With multiple head-first attempts from buyers to cross the $45K barrier failing miserably, the BTC price starts a sideways trend. Leading to an indecisive state, the anticipations grow strong for a bullish break due to some altcoins picking up pace.

Moreover, the 2024 outlook from multiple players in the crypto industry remains bullish, which helps the overall sentiment. The common factors are the high chances of Spot Bitcoin ETF approval, the 2024 Bitcoin halving, and the potential rate cuts. Thus, the Bitcoin price prediction remains bullish for 2024.

Coming to the ongoing BTC price movement, the 1.20% drop last night continues the bearish streak of 2.05%. However, the short-term trend maintains a higher low formation and projects bullish dominance at lower levels.

BTC Price Analysis

The 1D BTC price chart shows the sideways trend growing longer; the longer it goes on, the more the chances of a bearish reversal. Hence, if the buyers fail to surpass the $45K barrier in the first week or ten days of 2024, the bears may soon take over the trend control.

Source – Tradingview

Currently, the BTC price trades at $42,056 and forms a Doji candle while teasing a bullsih reversal. Moreover, the highlighted eclipse marks the lower price rejections, forming a higher low formation.

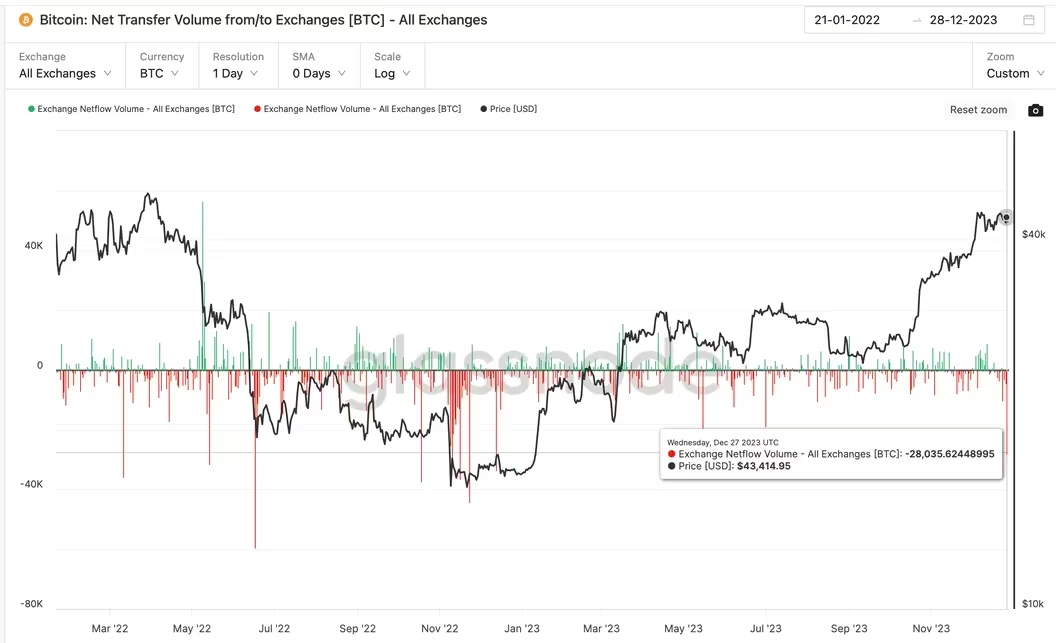

On Wednesday, a significant amount of Bitcoin – about 28,000 BTC valued at $1.19 billion – was withdrawn from centralized exchanges. This was the biggest withdrawal in a single day since December 14, 2022. When investors move Bitcoins out of exchanges, it often suggests they plan to keep them for a longer time or want to manage them directly.

The total number of Bitcoins held in centralized exchange wallets has now fallen to 2,327,025 BTC, the lowest since April 2018. Generally, having fewer Bitcoins available on exchanges can lead to less pressure to sell them, which might help increase the BTC price.

Is It Worth Buying Bitcoin in 2023?

As Bitcoin shows sustainability above $40K, the buyers will likely manage to drive the uptrend beyond the $45K threshold and aim higher to reach the $50,000 mark. Potentially starting a new uptrend for 2024, the BTC price will likely enter 2024 at levels greater than $50,000.

On the flip side, a failure to sustain above $42K will likely prolong the correction spree to the $40K mark. In this case, Bitcoin will likely retest the crucial support zone and the 50D EMA at $40,227.

Source: https://coinpedia.org/price-analysis/with-bitcoin-hodlers-exiting-centralized-exchanges-will-btc-price-cross-50k/