Decentralized finance is quietly redefining its identity. Instead of riding hype cycles or retail-driven frenzies, today’s momentum is coming from a different place: traditional finance is stepping in—and bringing real assets along with it.

A new report from global exchange Bybit highlights this changing dynamic, pointing to the growing role of tokenized government securities and decentralized trading infrastructure as key areas of development.

Real Assets Go Digital

What was once a speculative playground is now becoming home to tokenized instruments backed by the real economy. Platforms are offering blockchain-based exposure to traditional assets like government bonds, allowing investors to earn predictable returns through a decentralized interface. This trend is attracting attention from large-scale players who were previously hesitant to engage with the crypto space.

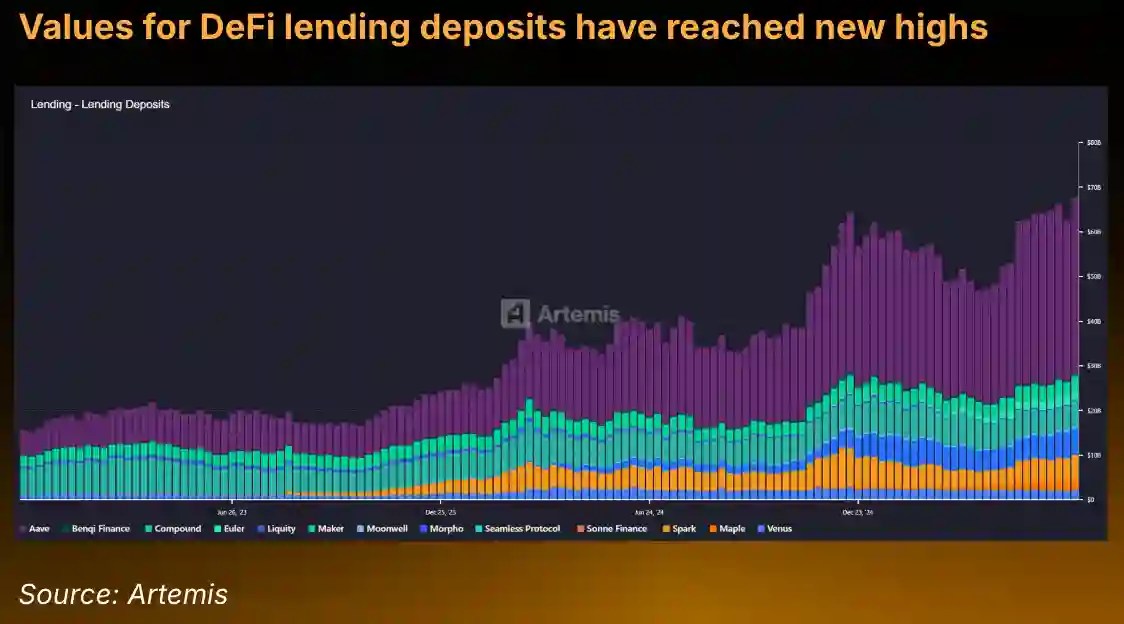

Bybit’s data shows billions now flowing into these digital equivalents of treasury products, signaling a deeper convergence between crypto and conventional markets.

Decentralized Trading Gets Competitive

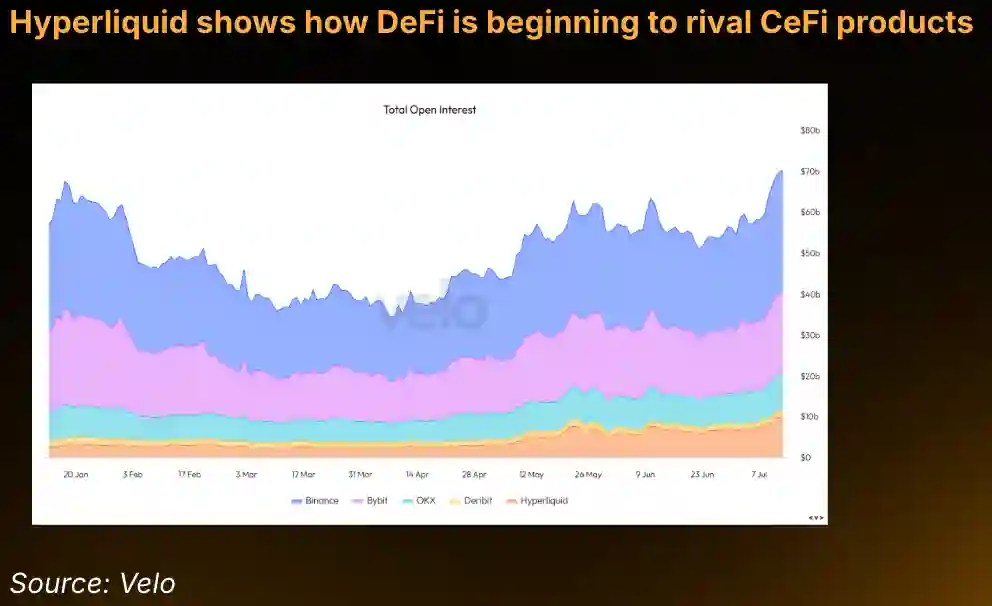

Decentralized trading platforms aren’t just evolving—they’re growing into legitimate rivals of their centralized counterparts. The volume of derivatives being handled on some decentralized platforms has reached eye-catching levels, prompting a new wave of hybrid models that combine the speed and liquidity of centralized exchanges with the openness of blockchain.

This shift is giving rise to trading venues that no longer compromise between transparency and efficiency.

Winners and Laggards in the Current Cycle

Not all areas of DeFi are advancing at the same pace. While tokenized assets and DEX infrastructure are gaining traction, other narratives—like the integration of artificial intelligence into DeFi—have failed to maintain momentum. Similarly, some staking solutions are seeing slower adoption, hindered by market volatility and uncertain token economics.

The divergence between thriving sectors and those struggling for relevance reflects a broader maturation of the space.

Highlights from Bybit’s Research:

- Traditional assets are being tokenized and offered on-chain.

- Institutional interest is steering growth in lending and fixed-income-like products.

- Decentralized derivatives markets are scaling rapidly.

- Hybrid trading models are emerging as a new standard.

- Certain niche sectors in DeFi are losing steam amid weak demand.

A New Financial Layer is Forming

DeFi is no longer defined by high-risk experiments or yield-chasing strategies. It’s becoming a layer of programmable finance that complements traditional systems. With regulated players entering and real-world instruments going digital, the foundations for a more robust on-chain economy are now being laid.

And this time, it’s not just crypto natives building the future—it’s the institutions, too.

Source: https://coindoo.com/institutions-pivot-to-defi-as-traditional-assets-enter-the-blockchain/