- Bloomberg reports Asia-Pacific exchanges resist crypto treasury conversions, but primary sources confirm no direct statements.

- No direct evidence of market impact or official policies from exchanges.

- Crypto community focuses on other regulatory topics; direct reactions limited.

The Hong Kong Stock Exchange, along with Indian and Australian counterparts, reportedly resists companies shifting towards cryptocurrency treasuries, citing regulatory compliance concerns.

This resistance highlights potential regulatory challenges for firms integrating cryptocurrencies, impacting market strategies without direct confirmation from major exchange executives or official regulatory statements.

Exchanges’ Ambiguous Stance on Crypto Treasury Integration

Unconfirmed Reports Amidst Expanding Crypto ETP Markets

Three prominent exchanges in the Asia-Pacific region, particularly the Hong Kong Stock Exchange, have reportedly resisted corporate transitions to crypto treasuries. However, there’s a lack of authoritative confirmation from these exchanges regarding any formal inquiries or decisions about company strategies focusing on significant liquid asset holdings.

The cryptocurrency industry and communities globally have not shown strong reactions to these alleged restrictions. Key influencers in the space have focused attention elsewhere, notably on U.S. regulatory advancements. Thus far, professional and amateur analysts alike have noted the continuing growth of virtual asset ETPs in Hong Kong.

Historical Context, Price Data, and Expert Insights

Did you know? The Hong Kong Stock Exchange has expanded its virtual asset exchange-traded products market to a value of HKD 8.1 billion as of September 2025, indicating an ongoing focus on investment products despite uncertainties in corporate crypto treasury policies.

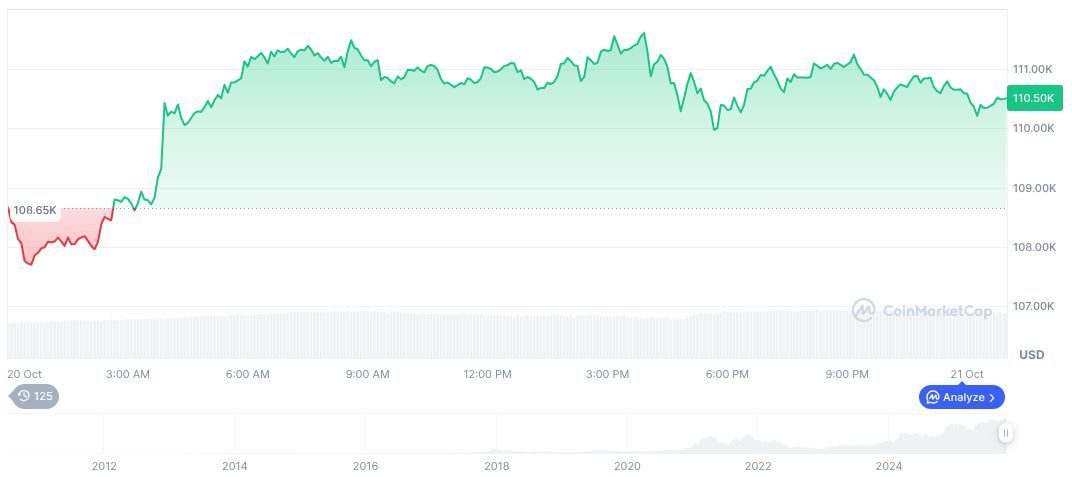

According to CoinMarketCap, Bitcoin currently trades at $107,990.34 with a market cap of formatNumber(2153110624838.86, 2). It dominates 58.88% of the market. The last 24-hour trading saw $102,555,462,151.71 exchanged, marking a 67.02% increase. However, Bitcoin’s price reflects a declining trend, down -2.15% in 24 hours and -9.3% over the past 90 days.

From insights compiled by the Coincu research team, there is a potential for regulatory frameworks in Asia-Pacific regions to adapt, creating shifting paradigms in crypto market operations. Future exchange strategies may increasingly involve technological innovations and strict compliance measures.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/asia-exchanges-block-crypto-treasury/