Tether, the company behind the world’s most commonly used USD stablecoin of the same name, is set to run on its own blockchain. The chain, called “Stable,” will use forms of USDT for both settlement and “gas” fees. Tether has cited “unpredictable and high fees,” inadequate speed and privacy, and “complex user experience” among its grievances with operating the stablecoin on multiple public blockchains.

Other stablecoin operators will likely be interested in Tether’s latest moves. There is now over US$250 billion in value circulating in the digital economy, with some projections claiming that number will double and more over the next couple of years. Over 62% of that total is in Tether (or USDT) at $159 billion, with Circle’s USDC coming in second at 24% ($62.2 billion). There are several others to account for the remaining billions, though their market share percentages are in the single digits.

USDT tokens exist on multiple blockchains. Most Tether “lives” on TRON (TRC-20), which accounts for around 37% of the total supply. Ethereum (ERC-20) is just behind that with ~31%, and there are smaller shares of USDT on Polygon, Solana, Avalanche, and BNB Chain (as well as several others). Though exchanges will generally allow USDT holders to withdraw on any network they choose, you can’t send ERC-20 Tethers to a TRC-20 address without using a “bridge” between networks, and having the know-how to do so. The same situation applies to USDC.

Tether transactions make up a large proportion of network traffic on these blockchains, particularly TRON—it’s more than half of TRON’s total transaction volume. A native USDT token also works as a marketing and credibility boost for these networks, attracting users and developers who may want to try their other features. For example, TRON’s USDT traffic share largely results from being faster and cheaper than Ethereum, while USDT on Ethereum attracts DeFi builders/traders and token creators. If Tether and other stablecoins move to their blockchains, those blockchains may start to lose their appeal.

Why are stablecoins important?

One of Bitcoin’s most enduring slogans promises it will be “the money of the future”. However, most BTC and other blockchain tokens sit idle in cold wallets and on exchanges as owners hoard (or “HODL”) in the hope of exponential value gains. Daily price volatility, network congestion, and high transaction fees have provided extra disincentives to using these assets as payment currencies.

Starting with Tether’s initial launch (as “Realcoin”) in mid-2014, stablecoins have emerged as a compromise option for those seeking digital financial networks independent of the existing global banking system, but with familiar-sounding unit names and less speculative volatility. Along with greasing the financial transfer machinery for digital asset exchanges and their customers, stablecoins also streamline international remittances and cross-border trade.

There are even some (as-yet-unproven) theories that the U.S. Treasury may tacitly approve of stablecoins as an eventual replacement for the non-U.S.-controlled, offshore proxy-dollar economy historically known as “Eurodollars.” That stablecoin operators are buying up billions of dollars in T-bills to back their tokens probably doesn’t hurt either.

The common definition of a stablecoin is a digital asset (generally blockchain-based using a token protocol) with a value pegged 1:1 to an existing fiat currency or precious metal. Operators use various techniques to retain their pegs, with varying degrees of success. Backing by equal-value real assets is the most common, while maintaining pegs via algorithmic trading has led to the occasional catastrophe.

Although Tether is frequently criticized for failing to publish detailed audits of its exact real-asset holdings, it largely retains its users’ trust by holding its 1:1 value peg with USD (notwithstanding a few brief hiccups) over its 11-year history. In theory, stablecoins are always redeemable for the asset they represent. USDT and USDC “back” their digital tokens with a combination of USD cash balances, the aforementioned U.S. Treasuries, and other bonds/debts, as well as other digital assets.

The solidity of this redeemability guarantee is less important than the perception it exists—similar to how we assume we can withdraw all our money from our bank accounts should we need to, but banks hope we don’t all try at once. As with fiat currencies themselves, exactly what “backs” a stablecoin’s real-world value is just another part of the financial world’s complexity.

All this leads us back to the original topic of this article, which is Tether’s decision to create its own blockchain network. Let’s find out some more about how it works.

Stable chain for a stablecoin

Like other blockchain users and developers, Tether cites scalability, network traffic, and uncertainty over fees and settlement speed as its primary motives for finding an alternative.

In its introduction to Stable, Tether stated:

“With over $150 billion in circulation and more than 350 million users globally, USDT leads the stablecoin market, powering centralized exchanges, decentralized finance (DeFi), and international payments. Yet, current infrastructure struggles to meet increasing demands for lower costs, higher speeds, and greater reliability.”

For those users experiencing stablecoins for the first time, the concept of a digital dollar that exists on multiple (and incompatible) blockchain networks is complex and confusing. For starters, there wasn’t a universal “USDT address,” and you couldn’t simply send Tethers from one network to another. Additionally, USDT transactions require “gas fees” in that blockchain’s native currency. You could transfer it from an exchange, but then be stuck with unmovable Tethers in your wallet until you acquire a separate balance in ETH, TRON, SOL, etc.

These issues create a learning curve even for previous Bitcoin users, and may baffle complete newcomers. If a stablecoin wants to be the world’s currency of choice for daily and international commerce, the user experience should be as simple and streamlined as possible.

Tether’s Stable network doesn’t completely remove complexity from the experience, but it at least puts everything in one place… sort of. There are a few quirks in the architecture, and still some yet-to-be-made decisions on some of the exact technologies it will utilize. According to Tether’s Stable roadmap, these will come as upgrades and improvements as the network matures.

How Tether’s network-of-its-own will function

Tether describes Stable as “a network dedicated to USDT” and “the definitive home for USDT,” with sub-second block times (with finality) and full compatibility with Ethereum Virtual Machine (EVM) contracts and tools.

