Key Takeaways

Bitcoin could approach $198K, Ripple nears a $125 million settlement, and Ethereum eyes $15K. Memecoin ETFs loom and DeFi adoption accelerates, making 2026 a pivotal year across multiple sectors.

In 2025, crypto markets exploded, with total market cap exceeding $4 trillion.

Despite economic uncertainty, geopolitical tensions and regulatory concerns, crypto proved more entrenched than ever.

Over the past seven months, institutional demand for cryptocurrency surged. Bitcoin [BTC] stabilized above $100k.

Moreover, crypto-friendly policies and regulatory frameworks slowly emerged in the U.S. since the Election of Donald Trump.

But what should we expect in 2026?

Prediction 1: Bitcoin to break new milestones

Since dropping to a low of $74k four months ago, Bitcoin rallied to a new all-time high of $124,517. It stabilized above $100k and has held it for over 60 days.

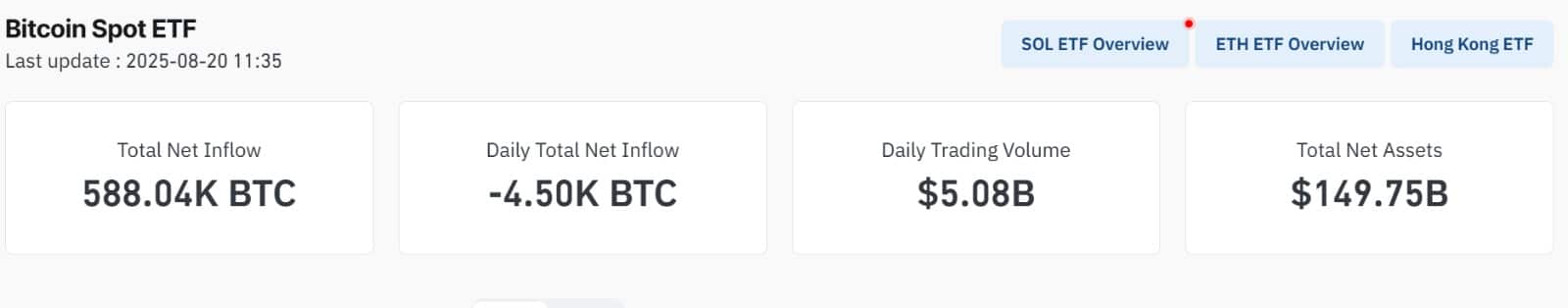

Significantly, this uptrend was fueled by institutional demand and capital inflows through ETFs. Bitcoin’s Spot ETFs’ Total Net Assets hit approximately $150 billion, indicating massive demand.

Source: CoinGlass

Amid steady inflows, Bitcoin’s bull cycle may prove extended and exhausting. In such a case, based on the long-term power law, Bitcoin might reach $130k in September 2025 and close the year at $141.9k.

Source: Bitbo

In 2026, if institutional demand remains constant and macroeconomic conditions remain favorable, Bitcoin could peak at $198k.

In the most bullish scenario, if BTC continues to rise at the same rate as it has over the past year, it might reach $211k.

Prediction 2: XRP regulatory framework to become clearer

Ripple [XRP] became the breakout altcoin of 2025. Over the year, XRP soared ~620%, climbing from $0.50 to $3.60.

Having said that, the surge was linked to U.S. regulatory shifts. Since 2018, the SEC had waged war on Ripple, eroding investor confidence.

Source: X

Now, with policy changes, Ripple’s battles appear near conclusion. Brad Garlinghouse confirmed the SEC would drop its case, while Ripple agreed to pay a $125 million fine after Judge Torres rejected a $50 million reduction.

This resolution sets a precedent for future crypto cases and opens doors for institutional adoption, especially in cross-border settlement. If $5 breaks in 2025, XRP could rally toward $10 in 2026.

Prediction 3: Ethereum rallies to an ATH

While Bitcoin and XRP rallied at the start of 2025, Ethereum [ETH] plummeted, especially over Vitalik Buterin’s political stands. Yet institutions, whales, and ETFs returned strongly in recent months.

At press time, Spot ETH ETFs managed ~$22 billion in assets. Also, ETH has become an institution’s favorite with Bitmine, Sharplink, and BlackRock aggressively accumulating it.

In this case, we expect institutions and ETFs to push Ethereum to rally into a new all-time high.

As such, ETH could retest $5K in September, climb to $8K by year-end, and average $9K–$10K through 2026. A cycle peak near $15K remains possible.

This price uptick will be primarily driven by upgraded network and staking scarcity. As such, we expect the layer 2s of Ethereum to improve transactions and reduce costs, thereby making the blockchain dominant.

Prediction 4: Memecoin ETFs, approval, and adoption

Memecoins, especially Dogecoin [DOGE], have had a dismal performance in 2025 so far. The Official Trump [TRUMP] hype quickly dissipated once it emerged.

This is because capital has massively rotated to Bitcoin, XRP and ETH. However, this doesn’t mean all is lost.

Like other coins, market players have pushed for a memecoin ETF. As such, Grayscale and Bitwise applied for Dogecoin ETFs, while Canary Capital applied for Pudgy Penguins [PENGU] ETFs.

In 2026, approval of a Dogecoin ETF or another memecoin could trigger fresh speculative frenzy.

Prediction 5. DeFi, tokenized treasuries become mainstream

Amid a growing cryptocurrency market, adoption and growing support from major economies such as the United States, DeFi becomes closer to the everyday consumer.

For that reason, it’s natural to expect traditional CeFi pools to integrate with DeFi, expanding borrowing, lending, and yield functionalities.

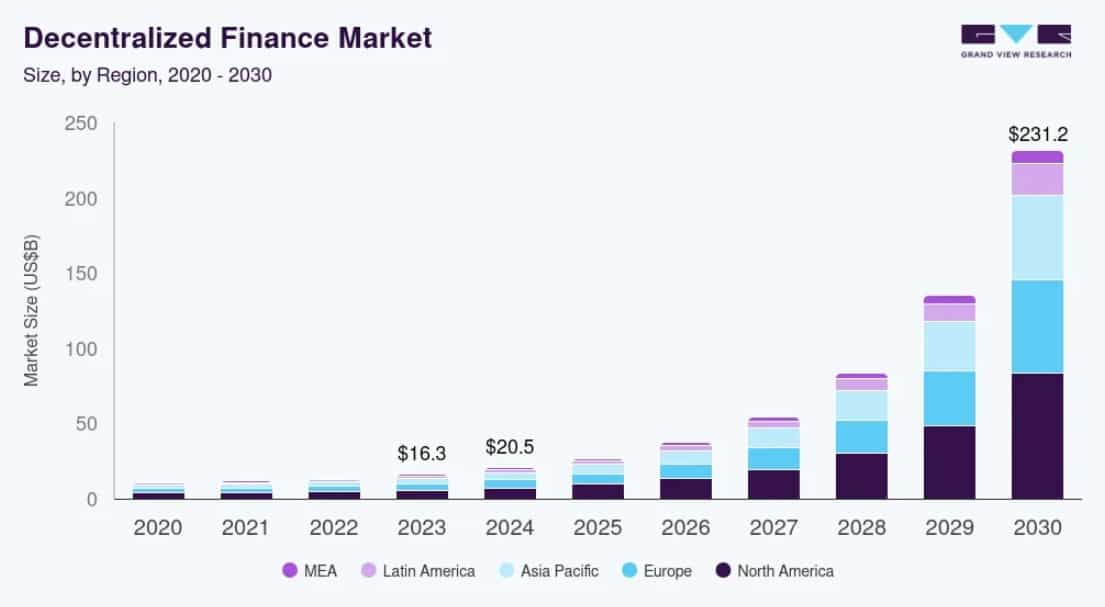

Source: Grandview

Therefore, in 2026, we expect the DeFi market to grow from its current $21 billion and surpass $30 billion. This will push the long-term projection towards $231 billion into reality as DeFi integrates growing AI.

Road ahead for cryptocurrency in 2026

Looking at previous cycles, the crypto market continued to grow over the past decade with minimal drawdowns. Now, with a $4T market cap, crypto stands among the world’s top asset classes.

And in 2026, the growth will continue not only for Bitcoin, but also for other altcoins and the broader blockchain ecosystems.

As a result, the total market cap of cryptocurrencies will most likely reach $5 trillion and flip, becoming among the top global economies.

Source: https://ambcrypto.com/5-bold-crypto-predictions-for-2026/