Bitcoin and altcoins experienced heightened volatility following a major market crash earlier this week, driven by concerns over a potential Trump trade war. While Bitcoin briefly rebounded above the $100K mark, the momentum was short-lived, revealing underlying market fragility. Former BitMEX CEO Arthur Hayes pointed to declining US dollar liquidity as a potential challenge for the crypto market in the near future.

Bitcoin and Altcoin Correction Still Pending?

Bitcoin price has corrected another 2% in the last 24 hours and is flirting around $97,500, with daily trading volumes dropping 20% to $64.3 billion. Altcoins are also seeing strong selling pressure as Ethereum (ETH) moves to its support of $2,700, while the XRP price tanked 8% earlier today amid the XRP Ledger network downtime.

USD Liquidity to Decide Bitcoin and Altcoin Movement Ahead

Former BitMEX CEO Arthur Hayes stated that macro factors will play a crucial role in deciding the crypto market trajectory moving ahead. Sharing insights from insights from renowned macroeconomist Felix Zulauf, Hayes pointed out troubling signs in the U.S. dollar liquidity landscape. He highlighted three key factors in deciding the market trajectory:

- A declining U.S. fiscal deficit will negatively impact dollar liquidity.

- An increased Treasury General Account (TGA), despite reaching the debt limit weeks ago, further strained dollar liquidity.

- U.S. banks reducing dollar loans to foreign entities, which could amplify the liquidity squeeze.

He suggested that the drying up of US Dollar liquidity is not an ideal scenario for the crypto market rally ahead. Last week, Arthur Hayes predicted that the BTC price could crash to $70,000, expecting a “mini financial crisis” before starting the mega rally to $250K.

BTC Trend Moving Ahead

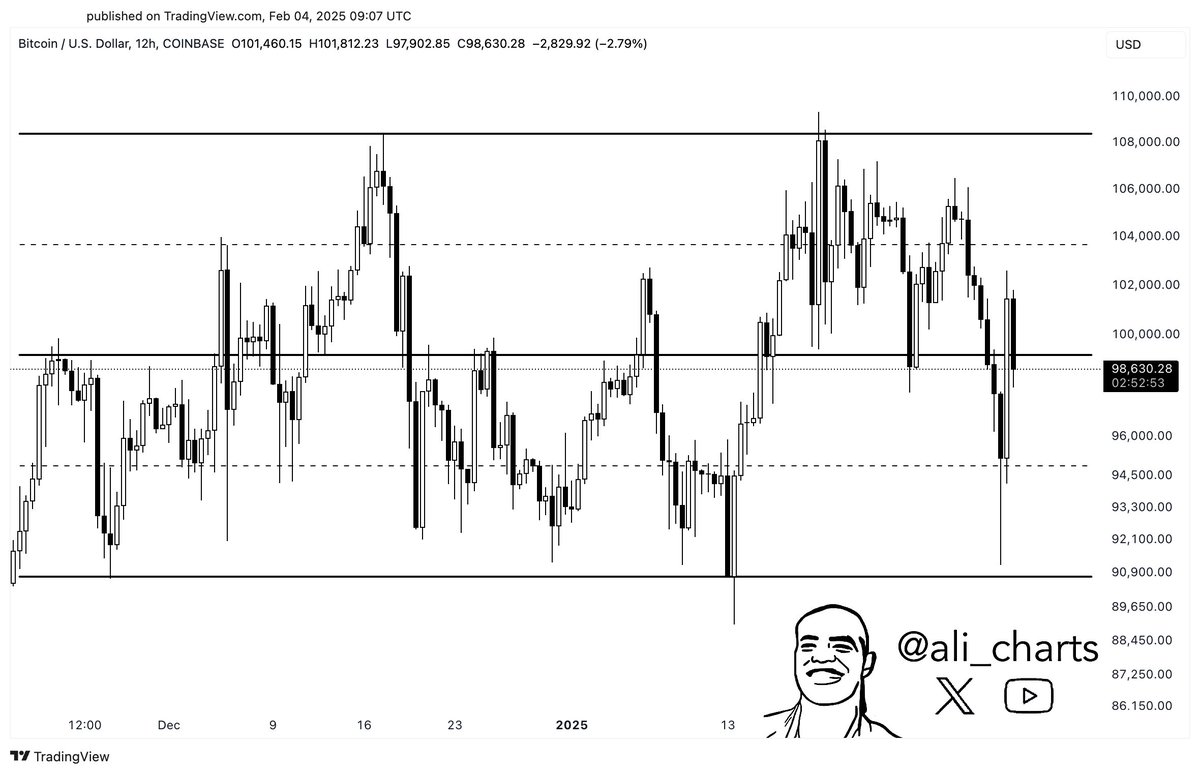

Cryptocurrency analyst Ali Martinez has highlighted BTC’s current price movement, noting that the asset is consolidating between $90,900 and $108,500.

Martinez emphasized that a clear breakout beyond this range is necessary to determine the direction of BTC’s next trend. “Until we see a decisive move, the trend remains uncertain,” the analyst stated.

Key Macro Factors To Watch

The US jobs data coming ahead this week will be crucial in determining the next monetary policy changes moving ahead. So far, the labor market has shown strength, with inflationary pressure staying intact. As a result, the US Federal Reserve decided to keep interest rates unchanged during the FOMC meeting last week.

The USD/JPY pair began the week on a cautious note, giving back a portion of Friday’s gains. The pullback is attributed to mixed US Treasury yields and continued increases in Japan’s 10-year government bond (JGB) yields. Popular Bitcoin critic Peter Schiff stated:

“The yield on the 10-year Japanese government bond is now up to 1.28%. The rise in JGB yields is a big story that few are paying attention to. The coming greater financial crisis may well begin in Japan, but the impact will be even greater in the U.S”.

Apart from Bitcoin, some altcoins have started showing strength at the moment. Investors are waiting on the sidelines for any decisive action to kick in.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/will-bitcoin-and-altcoins-correct-further-amid-crashing-us-dollar-liquidity/

✓ Share: