- USDT transfers across major blockchains reach $5.29 billion as of August 1, 2025.

- Tron, BNB Chain, and Ethereum lead USDT market share changes.

- Market shifts highlight evolving blockchain ecosystem and user adoption.

Glassnode report indicates USDT transfers have rebounded to $5.29 billion on major blockchains as of August 2025, highlighting shifts in market activity and blockchain usage.

This trend underscores evolving blockchain preferences, with Tron and BNB Chain leading in USDT transfers, impacting liquidity dynamics and signaling potential capital reallocation in DeFi ecosystems.

Tron, BNB Chain, and Ethereum: USDT Transfer Leaders

Paying attention to rising transactions, Glassnode reported a gradual recovery in the stablecoin market since early 2022. The dominance of Tron, BNB Chain, and Ethereum in USDT transfers illustrates shifting user preferences in blockchain ecosystems. Notably, BNB Chain has now overtaken Ethereum with more than 30% of USDT transfers. This change reflects a capital flow shift, likely driven by BNB Chain’s increasing utility and lower fees.

Market experts note the growing liquidity in these blockchains, with Tron and BNB Chain attracting more user activity. Activity spikes have prompted discussions across crypto communities about potential shifts in investment strategies. Richard Teng and Justin Sun, key figures at BNB Chain and TRON, emphasize user trust and developer engagement as key growth drivers on their respective chains. Sun recently highlighted TRON’s continued dominance in USDT transfers, asserting it as a testament to their ecosystem’s innovation.

Justin Sun, Founder, TRON DAO, remarked, “TRON continues to set the standard for on-chain USDT transfers. Our growth is a testament to user trust and developer adoption.”

Market Activity and Future Innovations in USDT Transfers

Did you know? USDT transfer volumes historically spike before altcoin seasons, correlating with increased blockchain activity and market volatility.

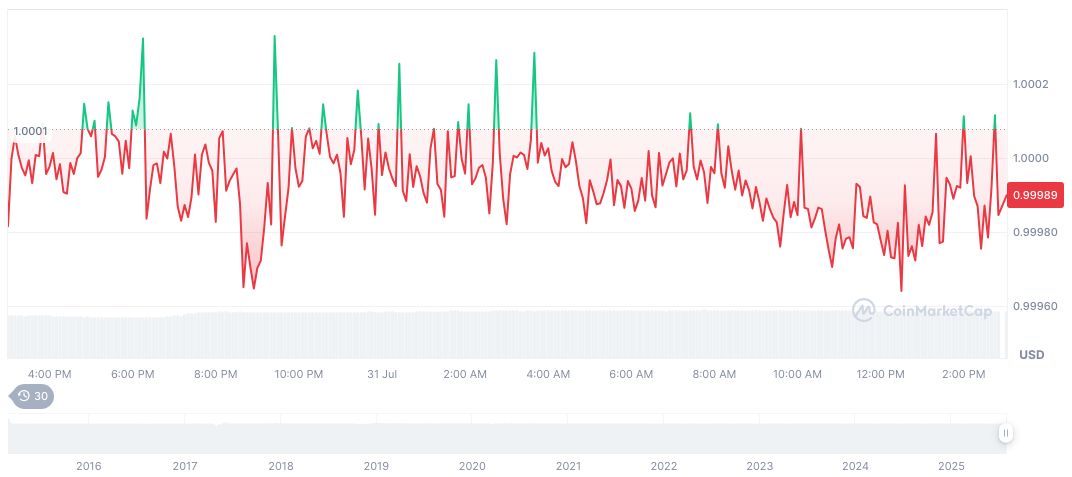

Tether USDt, with a market cap of $163.73 billion, shows a 24-hour trading volume of $128.14 billion, according to CoinMarketCap. Despite a price stability of $1.00, it experienced a 1.25% drop over 24 hours and a 5.19% decrease over the past seven days. The circulating supply stands at 163.75 billion.

Analysts at Coincu research foresee further transfer activity streamlining capital reallocation towards emerging DeFi projects. This trend could affect layer-2 solutions that offer delegated security and trade efficiency. With historical precedents of heightened USDT transfers leading to market shifts, there is potential for increased blockchain utility and innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/usdt-transfers-blockchain-trends/