BRC-20 or the altcoins built on top of the Bitcoin Network, are gaining huge momentum nowadays, as they have reached beyond $300 million in market capitalization within just 2 months of their launch. The platform has more than 13,000 tokens in circulation, with the most popular being ORDI, PEPE, PIZA, MEME, MOON, PUNK, DOMO, OSHI, XING, and SHIB.

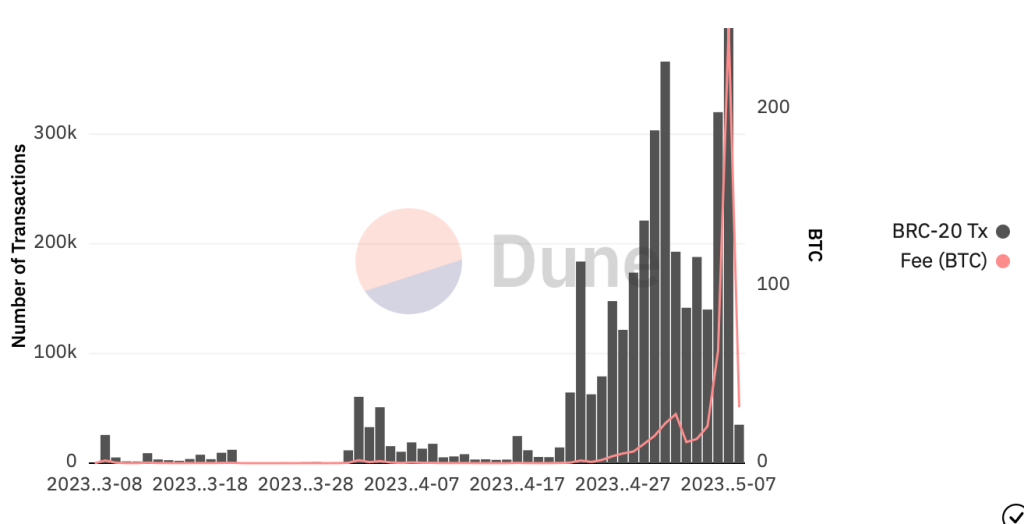

Pepe, not the ERC-20 one, has a market capitalization of around $17.6 million, and the other top BRC-20 tokens account for 86.55% of the total $300 million market cap. As per Dune Analytics, the highest number of transactions were recorded during the last trading day, close to 400K, with average fees of more than 245 BTC.

With the rise of these tokens, the Bitcoin ecosystem is experiencing very high demand for the BRC -20 tokens. These are text-based inscriptions and ordinals, which are nothing but new types of NFTs created on the Bitcoin blockchain. According to Glassnode data, the network is experiencing high demand for block space, which is being driven by BRC-20 tokens.

Besides, the growing demand for these tokens has landed the entire network in deep trouble. Presently, there are nearly 400K unconfirmed transactions, which are assumed because of these BRC-20 tokens. Meanwhile, the fees have also skyrocketed heavily, along with the mining rewards, which have also gone parabolic.

The recent Taproot upgrade has just made it simple to productize the Bitcoin block space into any arbitrary protocol. Therefore, it can certainly not be considered as an attack on the Bitcoin network but a chance to enhance the use cases of the platform.

Source: https://coinpedia.org/news/are-brc-20-tokens-the-next-big-thing-in-the-crypto-space-all-you-need-to-know/