- Arthur Hayes sells over $2 million in crypto assets.

- Large-scale sale impacts Ethereum and DeFi tokens.

- Market reacts with short-term volatility and liquidity concerns.

Arthur Hayes, former BitMEX CEO, reportedly sold $2.45 million in crypto, including ETH, ENA, LDO, AAVE, and UNI, tracked by Lookonchain on November 16, 2025.

The sale impacts market volatility, pressuring DeFi tokens’ liquidity and Ethereum’s support levels, although no official statements from Hayes offer insight into the motives behind these transactions.

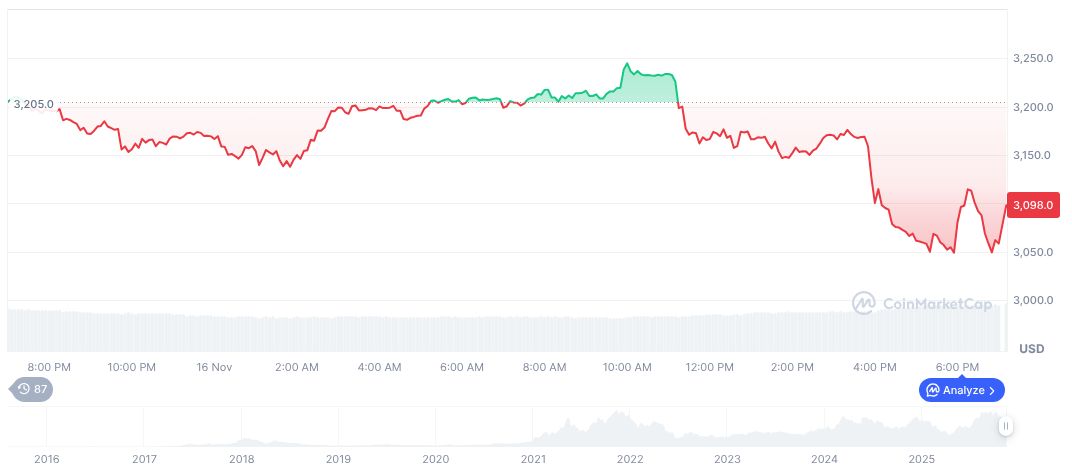

Ethereum Market Faces Volatility Amid Large Sell-off

The immediate implications of Hayes’ actions have been observed in various market segments. With his disposal of large quantities of digital assets, particularly Ethereum, market weaknesses have surfaced, triggering concerns about continuity at specific price points. The rapid liquidation of these assets is impacting short-term stability.

Comments from financial experts underscore the temporary market strain. Tom Lee, an industry KOL, highlighted:

“In my view, the weakness in cryptocurrencies has all the following signs: a significant gap in the balance sheets of one (or two) market makers; sharks are poised to sell Bitcoin, attempting to trigger a liquidation/price crash. This pain is short-term and will not change Wall Street’s supercycle of building Ethereum on the blockchain. Now is not the time to use leverage. Don’t let yourself get liquidated.”

Market Data and Insights

Did you know? Large-scale transactions by influential figures like Arthur Hayes have historically caused significant market dips, sometimes correlating with wider economic trends, influencing both investor sentiment and asset valuations.

According to CoinMarketCap, Ethereum’s current price stands at $3,068.35, with a market cap of approximately $370.34 billion, reflecting 11.65% dominance. Trading volume has reached $26.36 billion, showing a 4.33% decrease over 24 hours. In the past 90 days, ETH has faced a 29.86% drop.

Insights from Coincu research indicate that while immediate repercussions are expected in both DeFi protocols and Ethereum’s ecosystem, potential regulatory or technological shifts might stabilize impacted sectors. Historical trends suggest a resilience in major assets post-sale events by influential market players.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/arthur-hayes-sells-crypto-assets/