On Sunday, Bitcoin (BTC) price rose nearly 4% after forming a local bottom on Saturday at $62,052. This uptrend beat crypto market expectations of a correction. If this trend continues, is $70,000 next for BTC or a correction?

In this CoinGape article, let’s find out if Bitcoin will continue its climb or crash lower.

Bitcoin Price Today is up 1.91%

After a 4% rally over the weekend, the early Asian session on Monday saw a 1.12% correction which was followed by the next leg that pushed Bitcoin price up by 1.91% today.

BTC Price Analysis: Is $70,000 Next Target Bitcoin?

With the weekend pump, BTC price has slithered closer to $65K, a key resistance level. This barrier has served as support and resistance level for the past 90 days, leading to 9% and 23% rallies after retesting it. So, a revisit of this critical hurdle will play a pivotal role in determining the directional bias for Bitcoin.

A weekly candlestick close above $65K would count as a successful flip of this hurdle. Beyond this, BTC bulls need to defend this level, which showcases that buyers are stepping up. If these two conditions are met, Bitcoin price prediction hints at a sustained move to the upside.

In such a case, the next short-term target is $67,700 and $70,101.

BTC’s 7-Month Historical Data Hints Reversal

The 12-hour Bitcoin chart below highlights that aggregated Open Interest (OI) of futures and spot market is range bound between $21 billion and $16 billion. This range coincides with key local tops and bottoms formed in the past seven months.

If history repeats, Bitcoin price could form another local top when OI hits $21 billion, the upper limit of the aforementioned range.

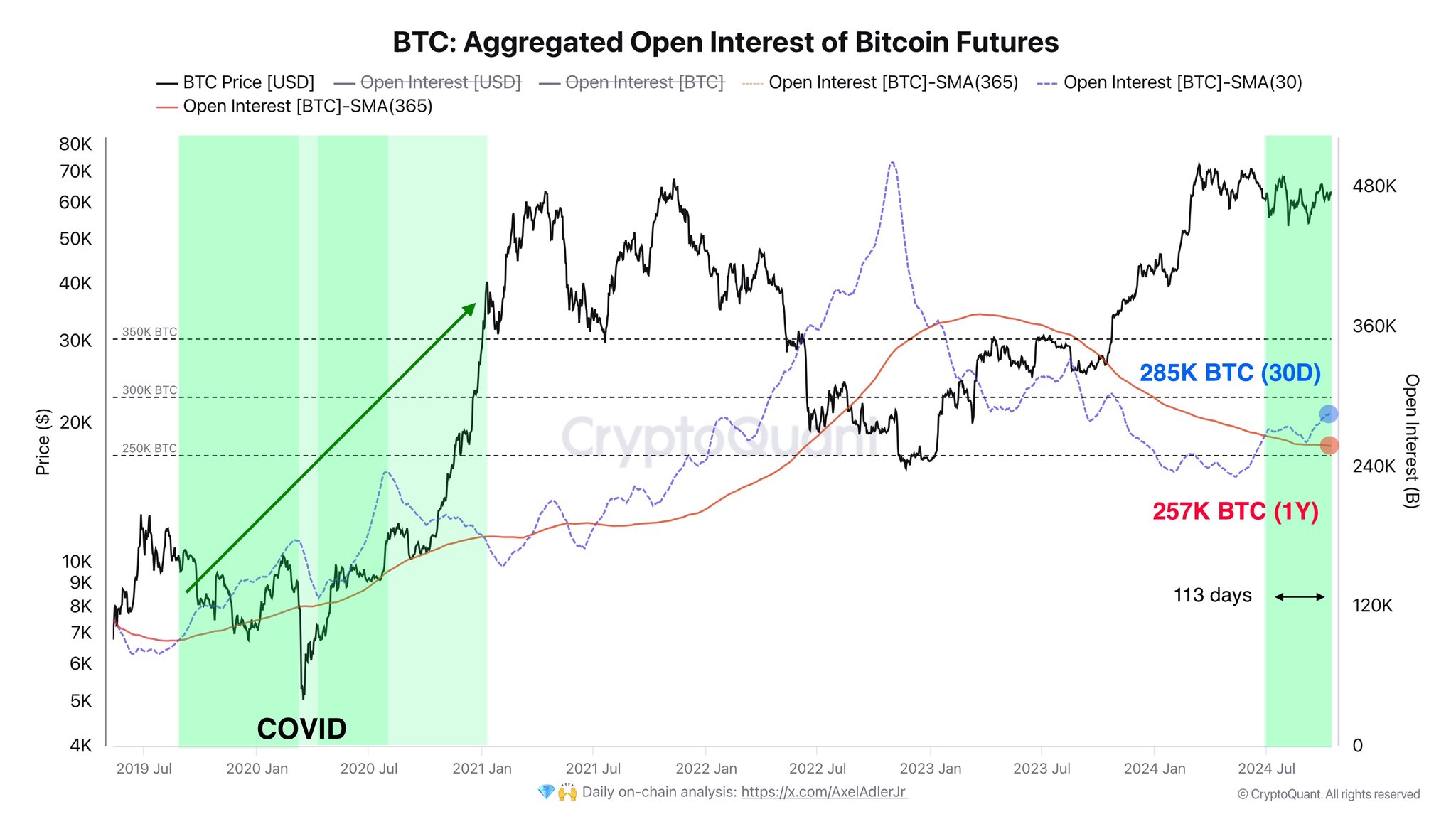

On a similar topic, on-chain enthusiast Axle Adler Junior posted his thoughts on OI to X. Based on his analysis the BTC-denominated Open Interest has seen a considerable increase in the past quarter, pushing it to 285K, which is well above the annual average of 257K.

Additionally, Adler Jr. noted that the 30-day OI moving average crossover above the yearly OI has triggered volatile moves in the past, preferably to the upside. Again, if history repeats, BTC could end October on a bullish note.

Regardless of the recent uptick, the short-term outlook for Bitcoin price remains uncertain, but the long-term bullishness still remains.

Frequently Asked Questions (FAQs)

The exact reason is unclear, but technical analysis suggests a potential breakout above key resistance levels.

A weekly candlestick close above $65,000 would confirm a successful flip of this hurdle.

Aggregated OI range-bound between $16-21 billion hints at a potential local top formation; BTC-denominated OI increase suggests volatile moves to the upside.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/markets/bitcoin-price-will-weekend-rally-propel-btc-to-70000-next/

✓ Share: