The Decentralized Financial System (DeFi) gives users various abilities such as trading, borrowing, and staking their assets without involving a third party, such as traditional banks.

In the DeFi system, a transaction is recorded in the blocks of a blockchain, similarly to that of a ledger. Further, these transactions are verified by one of the many users on the network.

Once the verification reaches a consensus, the block is then encrypted. A new block is then created containing the information of the previous one, and this process is continued indefinitely.

Market Performance 2023

The year started positively as the industry experienced a significant value increase. Top cryptocurrencies had added over 50% to their portfolio in Q1 of this year. The industry recorded significant price volatility in its chart for the next eight months.

As the hype of Bitcoin spot ETF grew, the market regained momentum, and with the Bull run on the horizon, the industry is set to record a new high as each cycle has displayed a new all-time high (ATH).

The DeFi industry has displayed a decent increase of approximately 29% in value, successfully reclaiming the $100 Billion mark. The total number of users has crossed seven Million this year, indicating investors’ rising interest in it.

DeFi has revolutionized the payment system and has come a long way since its inception. Despite the category experiencing a massive correction during the past year, it has regained momentum and recorded a rise of over 50% in its valuation Year-On-Year (YOY). The industry is expected to achieve new heights in the coming time.

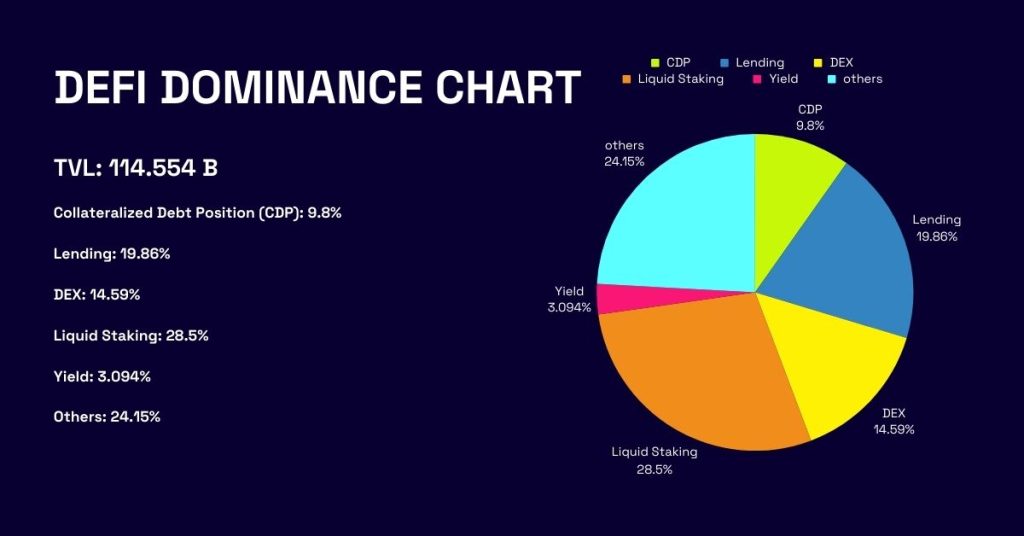

Top DeFi Categories:

The DeFi market is still early and expected to increase folds during the upcoming Bull run. The Decentralized finance system had recorded a top of $171 Billion during the previous run.

Further, the category is divided into many sub-parts which play significant roles in their respective fields. Most TVL is currently in Collateralized Debt Position (CDP), Lending, DEX, Liquid Staking, and Yield.

Collateralized Debt Position (CDP):

Created by the Maker DAO, CDP plays a unique role in the DeFi system as it locks up the collateral assets in a smart contract exchange for the stablecoins. This is widely used to comprehend customer databases other applications use to analyze, track, and manage customer interactions.

The Collateralized Debt Position has recorded a rise of 15.73% in value from $8.104 Billion in 2022 to $9.377 Billion today. The increase in value highlights the rising trust of the investors in this system.

Maker DAO has accounted for most of the CDP TVL this year with a total value of $5.823 Billion, followed by JustStables with a value of $1.204 Billion and Liquity with $737.78 Million locked this year.

Lending:

It is a form of Decentralized Financial (DeFi) system where investors can lend their cryptocurrency to borrowers in return for interest payments. Borrowing cryptocurrency is easy as it requires no additional documents and charges less interest when compared to other sectors.

Lending plays an important role in the DeFi ecosystem as it accounts for a major share of the TVL of the industry. Over the past year, the Lending category has jumped over 91% in value, displaying a strong upward trajectory.

