In the fast-moving crypto market, prediction tools that combine data, analytics and insight help traders and investors anticipate moves, manage risk and act with more confidence. While no forecasting model can guarantee perfect accuracy—especially in a market as volatile as crypto—the right tools can significantly improve decision-making by highlighting trends, potential market movements and momentum shifts.

In this article, we’ll look at three of the most effective prediction sources in 2026, each with a distinct focus and utility.

List of the best prediction sources in 2026:

- CoinCodex – AI-powered forecasts, wide coverage and transparent historical accuracy

- TradingView – Technical analysis, community ideas and real-time market signals

- Lookonchain – On-chain analytics and smart-money tracking via Twitter & reports

The best crypto prediction sources in 2026

Here is an overview of the most reliable crypto prediction platforms available this year. Each of these tools brings its own approach to forecasting the market, blending data insights, analytics and community-driven signals to support better trading decisions.

1. CoinCodex – AI-powered forecasts, wide coverage and transparent historical accuracy

CoinCodex offers detailed cryptocurrency predictions across thousands of assets using algorithmic models that analyze price history, technical data and broader market patterns like Bitcoin halvings. The platform delivers both short-term and long-term projections, including dedicated outlooks for Bitcoin, Ethereum and other major cryptocurrencies. Its forecasting engine is supported by extensive market data, allowing users to explore price ranges, seasonal trends and cyclical behaviour that influence market direction.

Beyond predictions, CoinCodex provides real-time price charts, historical performance tracking and comparison tools that help traders evaluate asset movements with more context. The platform also covers individual exchanges, token sales, and the latest news, giving users a comprehensive overview of crypto market conditions. By combining forecasts with live data and analytics, CoinCodex serves as a versatile tool for traders seeking accurate, data-driven insights.

Key features of CoinCodex:

- AI-forecasting engine; uses historical data, volatility cycles and algorithmic modelling.

- Wide asset coverage; predictions for cryptocurrencies, forex, precious metals, and stocks

- Short- and long-term forecasts; daily prediction data points up to the year 2050

Pros:

- Broad market coverage

- Algorithmic approach

- Prediction models up to 2050

Cons:

- As with any model, predictions are not always accurate

- Performance may degrade in erratic markets or for newer assets that lack historical data

2. TradingView – Technical analysis, community ideas and real-time market signals

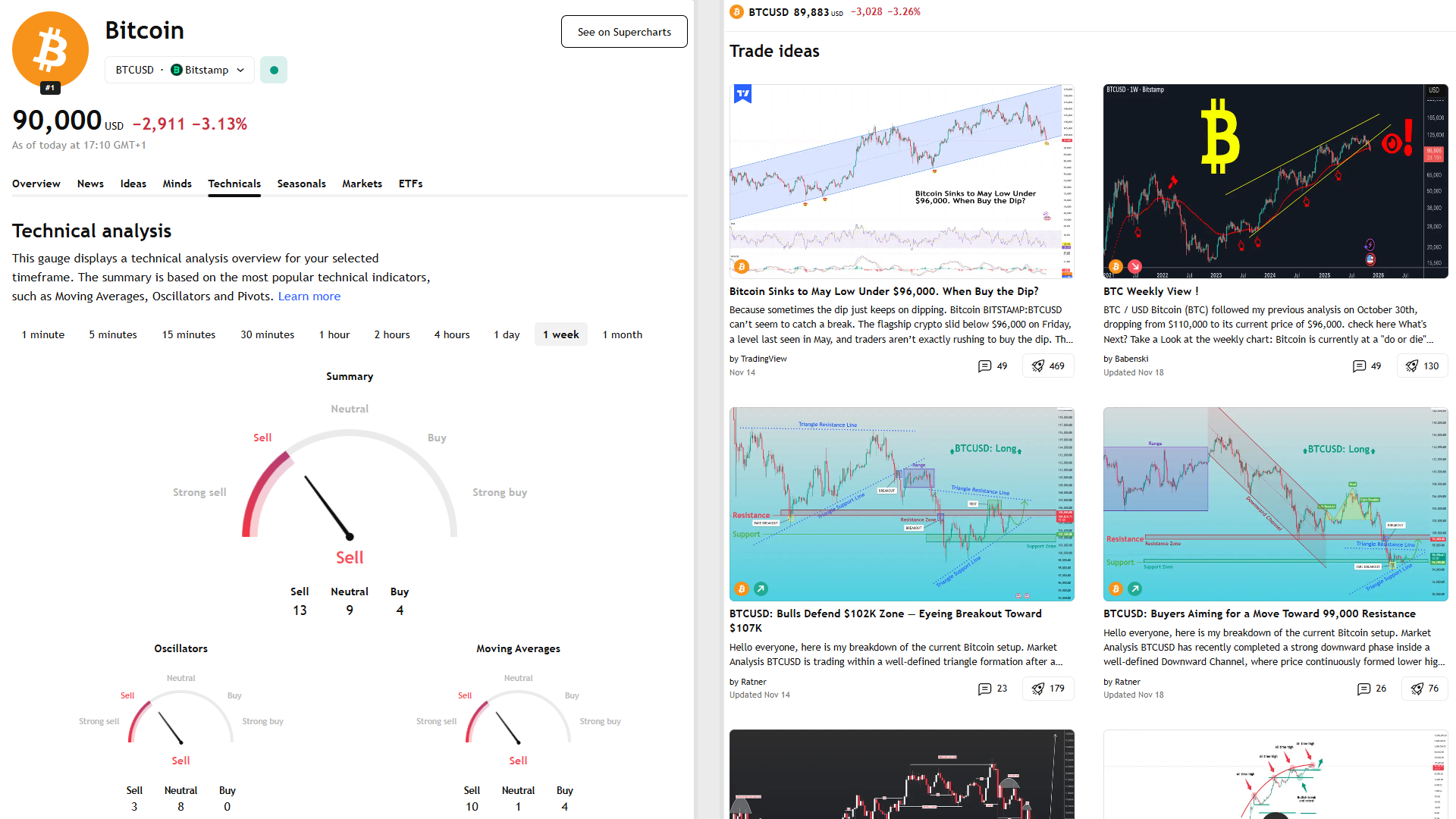

TradingView provides one of the most widely used platforms for charting, technical indicators and community-shared market ideas. Its BTC/USD technicals dashboard aggregates signals from oscillators, moving averages and trend indicators to reveal current market sentiment at a glance. Traders can use these summaries to quickly gauge whether conditions lean bullish, bearish or neutral, making it a practical resource for active market monitoring.

In addition to its technical ratings, TradingView’s ideas page hosts thousands of trade setups, forecast scenarios and chart analyses published by experienced traders worldwide. These community ideas often explore breakout patterns, support and resistance structures, trendlines and macro perspectives. With powerful charting tools and a continuous flow of user-generated insights, TradingView helps traders stay informed while refining their own technical strategies.

Key features of TradingView:

- Technical indicator suite; includes oscillators, moving averages, RSI, MACD, etc.

- Ideas from community traders; peer-submitted charts and forecast commentary.

- Realtime updates and charting flexibility; useful for both short-term and swing trading.

Pros:

- Powerful for technical traders

- Rich community input

- Flexible charting

Cons:

- Forecast ideas vary in quality (user-generated)

- Less focus on long-term algorithmic projections

3. Lookonchain – On-chain analytics and smart-money tracking via Twitter & reports

Lookonchain specializes in on-chain research, tracking wallet flows, exchange movements and smart-money activity across multiple blockchains. The platform is known for its ability to identify whale behaviour—such as accumulation patterns, token unlock movements and unusual fund transfers. This allows traders to detect emerging market trends or potential volatility before they show up on traditional charts.

The project’s official X (Twitter) account posts rapid-fire alerts covering whale transfers, new wallet activity, fund migrations and token flow anomalies. These real-time updates offer a unique prediction angle, especially for traders who rely on blockchain transparency to anticipate market shifts. By interpreting wallet patterns and transaction data, Lookonchain acts as an early-warning system for major moves driven by high-capital players.

Key features of Lookonchain:

- Smart-money identification; monitors whale wallets, CEX inflows/outflows and large transfers.

- On-chain event analysis: articles and alerts that explore what big players are doing.

- Brief actionable signals via social media alerts for timely moves (whale buys, listings, etc).

Pros:

- Unique viewpoint via on-chain data

- Good for anticipating major flows before price moves

Cons:

- Requires interpretation (raw signals may not immediately translate into price moves)

- Less built-in forecasting than algorithmic models

Final Thoughts

Crypto forecasting tools are most effective when used as part of a diversified strategy. Even the best models cannot predict every market move with perfect accuracy, but they can provide valuable context, trend probabilities and early signals. Using multiple data sources—forecasts from CoinCodex, technical setups from TradingView and on-chain intelligence from Lookonchain—offers a well-rounded approach to navigating the volatility of the crypto market.

*This content was published as part of a collaboration.

Source: https://en.bitcoinsistemi.com/3-best-crypto-prediction-sources-in-2026-most-accurate-forecast-tools/