There exists a common meme in the blockchain and cryptocurrency industry that claims “this time is different.” It almost never is.

However, when it comes to analyzing bear markets, there are key differences between the current crypto-market downturn and those of the past. Here are five reasons why this crypto bear market differs from the one four years ago.

Institutions are participants in the crypto market this time (and they aren’t leaving)

One of the most obvious differences between the crypto bear market of 2018 and today’s is the presence of institutions.

In 2018, the wider narrative was that institutional investors would eventually enter the crypto market once proper on-ramps were established. There was no talk of Michael Saylor or MicroStrategy. The big on-ramp everyone was waiting for back then was Bakkt’s Bitcoin futures from New York Stock Exchange owner Intercontinental Exchange — which ultimately launched in September 2019. Bakkt indeed provided a regulated method for institutional investors to gain exposure to BTC, which set in motion a wave of institutional investment.

Whether or not institutional investors have the appetite to open up a long position in the crypto market at the time of this writing is up for debate, but the fact remains that institutional investors are a bonafide part of the wider crypto market now.

Institutional and high net worth investors also have more advanced trading tools at their disposal than ever before, such as OKX’s block trading platform — which supports a suite of specialized strategies for those making advanced trades in bulk.

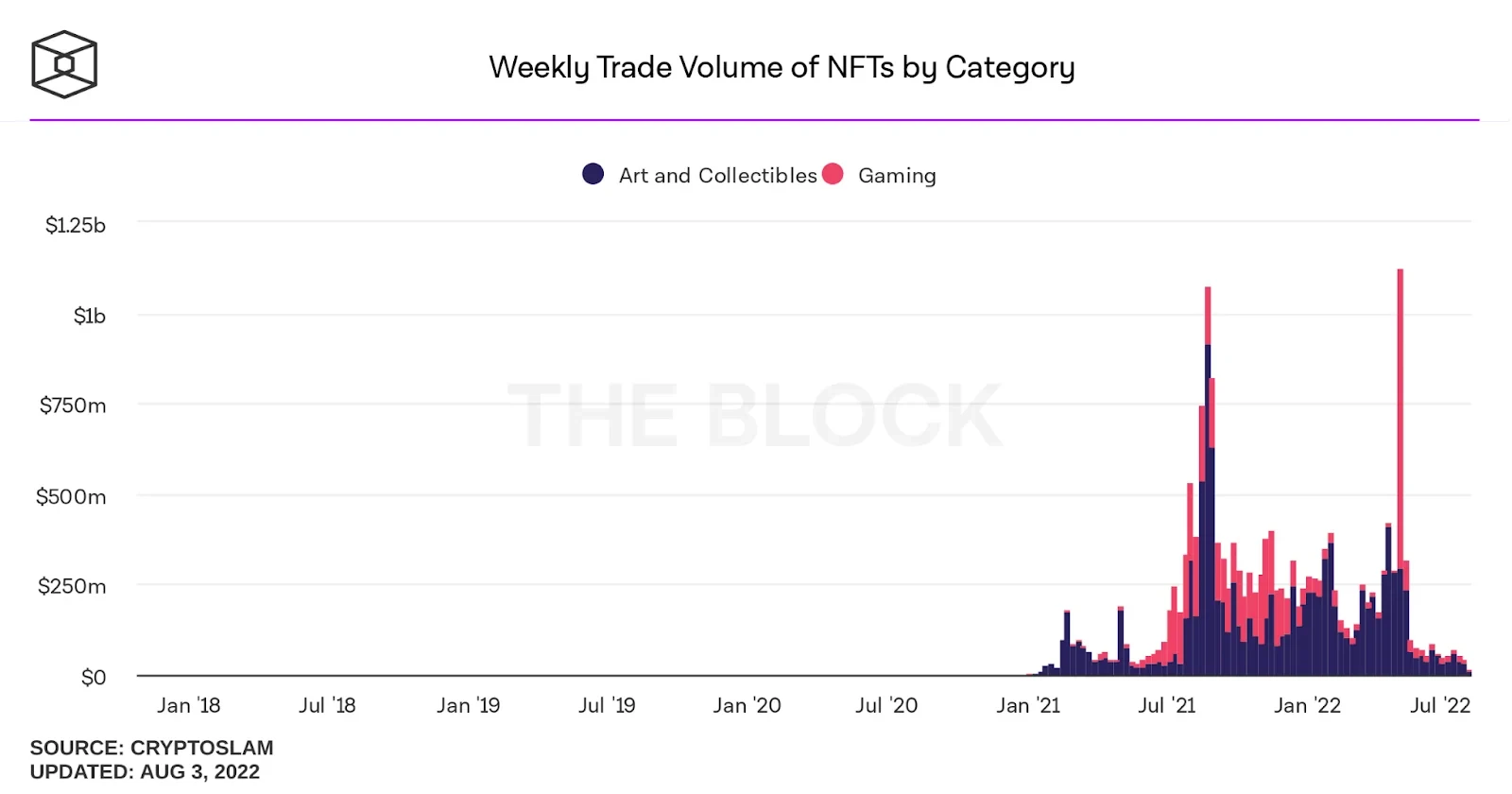

NFTs are now mainstream

While nonfungible tokens technically existed in 2018, they were very much under the radar. Everyday people in everyday life had not heard of NFTs. Saturday Night Live was years away from doing a skit about them, and there was no debate about NFTs destroying the environment and potentially ruining video games. At most, NFTs were primarily discussed at crypto conferences as certificates of authenticity for physical property.

Now, everyone knows about NFTs. You’d be hard-pressed to find someone who hasn’t at least heard of them, and most people probably have an opinion about them. The sector has something of a life of its own in regard to cryptocurrency markets, and major companies around the globe — from Tiffany’s to Nike — have taken to launching NFT-related projects.

With NFTs possibly gaining more widespread adoption after a successful transition of Ethereum from proof-of-work to the more environmentally friendly proof-of-stake, they certainly provide a different market dynamic than we saw in the last crypto bear market.

