- Robinhood’s blockchain platform for EU to trade U.S. securities.

- Institutional blockchain adoption increases.

- Arbitrum and Solana as potential partners.

Robinhood Markets Inc. has announced plans to launch a blockchain-based platform enabling European investors to trade tokenized U.S. securities as of May 7, 2025.

Robinhood’s blockchain platform represents a strategic step in its European expansion, poised to reshape cross-border investments and align with other major financial entities adopting blockchain technologies.

Robinhood Expands with Blockchain Platform for Europeans

Robinhood is pioneering a blockchain platform, allowing European investors access to tokenized U.S. securities. This initiative aligns with Robinhood’s strategic move into European markets, enhancing cross-border financial capabilities.

The deployment offers reduced clearing and settlement costs, potentially saving the financial sector billions. The Global Financial Markets Association highlights blockchain’s ability to cut global costs by up to $20 billion annually.

“The implementation of distributed ledger technology could result in annual savings of up to $20 billion in global clearing and settlement costs.” — Global Financial Markets Association

Industry Impact: Billion-Dollar Savings from Blockchain Adoption

Did you know? The European expansion aligns with Robinhood acquiring a Lithuanian brokerage license in April, permitting broader EU market access.

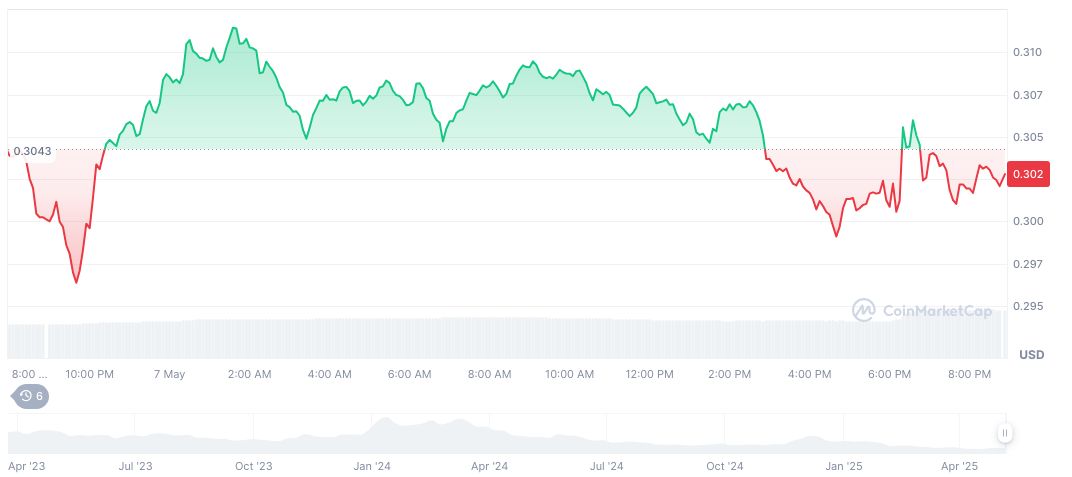

CoinMarketCap reports Arbitrum (ARB) at $0.30 with a $1.44 billion market cap and a 0.05% market dominance. Recent trading volume reached $135.72 million, reflecting a 41.44% 24-hour change. Price changes include a 0.71% increase over 24 hours, with long-term declines since February.

Insights from the Coincu research team indicate this move positions Robinhood among global leaders aiming for financial inclusivity through technology. Historical data suggest blockchain’s growth in financial sectors, prompting new regulatory frameworks essential for secure, decentralized exchanges.

Industry Experts have indicated, “The growing interest from institutional players in tokenized assets signifies a pivotal shift towards greater transparency and efficiency in cross-border trading.”

Source: https://coincu.com/336234-robinhood-blockchain-europe-trading/