- Circle’s USDC Treasury issued $500 million on Solana blockchain.

- Event boosts Solana chain’s liquidity, affecting DeFi activities.

- Solana-native tokens may benefit from increased USDC availability.

Circle’s USDC Treasury issued an additional $500 million USDC on Solana on October 17, as reported by Whale Alert, enhancing liquidity on Solana’s blockchain.

This substantial issuance may bolster Solana’s DeFi ecosystem, increasing liquidity while sparking discussion on stablecoin utilization and market adaptability.

Circle Boosts Solana with $500 Million USDC Mint

Circle issued the USDC mint, facilitated by

The lack of direct commentary from Circle highlights the reliance on public on-chain verification. The mint was split into two parts of $250 million each.

The $500 million USDC increase on Solana is likely to bolster network liquidity and DeFi activity. This substantial issuance might drive investor interest and is expected to affect trading volumes of popularly traded pairs within the Solana network.

Despite the substantial mint, Circle’s leadership, including CEO Jeremy Allaire, has not commented directly. According to the Coincu research team, “the mint could accelerate financial transactions on Solana, enhancing network scalability.” Regulatory discussions around stablecoins continue, but Circle prioritizes transparency and compliance, influencing market confidence.

Solana Liquidity Surge: Market Implications Analyzed

Did you know? The recent $500 million USDC mint on Solana by Circle aligns with past patterns of high-volume USDC issuance on blockchains, often driven by institutional liquidity demand.

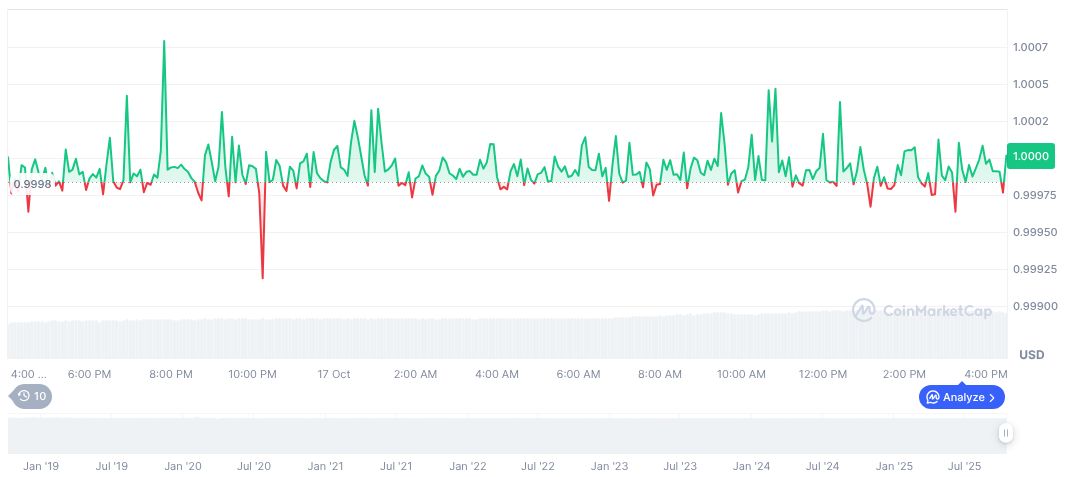

According to CoinMarketCap, USDC maintains a market cap of $75.93 billion. USDC’s price remains steady at $1.00. In the past 90 days, USDC’s price increased by 0.01%. The 24-hour trading volume is $24.77 billion, with a slight change of 12.61%.

The Coincu research team suggests the mint could accelerate financial transactions on Solana, enhancing network scalability. Regulatory discussions around stablecoins continue, but Circle prioritizes transparency and compliance, influencing market confidence. A related analysis by Coincu highlights potential implications for Solana’s price movements, as the network’s liquidity receives a significant boost.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/circle-mints-500-million-usdc-solana/