- Michael Martin predicts favorable crypto investment conditions.

- Venture capital may reach $25 billion by 2025.

- Crypto market dynamics attract institutional interest.

Ava Labs Director Michael Martin predicts a bullish shift in crypto investment, citing factors like Circle’s public listing and new regulations, likely impacting the market in 2025.

These developments suggest an increase in venture capital for cryptocurrency startups, potentially reaching $25 billion by 2025, with ramifications for market dynamics and investment strategies.

Institutional Capital and Regulatory Developments in Focus

Michael Martin from Ava Labs has articulated that a confluence of bullish signals is anticipated to significantly boost investment in cryptocurrency enterprises. Ascribed factors include the public listing of Circle, acquisitions like Stripe obtaining Privy, and heightened activity from Wall Street in blockchain initiatives.

The projection foresees an increase in venture capital towards crypto, expecting up to $25 billion by 2025. New regulations on digital assets are contributing to a generally optimistic outlook throughout the sector.

Michael Martin emphasized the necessity for crypto founders to exhibit decisive leadership and a robust go-to-market strategy. “It’s important for founders to have a scalable idea, access to customers, and a go-to-market strategy, but more than anything success in this program is about being decisive,” explains Martin.

Historical Trends and Market Predictions for Crypto

Did you know? The success of Circle’s public listing could mirror the influence of Coinbase‘s 2021 IPO, which catalyzed considerable investment and development across crypto markets globally.

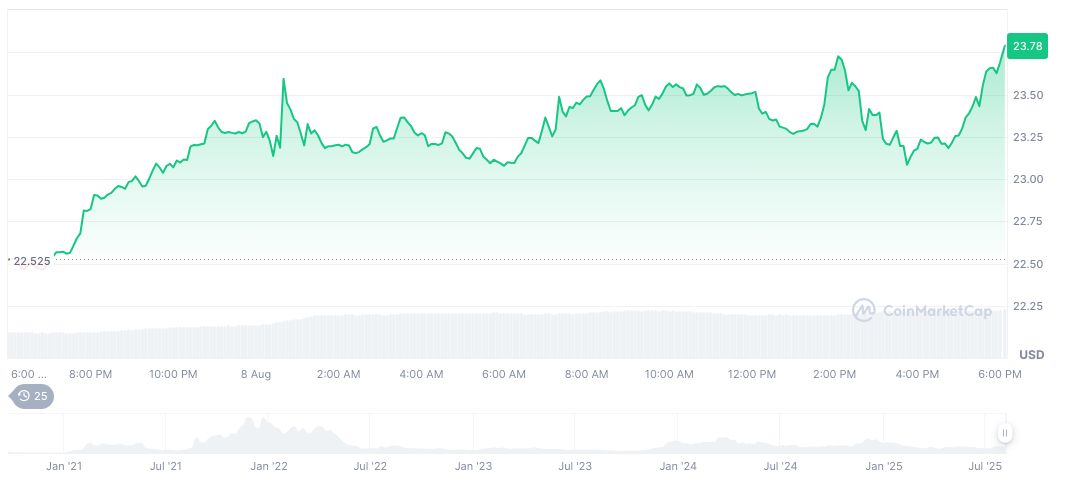

As of the latest data from CoinMarketCap, Avalanche (AVAX) is currently priced at $23.79 with a market cap of $10.04 billion. It has witnessed a 5.53% increase over the past 24 hours, marking a 9.98% rise in the last seven days.

Insights from Coincu’s research indicate potential further regulatory transformation could solidify crypto’s status within mainstream finance. The growth drivers include technological innovations in Layer 1 protocols, compliance in stablecoin usage, and enhanced security solutions for decentralized finance (DeFi).

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/ava-labs-bullish-crypto-forecast/