value area stretching from a low of $62,200 to $72,200. The retest of the value area low on August 8 resulted in a rejection and a 10% crash, which created a higher low on the four-hour chart. So far, BTC price has set up two higher highs and three higher lows, signaling that the recovery rally is in full swing. As long as this support holds for BTC, crypto markets will likely enjoy a neutral-to-bullish outlook. A breakdown of the $54,676 support level on the four-hour chart will invalidate the ongoing upswing and suggest a continuation of the downtrend.

The short-term outlook of Bitcoin price is also bullish as it showcases an inverse head-and-shoulder setup. This outlook also forecasts a 5% rally to $62,917 on the breakout above the $59,837 hurdle.

All in all, the crypto market outlook in the short-to-mid-term remains bullish, while the long-term outlook, at least until the end of September, remains uncertain. So, investors should refrain from taking up swing long or short positions until Q4.

Frequently Asked Questions (FAQs)

The short-term outlook is bullish, with potential for another crypto market rally.

The key support level is $54,676 on the four-hour chart.

Historical data shows that the third quarter has the worst performance, with an average return of 2.78%.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/beware-of-crypto-markets-until-october-3-key-reasons/

✓ Share: