Crypto presales tend to get a lot of attention during bull markets, but history keeps repeating the same lesson. The strongest long-term projects often emerge quietly during slower phases, when the focus shifts from hype to fundamentals. As the market looks ahead to the next cycle, infrastructure, security, and real utility are starting to matter more than fast narratives.

This is why BMIC ($BMIC) is one of the best crypto presale opportunities in 2026. Instead of launching another wallet or single-purpose product, BMIC positions itself as core security infrastructure for a future where crypto usage is broader, more complex, and more exposed to long-term threats.

Below are the five main reasons why many see $BMIC as the best crypto to buy at this stage of the market.

Quantum-Native Security Built From Day One

The biggest risk most crypto users are not prepared for is not market volatility, but cryptographic obsolescence. Many wallets and platforms rely on encryption that works today but becomes vulnerable once quantum computing reaches practical scale. BMIC is built to address that problem directly.

Rather than patching old systems later, BMIC is quantum-native from the ground up. Its architecture is designed to defend against “harvest now, decrypt later” attacks, where data is collected today and broken in the future.

This removes the need for disruptive migrations and emergency upgrades later on, which is a major reason BMIC is being viewed as long-term infrastructure rather than a temporary solution.

Zero Public-Key Exposure Through Signature-Hiding Architecture

Most wallets, including hardware wallets, expose public keys on-chain. That exposure is exactly what future quantum attacks are expected to target. BMIC takes a different route by removing public-key exposure altogether.

Using smart account structures and signature-hiding logic, BMIC keeps sensitive data off-chain and out of reach. This shifts security from device-level protection to protocol-level design. It is not about making keys harder to steal, but about eliminating the attack surface entirely.

This structural advantage is one of the clearest reasons BMIC stands apart from existing custody solutions.

Full Stack Protection: Storage, Staking, and Payments

Most crypto tools secure only one part of the user journey. Wallets protect storage, but staking and payments often introduce new risks. BMIC treats all three as part of the same security problem.

The platform secures long-term storage, enables quantum-secure staking without exposing classical keys, and supports protected payments designed to prevent cloning or future fraud. This unified approach matters most to long-term holders, who are more likely to stake assets and use them over extended periods.

It also explains why BMIC is increasingly discussed among serious altcoins to buy rather than short-lived utility tokens.

Enterprise-Grade Infrastructure With AI-Driven Security

BMIC is not limited to retail users. It is designed to scale into enterprise and institutional environments through its Quantum Security-as-a-Service model. Banks, fintech companies, healthcare providers, and governments can integrate custody, key management, and secure communications without rebuilding their entire infrastructure.

On top of that, BMIC uses AI-driven threat detection and optimization. The system continuously analyzes activity, adapts to emerging risks, and improves performance as cryptographic standards evolve.

This combination of quantum security and AI-driven protection positions BMIC as infrastructure that can grow alongside the broader digital economy.

Presale Structure and Tokenomics Designed for Long-Term Value

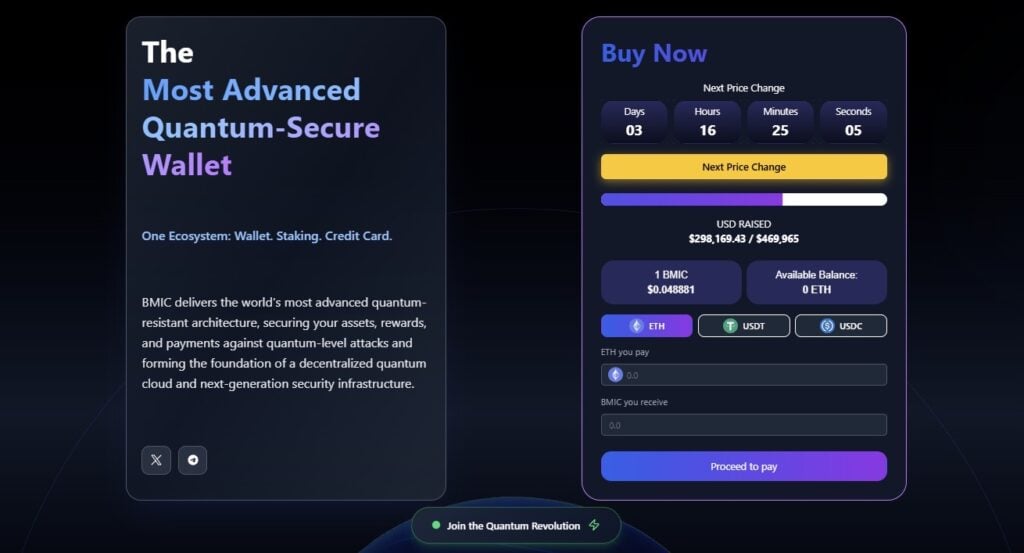

BMIC’s crypto presale is extremely well-structured. The total supply is capped at 1,500,000,000 tokens, with 50% allocated to the presale to ensure broad distribution. An additional 12% is reserved for rewards and staking (aiming for long-term participation in the network).

Liquidity and exchange listings account for 10%, while the team allocation is limited to just 3%, a relatively low figure compared to many projects. The ecosystem reserve stands at 9%, and 6% is dedicated to marketing.

The presale itself is structured across multiple phases, with prices increasing gradually and a planned launch price above the final presale tier.

That design creates a clear incentive for early supporters and is one reason BMIC is being mentioned more often when discussions turn to the best crypto presale setups ahead of 2026.

$BMIC: The Best Crypto to Buy Now?

BMIC does not rely on hype-driven narratives or short-term trends. Its value proposition is rooted in security, infrastructure, and long-term relevance. By addressing quantum threats, removing public-key exposure, securing staking and payments, and offering enterprise-grade solutions, BMIC positions itself as more than just another token launch.

As investors look for the best crypto to buy and reassess which altcoins to buy before the next cycle, projects built during quieter markets often stand out in hindsight.

With a clearly (and very strongly) defined use case, disciplined tokenomics, and a presale structure that rewards early conviction, BMIC is starting to get difficult to ignore for those focused on where crypto security is headed next.

Discover the future of quantum-secure Web3 with BMIC:

Presale: https://bmic.ai

X (Twitter): https://x.com/BMIC_ai

Telegram: https://t.me/+6d1dX_uwKKdhZDFk

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.