Stable has a “dual chain parallel” model consisting of the Stable Public Chain and the Plasma Chain. Stable Public Chain is the main Layer 1 blockchain, where all final settlements are made. Plasma Chain runs in parallel and is designed to process large volumes of small transactions and micropayments more efficiently, settling at certain intervals on the Public Chain. Their relationship is similar to that of BTC’s main chain and Lightning Network, although Plasma has its own consensus mechanism, while Lightning uses pre-funded payment channels.

For consensus, Stable Public Chain uses a custom delegated proof-of-stake (dPOS) mechanism called StableBFT. This is built on the CometBFT consensus engine (itself a fork of Tendermint), where stakeholders select a smaller group of validators to produce, vote on, and produce blocks. StableBFT decouples “transaction gossiping” and “consensus gossiping,” meaning all raw transactions broadcast are public, while consensus validators communicate separately to finalize which transactions to include in the next block and in what order. This is designed to prevent network congestion during high-volume periods.

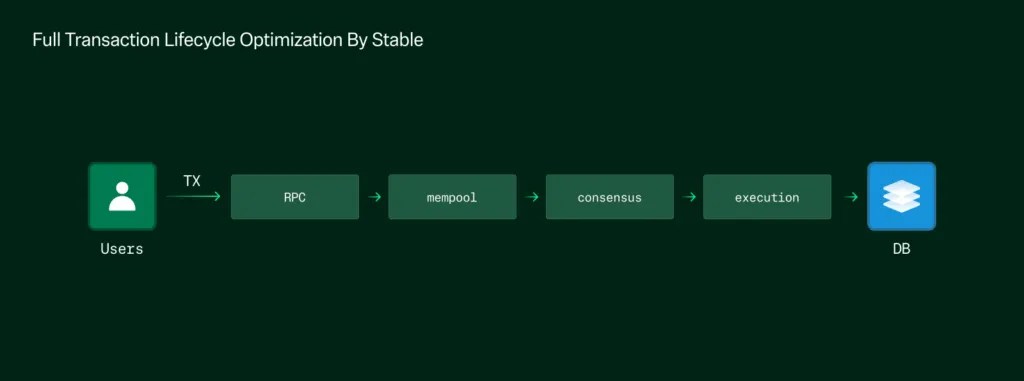

Stable’s stack also includes “Stable EVM,” its execution layer fully compatible with Ethereum to interact with its tools and wallets. The roadmap also looks at introducing StableVM++, an alternative written in C++ with an improved “optimistic parallel execution” (OPE) engine and “optimistic block processing” (OBP). Additionally, “StableDB” aims to speed up blockchain data storage by keeping recent data in memory and writing it to disk later. The stack also has an RPC (remote procedure call) layer that promises faster response times from nodes.

Future enhancements and upgrades to the Stable network include more efficient protocols for handling transactions and consensus, as well as confidentiality (or at least, privacy) features using zero-knowledge proofs (ZKPs). Private transfers mask the transaction amounts in on-chain records, while keeping sender/receiver addresses visible “for regulatory compliance and auditability.” Also on the future roadmap are: transaction bundling with the USDT Transfer Aggregator, and “Guaranteed Blockspace” to provide institutional USDT users with a more predictable environment. Tether is still considering various candidates for these functions.

Paying fees, sending Tethers everywhere

USDT is the native token on Stable. The standard token is used the same way it always has been, as a 1:1 pegged U.S. dollar asset. However, there are two variations of USDT on Stable. One is “USDT0,” a bridging token that allows users to move USDT value between Stable and USDT balances on other blockchains. The other is “gasUSDT,” a non-transferable native asset that holders use to pay Stable’s network fees (gas). Both variations have a 1:1 value peg to “standard” USDT, and Stable users can swap between all variants without incurring any extra fees.

This ensures Stable is not just another standalone version of USDT, but one with immediate deep liquidity that plays well with all other blockchain variants of the token.

USDT0 is an ERC-20 token based on the Omnichain Fungible Token (OFT) standard by LayerZero. Although the interactions between different variations of USDT sound complex on the surface, most of this complexity is handled on the back end, unseen by everyday users. A Stable Wallet user would simply send USDT value anywhere they like, regardless of the recipient’s preferred blockchain.

Stable as a sign and warning of financial technology trends

There’s no doubt Stable’s creation required extensive investment and other resources from Tether. This should be taken as a sign that Tether/USDT isn’t going away any time soon, and Tether, the company, sees little to no risk of regulators attempting to remove it from the digital asset market. It’s also a sign (as if we couldn’t see it already) that stablecoins are a very serious business, with Tether as the benchmark for how large the market could become.

There are also Tether tokens for other national currencies, but they’re almost an afterthought. USDT dominates, and making it simple and accessible to the world—for daily purchases and large-scale international trade—could also buttress the U.S. dollar’s position as the world’s reserve currency. Could Tether (the company) become a Federal Reserve for the rest of the world?

Having its dedicated network, and one optimized for large-scale and institutional use, may deflect accusations that Tether is just another token running on clunky, “hobby project” architecture. However, it also signals a move from using public, multi-use blockchains as the base network layer for vital financial infrastructure.

This is both a warning to all blockchains seeking to be the digital economy’s one universal truth ledger and an indication that large institutions see existing blockchain tech as inadequate for the purpose. Stablecoins themselves could shift the balance of power in financial sectors, and any trend towards proprietary networks for popular assets suggests blockchain protocols need to get serious about providing real… stability.

Watch: How do you build a successful ecosystem? Bring blockchain to the builders!

title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>

Source: https://coingeek.com/tether-creates-stable-blockchain-built-just-for-usdt-economy/