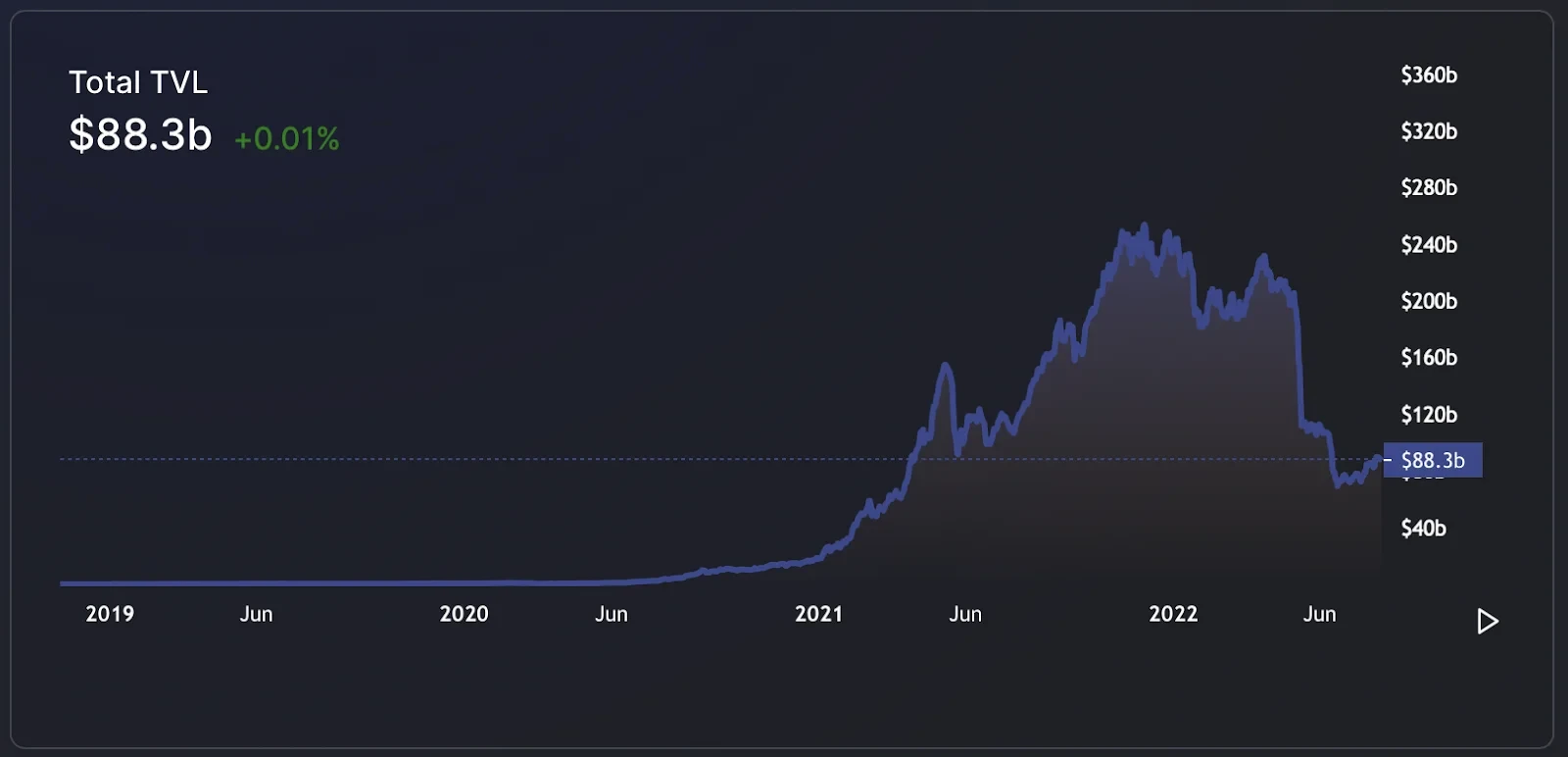

Decentralized finance has created a new market sector

The decentralized finance sector, as we know it today, didn’t exist during the last bear market — or, rather, it was still being built. For example, a remnant of the 2018 initial coin offering bubble, ETHLend, ultimately became industry-leader Aave.

One might argue that the “DeFi Summer” of 2020 was what really sparked the latest bull run, and one might also argue that it has also been partly responsible for the current bear market due to the collapse of Terra’s LUNA and UST, the perpetuation of Ponzi-like forks, the regular loss of funds from exploited DeFi protocols, and dried-up TVLs.

As with NFTs, the very existence of a fleshed-out DeFi ecosystem means the dynamics of the wider cryptocurrency market are different than during the last bear market — for better or worse.

The previous crypto bear market and this one aren’t similar technically

Looking at the charts, the technical pictures between the last cryptocurrency bear market and this one aren’t particularly similar.

The 2018 decline from bull-market peak to bear-market bottom was a collapse of 84.07% that took 364 days to play out. Comparatively, the current bear market found its (to date) bottom in only 217 days. Of course, it still could fall lower and take more time, but the rate and velocity of the decline has been sharper, harsher and with less relief.

The patterns are also totally different. In 2017, the price of BTC went parabolic and then crashed into a descending triangle formation — which, ultimately, capitulated to the downside. In 2021, we witnessed something of a “double bubble,” double-tip formation in the price of BTC before dramatic overleveraging from hedge funds and a poor macroeconomic outlook capitulated BTC’s price back below its previous all-time high.

This could be crypto’s first recession

The macroeconomic picture is totally different now than it was in 2018–2019.

Most notably, the last cryptocurrency bear market preceded COVID-19 and its global macroeconomic consequences — i.e., lockdowns, closures, money printing by central banks, stimulus checks, inflation, etc. There is also an ongoing military conflict in Ukraine, which is currently causing an energy crisis in Europe and a food crisis elsewhere in the world. Overall, most would agree the geopolitical and global-macroeconomic situations are far from ideal.

The United States, meanwhile, is on the brink of a recession — if not already in one — which is something BTC and the cryptocurrency market it spawned have never experienced. How crypto will fare in a global economic recession is up for debate, but its relative correlation to traditional markets suggests that it may fail to decouple as the alternative economic system it was largely intended to be.

Source: https://www.okx.com/academy/en/2022-crypto-bear-market-is-different