- Floating $1.85 million loss impacts market perceptions and trading strategies.

- Liquidation risk at $116,903.9 thresholds.

- Increases volatility hiring short-term BTC traders.

On October 26, 2025, on-chain monitoring by Ai Auntie identified that the ‘100% Win Rate Whale’ faced a $1.85 million floating loss from a short position in Bitcoin.

The impending risk of liquidation could spur volatility in the market, reflecting the significant influence of large traders on cryptocurrency price dynamics.

Whale’s $1.85M Loss Sparks Market Volatility Concerns

The opponent of the “100% Win Rate Whale” is experiencing a significant floating loss due to a large short position on Bitcoin. This situation is monitored by Ai Auntie, with the current BTC price just $4,100 shy of the liquidation threshold.

The floating loss places substantial pressure on the market, leading to heightened speculation and potential price volatility. The liquidation price is a focal point, indicating potential forced buybacks if prices increase unexpectedly.

“The liquidation price is set at $116,903.9, which is only about $4,100 above the current BTC price, indicating acute risk concentration” – Ai Auntie, On-chain Analyst, Twitter/@ai_9684xtpa

The lack of public statements from the “100% Win Rate Whale” has led to intense scrutiny in trading communities, with active monitoring by Ai Auntie keeping market participants informed. Notable analysts are closely tracking this unfolding situation.

Bitcoin Trends Resemble 2021 Short Squeeze Scenarios

Did you know? The current BTC short position resembles similar events in early 2021 when leveraged short squeezes resulted in multi-million-dollar liquidations, causing significant price spikes.

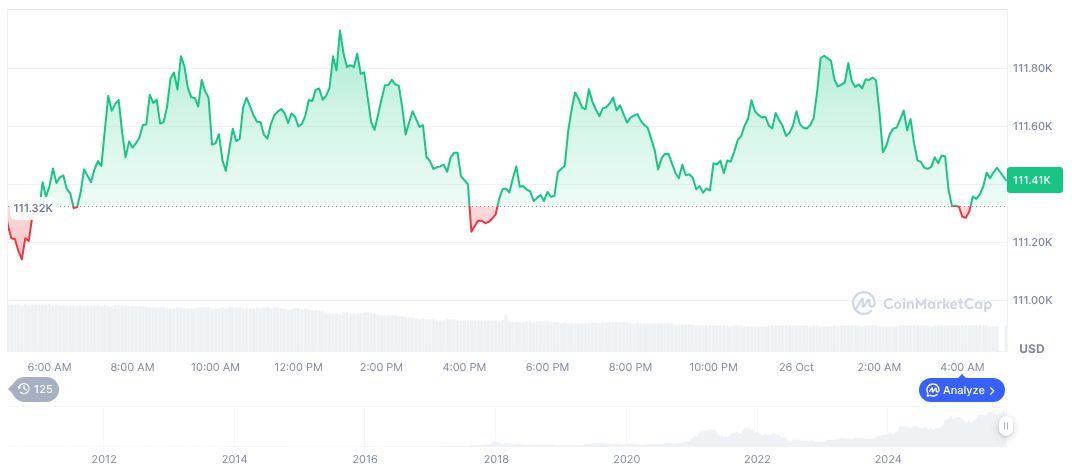

Bitcoin (BTC) trades at $113,520.44 as of October 26, 2025, with a market cap of $2.26 trillion and a market dominance of 58.97%, according to CoinMarketCap. Trading volume surged 24.02% to $34.34 billion over 24 hours, showing a 1.74% price rise during this period.

The Coincu research team suggests that the current scenario poses significant volatility risks in the BTC market. Bitcoin’s market behavior can lead to pronounced short-term disturbances, accentuating stay vigilant strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/btc-whale-short-position-risk/