JustLend has the highest Lending value with a total of $6.6 Billion, an increase of 154% from $2.59 Billion recorded on 31st December 2022. Following this, the AAVE token stands second with a value of $6.391 billion, and Compound Finance has a value of $2.361 billion.

DEX:

It specifically represents the number and amount of assets deposited by the liquidity providers in the chosen protocol. It plays a unique role as DEX does not require any KYC checks or documents that provide personal information. This helps preserve its user’s privacy from being sold on third-party apps.

Despite the industry regaining momentum, the DEX category has recorded a loss of over 11% Year-On-Year (YOY) from $15.036 Billion previously to $13.402 Billion at the time of writing.

The Uniswap blockchain, with twelve chains, has the highest Decentralized Exchange (DEX) value of $4.083 Billion, followed by Curve DEX with a total value of $1.754 Billion and PancakeSwap with a value of $1.456 Billion.

Liquid Staking:

It allows its users to stake their tokens and actively participate in securing proof-of-stake blockchains. Staking is a win-win situation as it helps maintain liquidity in their assets and earn passively through it.

Liquid staking has a major share in the category as it accounts for 28% of the total value locked in the industry, which is $29.45 Billion at the time of writing.

Lido DAO has the highest Liquidation Staking with a value of $20.93 Billion, followed by Rocket Pool with a value of $2.6354 Billion. Binance Staked ETH has the third highest TVL at $1.736 billion.

Yield:

This refers to depositing coins/tokens into a liquidity pool of a DeFi protocol to earn rewards. The rewards are typically distributed through the protocols governance token. Through Yield farming, an investor can put their holding to work and earn additional tokens.

Over the past year, Yield has recorded a stable rise in value with an increase of approximately 20%, from $1.311 Billion in 2022 to $1.573 Billion at the time of writing.

Convex Finance dominated the Yield category as it contributed to most of the valuation of this category with a total value of $1.977 Billion, followed by Aura with a value of $392.89 Million and Pendle with a locked value of $253.35.

Top DeFi Performers Of 2023:

Despite the DeFi category losing over 50% valuation following the market pump during the start of the year, it has successfully managed to regain the lost momentum it once had. On the other hand, the top blockchains such as Lido Dao, Maker Dao, Uniswap, and others in this category have continued to display notable price action in the year 2023.

- Lido DAO (LDO): The LDO blockchain has the highest Total Value Locked (TVL). It has displayed a jump of over 255% in value when compared to Year-On-Year (YOY) from $5.787 previously to $20.934 Billion today. Following the ETH withdrawal activation, LDO recorded a significant rise in value and jumped over 73% since then.

- Maker DAO (MKR): The MKR token has lost its dominance to LDO as the blockchain currently has a TVL of $8.549 Billion, an increase of 27.48% from $6.706 Billion previously. The MKR token recorded significant price action during the Q3 as it had gained massive bullish sentiment from the cryptocurrency market.

- Uniswap (UNI): Despite the industry’s massive gains this year, UNI blockchain has added 23.20% to its TVL. This chain displayed significant price volatility, resulting in constant dumps in the market.

- AAVE (AAVE): The Aave has displayed a notable run, adding over 73% to its TVL from $3.826 Billion in 2022 to $6.41 Billion in 2023. Following the market pump in October, it added 43% of its total gains this year.

- Rocket Pool (RPL): It has displayed a massive jump in its valuation this year. The RPL has jumped over 366% from $565.01 Million previously to $2.635 Billion in 2023. RPL had recorded major transaction movements during mid-2023, resulting in the surge. Further, the October pump has played a significant role, accounting for 56.75% of the overall gains.

Future of DeFi:

The DeFi industry plays an important role in the crypto-verse as it has housed some of the most unique and fundamentally strong projects in the crypto space. DeFi’s Total Value Locked (TVL) currently stands at just over $120 Billion, a discount of over 35% from its previous ATH of $175.517 Billion recorded during the previous Bull run.

The Decentralized Finance (DeFi) system is bound to reshape the traditional financial system as it has come out with new, unique ways of payment system which shortly has huge potential.

Conclusion:

The DeFi industry has made significant progress over the years as it has constantly recorded an increase in its value. Further, the market for the DeFi categories records more users switching to its platforms, highlighting the rising interest of users toward it.

The DeFi market is predicted to regain its lost strength in the coming year and further record a new ATH, as this category plays a vital role in blockchain technology and financial systems.

Source: https://coinpedia.org/research-report/defi-report-2023-analyzing-trends-insights-and-new-peaks-of-decentralized-finance/