The BTC price kicked off the week with a highly volatile scenario, hovering around $58,500 in early US hours today. Historically, September has been a tough month for the crypto, with eight out of eleven years since 2013 showing negative returns. However, recent market signals hint at a potential reversal of this trend.

So, can Bitcoin finally break its September downtrend and surge ahead this month? Below, we explore the key levels to watch next for the flagship crypto.

Can BTC Price Break September’s Bearish Trend?

September has proven to be a challenging month for the crypto, with Bitcoin historical data showing that the crypto is often characterized by declining prices. According to CoinGlass data, the crypto has shown only three positive returns since 2013, i.e. 2015, 2016, and 2023, with all other years showing significant drops.

However, despite this bearish historical backdrop, some latest market trends suggest a potential shift in momentum.

On-Chain Data Indicates A Reversal Trend For Bitcoin

A report from on-chain analytics firm Santiment highlights promising signs of growth in the crypto market, even as traditional markets pause. The report notes “Bitcoin is showing signs of growth without relying on equities, signaling sector strength”.

This decoupling from traditional financial markets could prove crucial for BTC price, particularly if equities remain subdued. In addition, CryptoQuant’s latest analysis points to the crypto’s short-term Sharpe ratio resembling levels seen in September-October 2023, indicating a possible turnaround.

Meanwhile, a dip in the Sharpe ratio could signal an upcoming recovery phase for those with a bullish outlook, while bearish traders may view it as a precursor to continued volatility. These mixed interpretations add to the speculation that BTC might defy its usual September slump.

US Fed Rate Cut To Boost Sentiment

The highest crypto by market cap, along with the broader financial market, could benefit from the upcoming and most-anticipated US Fed rate cut. The US central bank is expected to announce a 25 bps rate cut in their policy rates in September, given the recent cooling inflation data.

For context, lower interest rates usually boost market sentiment, while raising the investors’ appetite for risk-bet assets like crypto. In other words, the lower rates could shift the market focus toward digital assets, potentially benefiting in gains for the crypto. Having said that, the market now eagerly awaits the upcoming US Job data this week for more insights on Fed’s upcoming stance.

Market FUD & Other Uncertainties To Consider

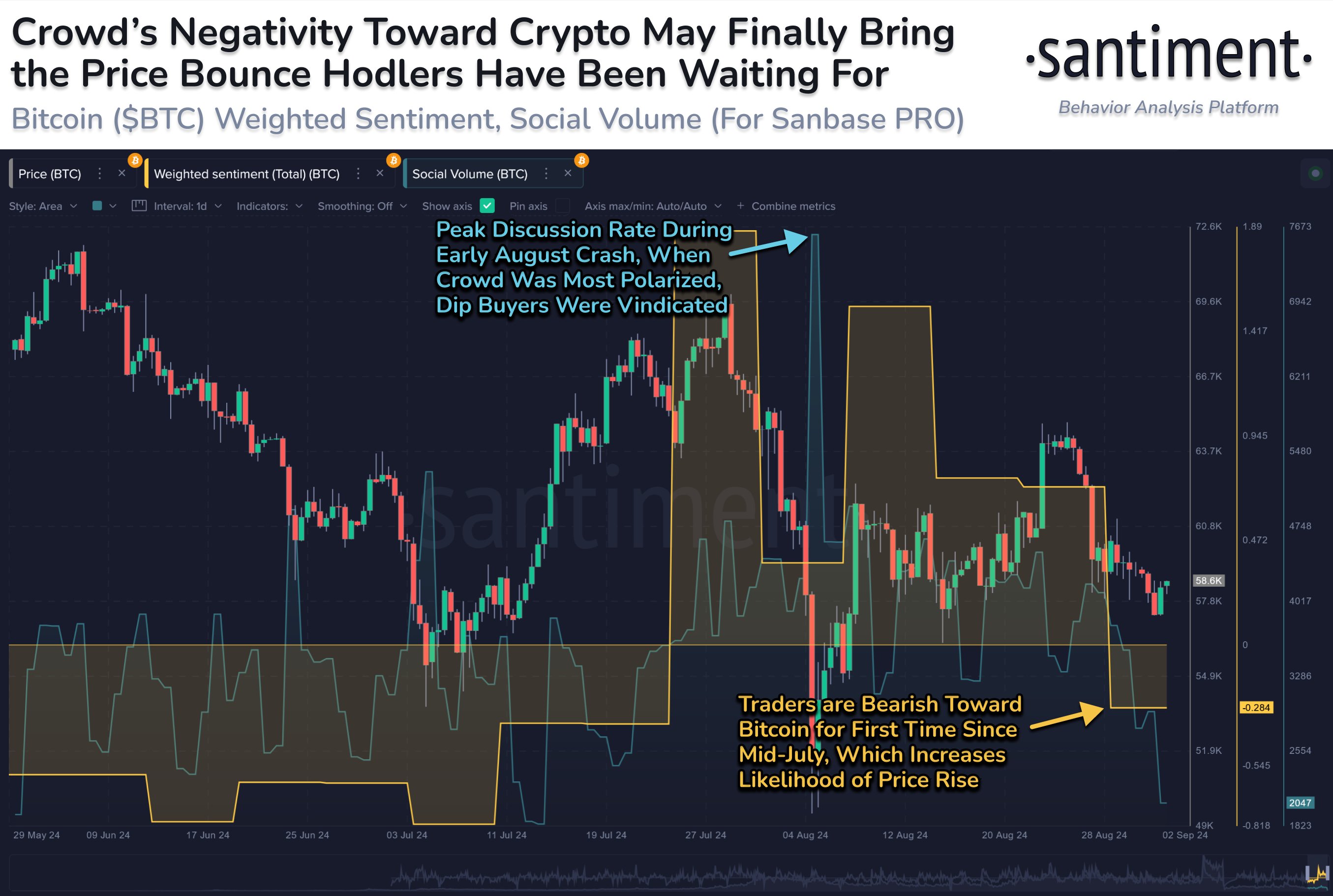

The growing fear, uncertainty, and doubt (FUD) among traders might contradictorily set the stage for a BTC price rebound. According to Santiment, increased trader bearishness could be a positive signal for Bitcoin’s near-term prospects, as extreme bearish sentiment often precedes a market reversal.

This dynamic could aid the crypto break free from its September curse and surprise investors with a rally. So, let’s take a look at key levels to watch for the flagship crypto.

What’s Next For BTC Price?

As of writing, BTC price was up 0.5% to $58,705.22, with its trading volume soaring 27% to $27.65 billion. Notably, the crypto fell to as low as $57,136 in the last 24 hours, highlighting the volatile scenario dominating the market. The Bitcoin Futures Open Interest (OI) rose 1% to $30.43 billion at the same time, indicating a positive market sentiment for the crypto.

In addition, a recent report showed that BTC whale activity has increased, with traders accumulating the crypto. This signals a positive momentum for the crypto going forward while signaling a potential rebound ahead.

Simultaneously, a recent analysis of Bitcoin price indicates a potential rally for the crypto in the coming days. Technical indicators and market trends suggest that the crypto could soar past the $83,400 level soon in a post-breakout rally.

However, to achieve that momentum, the crypto might face a potential downward pressure, which could give a “buy-the-dip” opportunity for the investors.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/will-btc-price-defy-september-downtrend-here-the-next-levels-to-watch/

✓ Share: