- AIOZ’s Netflow exhibited fluctuating trends, with notable sell-offs during downturns and strong inflows aligning with price recoveries.

- AIOZ experienced a sharp 40% price surge within an hour, with movement coinciding with significant whale accumulation.

At the time of writing, AIOZ Network’s [AIOZ] experienced a sharp 40% price surge within an hour.

This movement coincided with significant whale accumulation, particularly from Whale 0xc7c0 (convexking.eth), who purchased 8.9 million AIOZ tokens worth $4.12 million.

This acquisition increased their total holdings to 20.29 million AIOZ tokens, valued at $8.58M, at the coin’s current price of $0.43, as of press time.

Decoding the momentum behind AIOZ’s rapid surge

The analysis by AMBCrypto provides insights into the EMA cross and MACD indicators in a one-hour timeframe. AIOZ broke above the 9-period EMA, signaling a bullish trend.

Source: CoinGlass

Simultaneously, the MACD line crossed above the signal line, reinforcing upward momentum. A shift to positive territory on the histogram further validated bullish sentiment.

This price action coincided with a whale’s substantial purchase, highlighting the impact of institutional activity on price movements. Large investors were crucial in increasing the price, showing how market sentiment shifts alongside whale activity.

The role of large holders in market movements

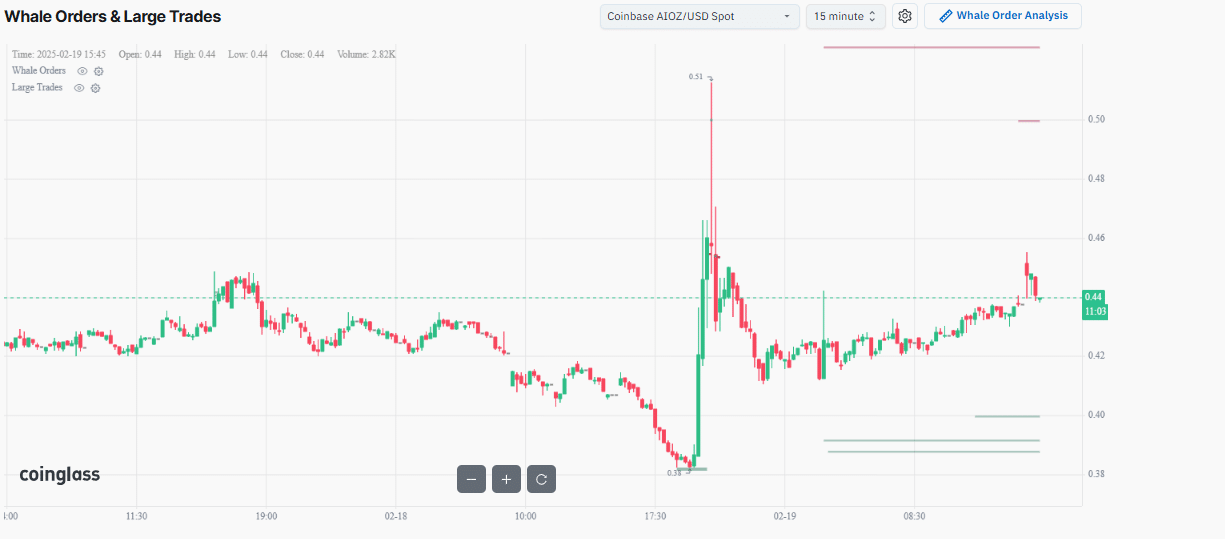

Moreover, the whale order indicator reveals that Whale 0xc7c0’s buy order appeared as a thick, dark line, indicating a large filled order.

Source: Coinglass

The size and duration of this order suggest a prolonged influence on AIOZ’s price action. This accumulation likely catalyzed the surge, demonstrating that substantial whale activity can be a precursor to strong price movements.

Large orders often predict future trends, making whale monitoring essential for traders.

How institutional behavior shapes price trends

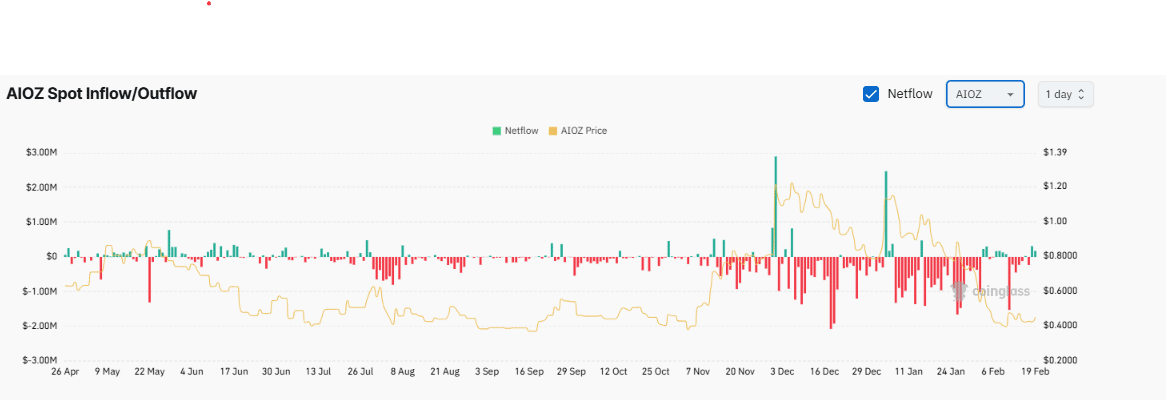

Further analysis illustrates a significant spike in net inflow, aligning with the price surge.

Over the past months, AIOZ’s Netflow has exhibited fluctuating trends, with notable sell-offs during downturns and strong inflows aligning with price recoveries.

Source: Coinglass

Large inflows in early December and mid-January corresponded with temporary price rebounds, reinforcing the correlation between whale accumulation and price movements.

Recently, inflows have stabilized after a period of strong outflows, suggesting potential price consolidation or gradual recovery.

If this pattern continues, AIOZ may experience further upward pressure or stabilization at current levels, depending on subsequent whale activities.

Understanding market psychology during volatile phases

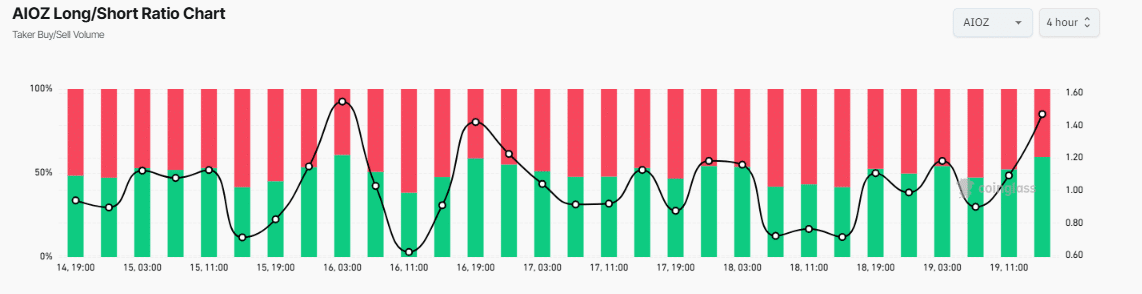

Finally, at press time, the Long/Short Ratio over four hours indicated short positions dominated the market. However, as the price surged, the ratio shifted towards long positions.

Source: Coinglass

This transition reflects a broader market sentiment shift from bearish to bullish, aligning with whale-driven buying pressure.

If long positions continue to gain dominance, further price appreciation could occur as traders anticipate extended bullish momentum.

The recent price surge in AIOZ was heavily influenced by whale accumulation. Moving forward, sustained whale interest and bullish market sentiment could drive further price increases or stabilization.

Source: https://ambcrypto.com/aioz-how-4-12m-whale-action-helped-coin-soar-40-in-an-hour/