In Brief

- Litecoin, Solana, and Hedera trend after ETF listings on Nasdaq and NYSE spark strong interest.

- Crypto.com’s CRO gains traction from Truth Social integration and rising transaction volumes.

- Bearish sentiment on ONDO and SPX suggests a possible short-term rebound, says Santiment.

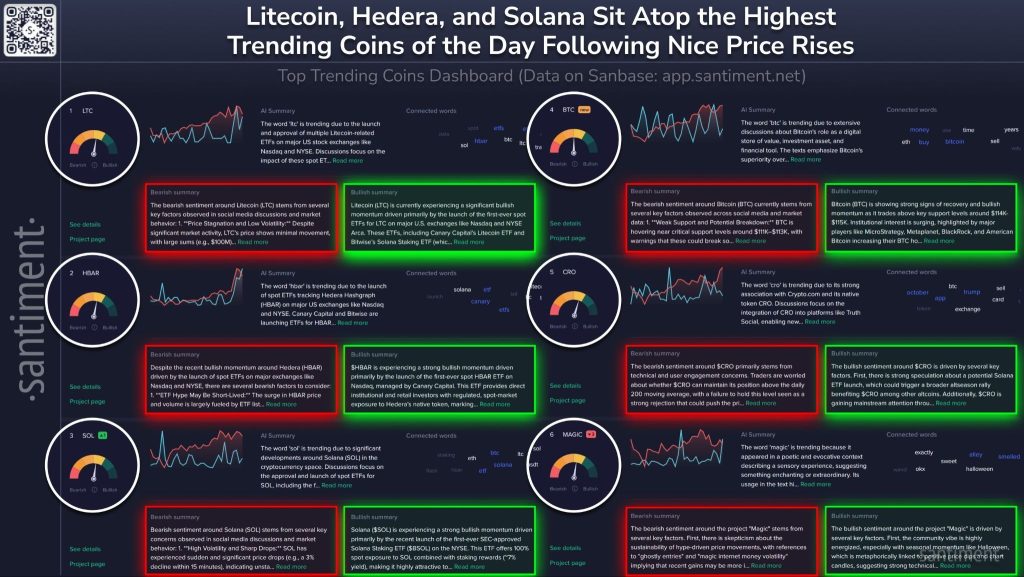

Social media data indicates a rise in chatter around several altcoins, led by Litecoin ($LTC), Hedera ($HBAR), and Solana ($SOL). All three are trending due to the recent launch of spot ETFs on major U.S. exchanges such as Nasdaq and NYSE. These ETFs are gaining traction despite a U.S. government shutdown, signalling strong institutional interest and regulatory momentum.

Litecoin is gaining attention for its inclusion in multiple ETF products, highlighting its longevity and status as a mined asset. Hedera saw price gains between 17% and 25% following its ETF debut, as investors responded to growing accessibility through regulated financial vehicles. Meanwhile, Solana discussions centre around Bitwise’s Solana Staking ETF ($BSOL), which offers staking rewards alongside price exposure.

Bitcoin, CRO, and Sentiment Signals Reflect Market Divergence

Bitcoin ($BTC) remains a constant focus, with users discussing its store-of-value role and comparison to traditional assets like gold. Sentiment around Bitcoin reflects long-term optimism, reinforced by commentary from high-profile figures and its use as collateral in lending platforms. The token’s reputation as digital gold continues to separate it from altcoin narratives.

Meanwhile, Crypto.com’s native token ($CRO) is trending due to platform integrations with Truth Social and prediction market use cases. Converting Truth gems into CRO has drawn user interest, boosting transaction volumes and market cap. Additionally, promotional campaigns and partnerships have pushed CRO near the $6 billion valuation mark.

On the other hand, bearish sentiment toward ONDO and SPX has intensified across platforms, pointing to frustration among retail traders. While crowd mood remains negative, these extreme levels of pessimism may signal oversold conditions. Historically, such setups often precede short-term rebounds driven by sentiment reversal and short covering.

This dynamic mix of optimism, product innovation, and crowd sentiment highlights an evolving crypto narrative.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/altcoin/altcoins-lead-crypto-buzz-as-etf-launches/