The crypto market has been a rollercoaster ride in recent months, with Bitcoin and Ethereum leading the charge while Altcoins seem to be lagging behind. But the situation could be changing now.

Is an Altseason combining? The question has been buzzing on social media recently. While it’s debatable if now is the right time to ask, it’s valuable to examine the current Altcoin market. Here’s a closer look at the factors affecting Altcoins today.

Expert Analysis on Altcoin Trends

Crypto expert ‘Crypto, Distilled’ has shared insights on X about what’s influencing the Altcoin market. Their recent posts cover various macroeconomic and political factors that could impact the future of Altcoins.

The series begins with a hopeful perspective. Despite recent underperformance, there may be a chance for recovery. The posts highlight potential positive drivers like upcoming interest rate cuts in September and the US presidential election in November, which could boost market momentum.

Altcoin Investors’ Disappointment

The series acknowledges the ongoing frustration among Altcoin investors. Since November 2022, the Altcoin market has struggled.

The focus is on how a few dominant Altcoins are overshadowing others, with less than 13% currently competing with Bitcoin’s market performance.

What’s Impacting the Crypto Markets?

Several recent events have significantly affected Bitcoin and Ethereum, according to the series. These include the launch of Bitcoin Spot ETFs, Bitcoin halving, approval of Ethereum Spot ETFs, and Ripple’s partial legal victory against the SEC. The series suggests that Bitcoin Spot ETFs have disrupted Altcoin growth while benefiting Bitcoin.

Economic Uncertainty and Its Effect on Altcoins

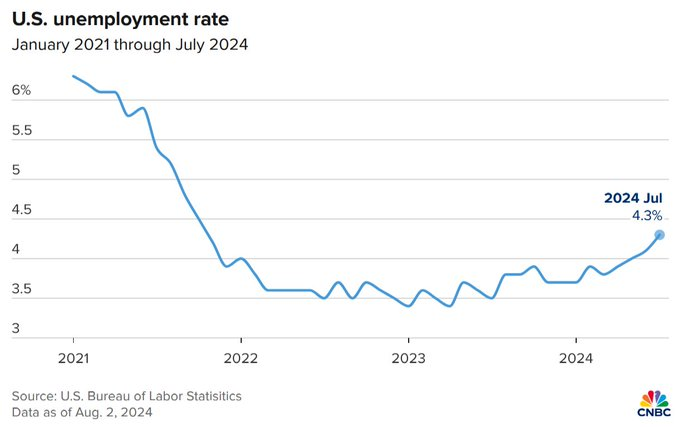

Economic uncertainty in the US, including rising unemployment and high interest rates, is a major concern. This has led investors to prefer safer assets over Altcoins, contributing to the market’s current struggles.

Potential Impact of Trump’s Election Victory

The series speculates about how a potential win by Donald Trump in the upcoming US election could affect Altcoin markets. It draws comparisons to the 2016 election, where small-cap stocks performed better than large-cap stocks after Trump’s unexpected victory, suggesting a similar positive effect for Altcoins might occur.

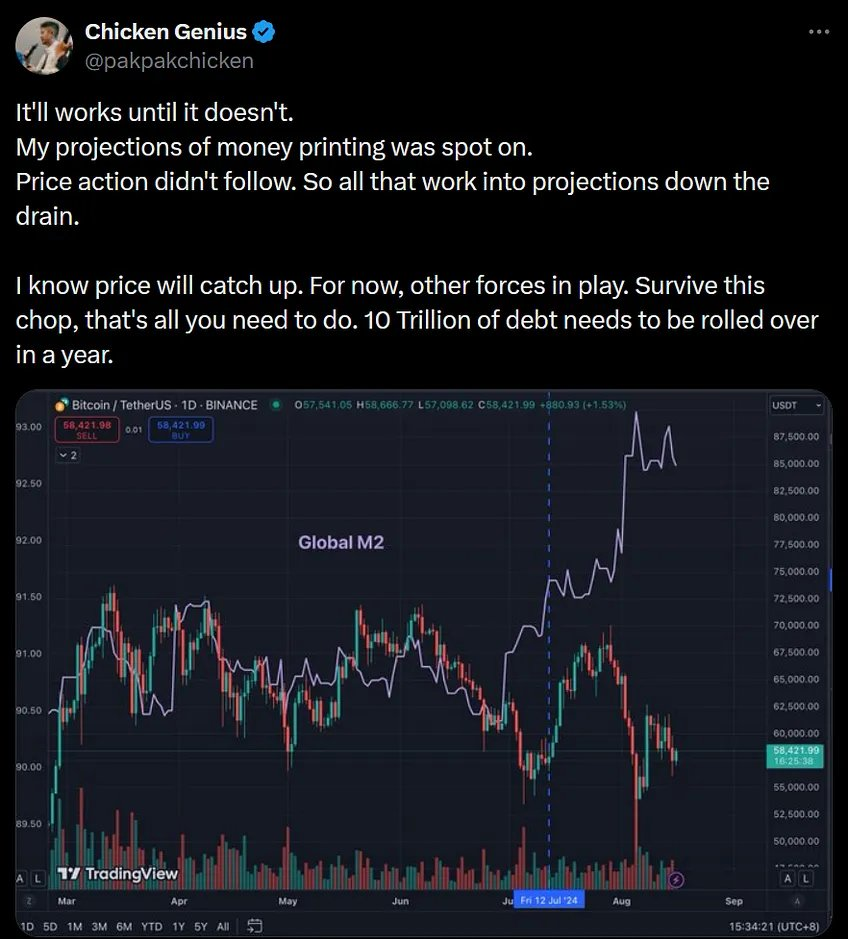

Rise in Global Money Supply

The post series also covers the macroeconomic factors of increasing global money supply. It explains how this development can positively impact the price of cryptocurrencies. An increase in money supply naturally leads to an increase in asset price. The post series also relies on the said principle to justify its argument about the possible increase in the Altcoin price in future.

Recession Fears and Investor Sentiment

Concerns about a looming recession also play a role. During economic downturns, investors often avoid risky assets like Altcoins. The series suggests that ongoing recession fears could lead to decreased interest in Altcoins.

In summary, if expected interest rate cuts stabilize the market, Altcoins might have a chance to challenge Bitcoin’s dominance. However, as long as economic uncertainty persists, Altcoins may find it difficult to compete with Bitcoin in the crypto market.

Read Also: Bitcoin Miners Face Toughest Revenue Drop in 11 Months: Is a Major Sell-Off Looming?

What Altcoins are you eyeing for the next big move? Let’s talk!

Source: https://coinpedia.org/news/crypto-market-news-analyzing-altcoin-trends-and-their-economic-predictors-for-2024-25/