- Circle minted $100 million USDC on Algorand, tracked by Whale Alert.

- Event adds liquidity, no immediate large industry reaction noted.

- USDC issuance aligns with ongoing liquidity and trading trends.

Circle minted $100 million USDC on the Algorand blockchain at 14:00 Beijing time on June 17, 2025. Whale Alert tracked this issuance without identifying the wallet address involved.

Such a large issuance of USDC suggests increased institutional demand for liquidity. This mint by Circle, USDC’s issuer, aligns with common issuance patterns seen when bolstering stablecoin supply.

Circle’s $100 Million USDC Mint on Algorand Examined

Circle initiated this minting, further expanding USDC’s availability on Algorand. Such mints generally indicate increased demand for liquidity, likely for institutional trading or exchange support. The transaction remains unexplained by official sources, including Circle’s executives, who have not commented publicly. This lack of immediate reaction or major public statement signifies the possible routine nature of the transaction, adhering to stable issuance practices. Statements from Circle or public blockchain announcements of such mints typically don’t follow each event unless strategic partnerships or major market impacts are foreseen. For more insight on strategic expansions, explore our coverage on the Coinbase Exchange sets sights on India.

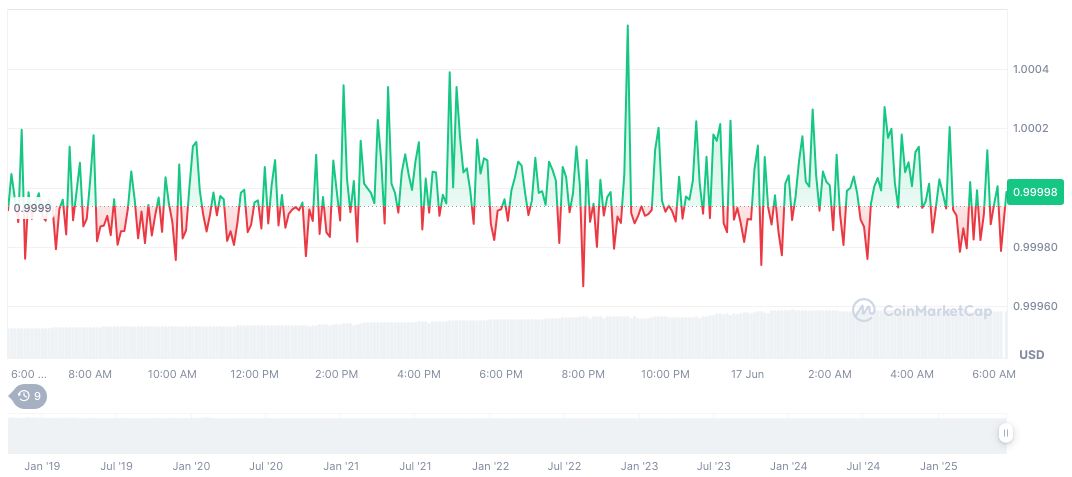

According to CoinMarketCap, USDC maintains a stable price of $1.00 with a market cap of 61,604,099,884.00 and dominance of 1.85%. Recent data reflects minor price fluctuations over a 90-day period, indicating stability amid new issuance.

“USDC supply and transaction volume grew significantly in the past year (to over $20 trillion annualized transaction volume, $45B+ capitalization), with issuance spanning 16 blockchains including Algorand,” said Jeremy Allaire, CEO of Circle.

USDC’s Market Stability and Institutional Demands

Did you know? In 2024, similar $100 million USDC mints on various blockchains supported institutional trades and liquidity demands with minimal price shifts. For continuous updates on market movements, consider how banking regulations influence crypto.

According to CoinMarketCap, USDC maintains a stable price of $1.00 with a market cap of 61,604,099,884.00 and dominance of 1.85%. Recent data reflects minor price fluctuations over a 90-day period, indicating stability amid new issuance.

Coincu experts predict ongoing strategic USDC mints, aiding institutions and DeFi protocols. Historical trends highlight market adoption and trading volume growth, suggesting these mints play a solid role in sustaining liquidity without regulatory upheavals or immediate market disruption. Such expert opinions align with typical stablecoin behaviors seen in past financial integrations. For more on liquidity trends and their impact, read about crypto payments innovations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343717-circle-usdc-mint-algorand-june-2025/