- Hong Kong’s strategy boosts tokenized investments; involves AI, blockchain applications.

- Investment sector supports blockchain for global market advantage.

- Government plans expansion in digital and financial services.

Hong Kong’s government, through Secretary for Financial Services Christopher Hui, announced a swift and positive response to AI and blockchain applications, aiming to tokenize long-term revenues like charging stations.

The initiative underscores the city’s commitment to digital finance, potentially broadening investment opportunities and enhancing market transparency, impacting investors and financial markets globally.

Hong Kong Drives Blockchain for Fintech Advancement

The Hong Kong government has reported a rapidly positive response towards the integration of AI, blockchain, and tokenized products. Authorities plan to utilize blockchain technology for converting long-term revenue streams into investor-friendly products. This will involve practical applications like tokenizing revenues from charging stations.

The rapid feedback from the market signals a growing appetite for innovative investment solutions. The Hong Kong Monetary Authority (HKMA) announced intentions to regularize tokenized government bonds and explore further applications in the financial sector.

Notable reactions include support from significant financial institutions like HSBC and Standard Chartered. These firms are integrating blockchain as a future settlement layer, suggesting robust institutional backing for the government’s strategy. Eddie Yue, Chief Executive of HKMA, reiterated their commitment to accelerating tokenization efforts.

“We will now begin incubating mature real-value use cases where tokenised deposits can offer significant advantages, starting with tokenised money market funds.” — Eddie Yue, Chief Executive, HKMA

Blockchain Integration Spurs Market and Institutional Reactions

Did you know? Hong Kong’s initiative to expand the use of blockchain mirrors earlier successful pilots like tokenized green bonds, demonstrating a strong trajectory in digital finance.

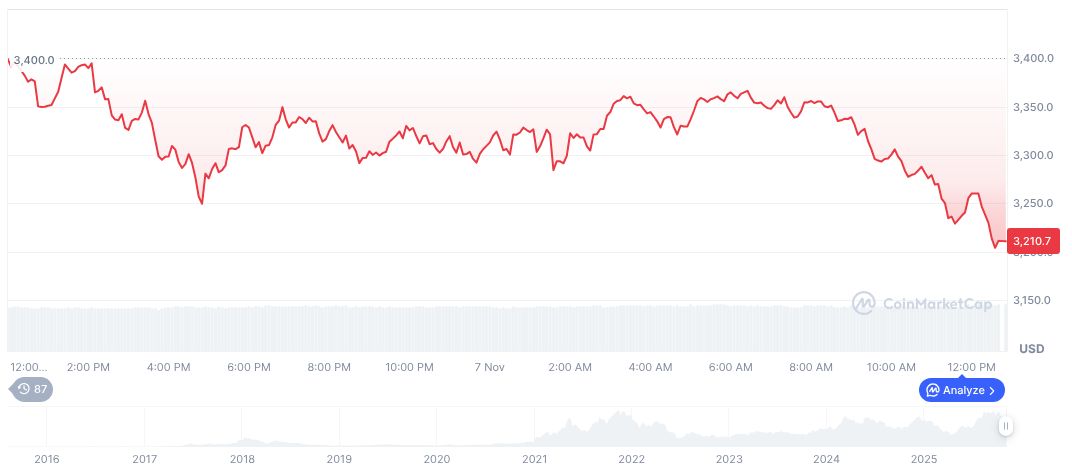

According to CoinMarketCap, Ethereum (ETH), a major protocol in tokenization, is priced at $3,449.99 with a market cap of $416.40 billion and a 24-hour trading volume up by 10.84%. Price changes indicate a 22.35% drop over 30 days, yet it remains pivotal in asset tokenization.

Coincu’s research highlights potential advancements in digital finance, forecasting enhanced cross-border investment opportunities and regulation-building requirements. A structured approach to tokenization could foster greater financial inclusivity and global market integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/blockchain/hong-kong-blockchain-tokenized-investments/